10813 Parke Place Oklahoma City, OK 73130

Estimated Value: $202,000 - $222,000

2

Beds

2

Baths

1,395

Sq Ft

$152/Sq Ft

Est. Value

About This Home

This home is located at 10813 Parke Place, Oklahoma City, OK 73130 and is currently estimated at $212,392, approximately $152 per square foot. 10813 Parke Place is a home located in Oklahoma County with nearby schools including Nicoma Park Elementary School, Nicoma Park Intermediate Elementary School, and Nicoma Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 5, 2008

Sold by

Cossey Shingleton Janice Laverne and Shingleton Charles

Bought by

Davis Sharon Jean

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,468

Outstanding Balance

$75,115

Interest Rate

5.99%

Mortgage Type

FHA

Estimated Equity

$137,277

Purchase Details

Closed on

Oct 31, 2005

Sold by

Isaac Homes Llc

Bought by

Cossey Janice Laverne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Interest Rate

5.9%

Mortgage Type

VA

Purchase Details

Closed on

Apr 20, 2005

Sold by

Isaac Construction Co Inc

Bought by

Isaac Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,600

Interest Rate

5.89%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Sharon Jean | $125,000 | The Oklahoma City Abstract & | |

| Cossey Janice Laverne | $120,000 | Capitol Abstract & Title | |

| Isaac Homes Llc | -- | Capitol Abstract & Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Sharon Jean | $114,468 | |

| Previous Owner | Cossey Janice Laverne | $108,000 | |

| Previous Owner | Isaac Homes Llc | $97,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,204 | $18,694 | $2,215 | $16,479 |

| 2023 | $2,204 | $18,149 | $1,938 | $16,211 |

| 2022 | $2,115 | $17,621 | $2,201 | $15,420 |

| 2021 | $2,041 | $17,108 | $2,423 | $14,685 |

| 2020 | $1,993 | $16,610 | $2,444 | $14,166 |

| 2019 | $1,977 | $16,655 | $2,270 | $14,385 |

| 2018 | $1,815 | $16,170 | $0 | $0 |

| 2017 | $1,801 | $16,059 | $2,302 | $13,757 |

| 2016 | $1,770 | $15,674 | $2,302 | $13,372 |

| 2015 | $1,790 | $15,324 | $2,349 | $12,975 |

| 2014 | $1,753 | $14,963 | $2,346 | $12,617 |

Source: Public Records

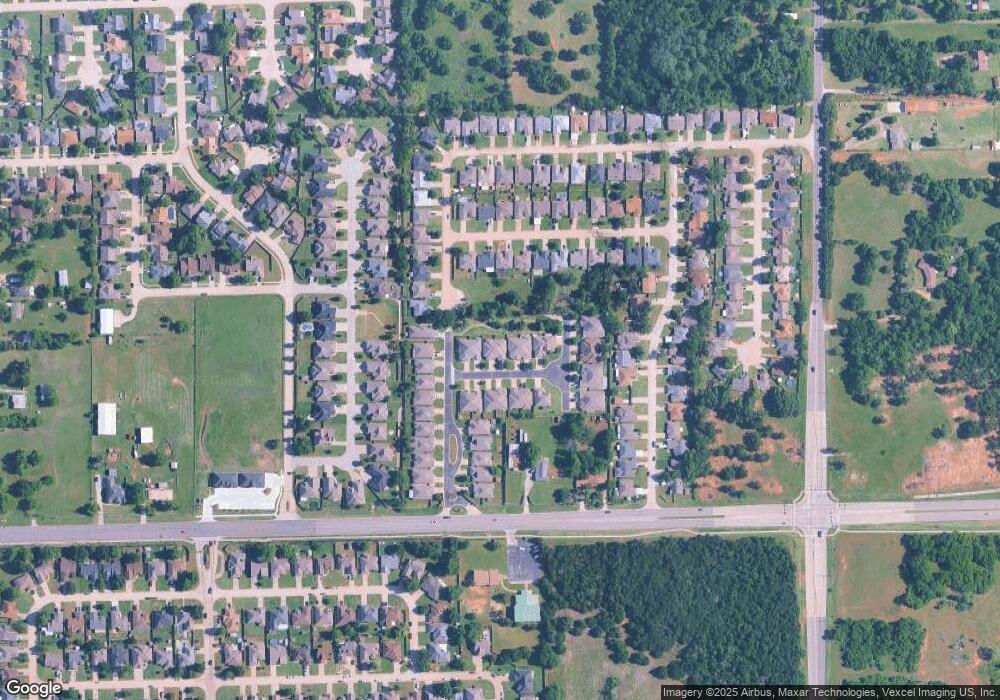

Map

Nearby Homes

- 10820 Ohara Ln

- 1301 Grand Manor

- 1104 Victor Ct

- 10800 SE 9th St

- 0 SE 15th St

- 1972 Leslie Beachler Ln

- 1917 Goldenrod Ln

- 10505 Willow Ridge Dr

- 11423 Village Ave

- 10323 Haven Cir

- 1501 S Avery Ave

- 2301 S Westminster Rd

- 10553 SE 23rd St

- 2319 Shell Dr

- 2055 Ridgeview Rd

- 11517 Sherwood Ct

- 000 Tbd Bellview Dr

- 11500 Sheffield St

- 10305 Saint Patrick Dr

- 2332 Snapper Ln

- 10817 Parke Place

- 10809 Parke Place

- 10821 Parke Place

- 10825 Parke Place

- 10801 Parke Place

- 10812 Parke Place

- 10829 Parke Place

- 10816 Parke Place

- 10808 Parke Place

- 10820 Parke Place

- 10804 Parke Place

- 10800 Parke Place

- 10824 Parke Place

- 1325 Parke Ave

- 1412 Parke Ave

- 1329 Parke Ave

- 1321 Parke Ave

- 1317 Tara Dr

- 10812 Ohara Ln