10834 Young Rd Defiance, OH 43512

Estimated Value: $500,000 - $572,451

4

Beds

4

Baths

3,123

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 10834 Young Rd, Defiance, OH 43512 and is currently estimated at $525,484, approximately $168 per square foot. 10834 Young Rd is a home located in Defiance County with nearby schools including Noble Elementary School, Tinora Elementary School, and Tinora Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 11, 2007

Sold by

Hamilton Kevin R and Hamilton Robin

Bought by

Hamitlon Robin and Hamitlon Kevin R

Current Estimated Value

Purchase Details

Closed on

Oct 30, 2006

Sold by

Callan Amy M

Bought by

Hamilton Kevin R and Hamilton Robin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Outstanding Balance

$196,156

Interest Rate

6.5%

Mortgage Type

Unknown

Estimated Equity

$329,328

Purchase Details

Closed on

Mar 28, 2001

Bought by

Hamilton Robin

Purchase Details

Closed on

Jan 12, 2000

Bought by

Hamilton Robin

Purchase Details

Closed on

Feb 17, 1998

Bought by

Hamilton Robin

Purchase Details

Closed on

Jan 4, 1996

Bought by

Hamilton Robin

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hamitlon Robin | -- | -- | |

| Hamilton Kevin R | $57,500 | None Available | |

| Hamilton Robin | -- | -- | |

| Hamilton Robin | -- | -- | |

| Hamilton Robin | $36,000 | -- | |

| Hamilton Robin | $31,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hamilton Kevin R | $328,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,665 | $165,850 | $12,040 | $153,810 |

| 2023 | $5,744 | $165,850 | $12,040 | $153,810 |

| 2022 | $5,874 | $138,240 | $10,470 | $127,770 |

| 2021 | $5,874 | $142,570 | $10,470 | $132,100 |

| 2020 | $5,897 | $142,570 | $10,470 | $132,100 |

| 2019 | $5,169 | $129,010 | $9,950 | $119,060 |

| 2018 | $5,318 | $129,010 | $9,950 | $119,060 |

| 2017 | $5,413 | $129,010 | $9,947 | $119,063 |

| 2016 | $4,678 | $125,548 | $9,250 | $116,298 |

| 2015 | $2,478 | $125,548 | $9,250 | $116,298 |

| 2014 | $2,478 | $125,842 | $9,250 | $116,592 |

| 2013 | $2,478 | $125,842 | $9,250 | $116,592 |

| 2012 | $2,478 | $125,843 | $9,251 | $116,592 |

Source: Public Records

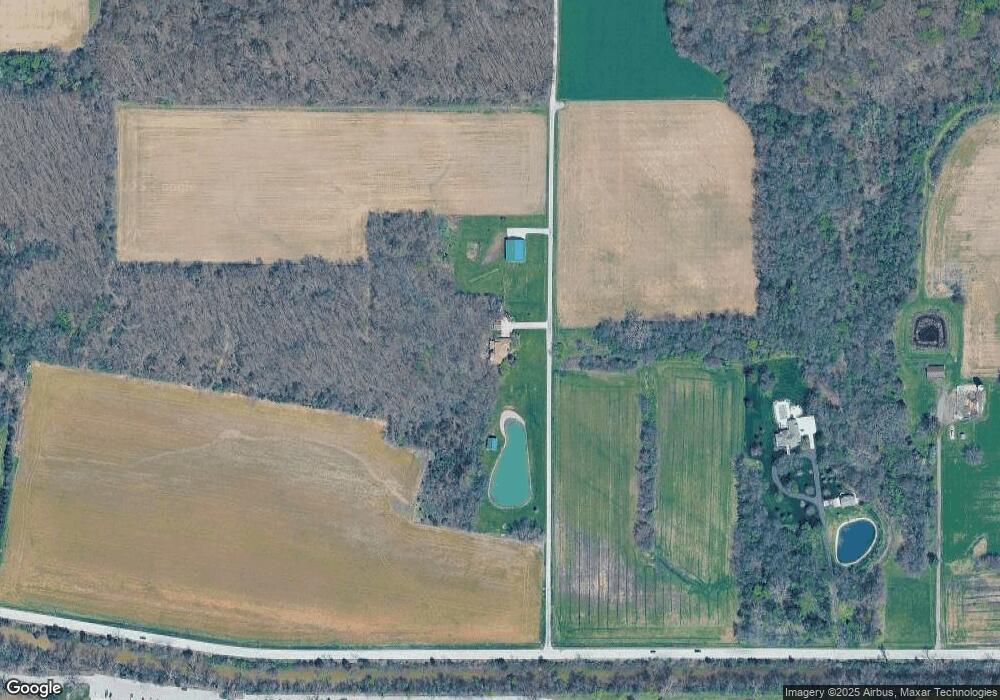

Map

Nearby Homes

- 8205 Independence Rd

- 26654 Elliott Rd

- 0 Domersville Rd

- 1506 Bristow Ct

- 1459 Deerwood Dr

- 1365 Heatherdowns Dr

- 1408 Heatherdowns Dr

- 673 Burning Tree Dr

- 655 Burning Tree Dr

- 649 Burning Tree Dr

- 1867 E 2nd St

- 1744 Lora Ln

- 00 Carpenter Rd

- 0 Carpenter Rd Unit 10001359

- 0 Carpenter Rd Unit 309402

- 512 Tiedeman Ave

- 1820 Ayersville Ave

- 230 Adams St

- 1275 Myrna St

- 1266 Myrna St

- 28571 County Road 424

- 9853 Young Rd

- 28157 County Road 424

- 28157 Ohio 424

- 28139 County Road 424

- 10071 Independence Rd

- 10049 Independence Rd

- 10075 Independence Rd

- 10168 Independence Rd

- 10043 Independence Rd

- 9983 Independence Rd

- 10156 Independence Rd

- 0 Independence Rd

- 9843 Independence Rd

- 10045 Independence Rd

- 9866 Independence Rd

- 29095 County Road 424

- 29125 County Road 424

- 9716 Independence Rd

- 0 Leach Rd Unit 6068671

Your Personal Tour Guide

Ask me questions while you tour the home.