10840 SW 153rd Ct Miami, FL 33196

The Hammocks NeighborhoodEstimated Value: $660,557 - $712,000

5

Beds

3

Baths

2,230

Sq Ft

$306/Sq Ft

Est. Value

About This Home

This home is located at 10840 SW 153rd Ct, Miami, FL 33196 and is currently estimated at $682,639, approximately $306 per square foot. 10840 SW 153rd Ct is a home located in Miami-Dade County with nearby schools including Dr. Gilbert L. Porter Elementary School, Hammocks Middle School, and Felix Varela Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2004

Sold by

Robinson Keith H and Robinson Cathy M

Bought by

Gianquinto Anthony F and Gianquinto Elizabeth A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Outstanding Balance

$78,686

Interest Rate

6.09%

Mortgage Type

Unknown

Estimated Equity

$603,953

Purchase Details

Closed on

Aug 12, 1997

Sold by

Pnc Mortgage Corp Of America

Bought by

Robinson Keith H and Robinson Cathy M

Purchase Details

Closed on

Apr 8, 1997

Sold by

Clerk Of The Circuit Court

Bought by

Pnc Mortgage Corp Of America

Purchase Details

Closed on

Aug 11, 1993

Sold by

Rodriguez Jhonny

Bought by

Rodriguez Jhonny and Rodriguez Sonia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gianquinto Anthony F | $305,000 | -- | |

| Robinson Keith H | $160,000 | -- | |

| Pnc Mortgage Corp Of America | $10,000 | -- | |

| Rodriguez Jhonny | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gianquinto Anthony F | $160,000 | |

| Previous Owner | Pnc Mortgage Corp Of America | $81,438 | |

| Previous Owner | Pnc Mortgage Corp Of America | $80,000 | |

| Previous Owner | Pnc Mortgage Corp Of America | $105,432 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,243 | $250,462 | -- | -- |

| 2024 | $4,026 | $243,404 | -- | -- |

| 2023 | $4,026 | $236,315 | $0 | $0 |

| 2022 | $3,865 | $229,433 | $0 | $0 |

| 2021 | $3,807 | $222,751 | $0 | $0 |

| 2020 | $3,764 | $219,676 | $0 | $0 |

| 2019 | $3,685 | $214,738 | $0 | $0 |

| 2018 | $3,513 | $210,735 | $0 | $0 |

| 2017 | $3,533 | $206,401 | $0 | $0 |

| 2016 | $3,344 | $202,156 | $0 | $0 |

| 2015 | $3,382 | $200,751 | $0 | $0 |

| 2014 | -- | $199,158 | $0 | $0 |

Source: Public Records

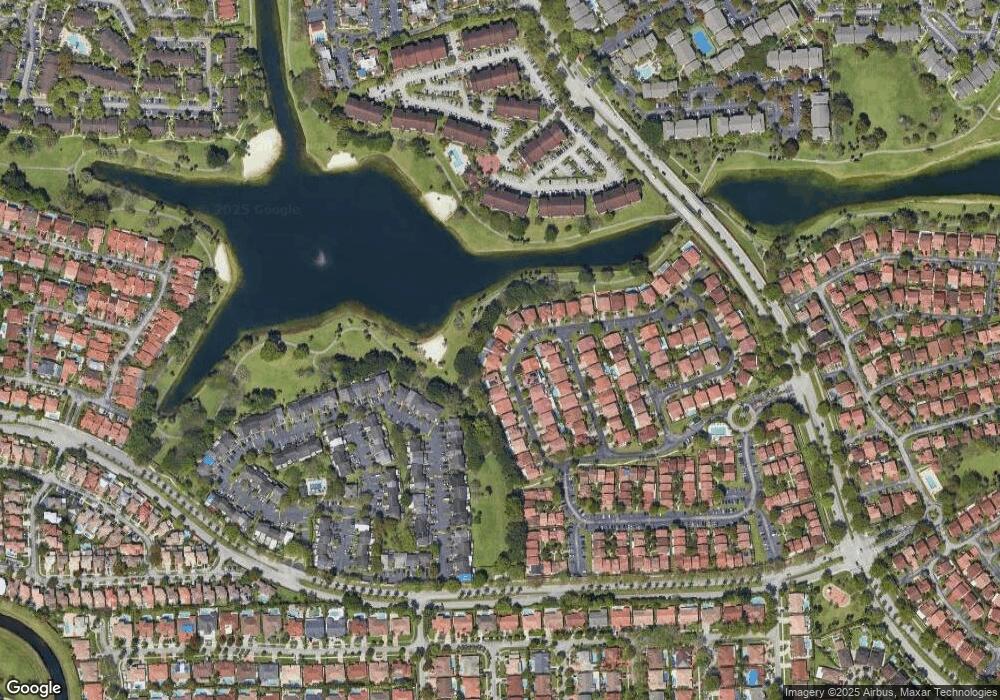

Map

Nearby Homes

- 11060 SW 153rd Ct

- 15293 SW 111th St

- 10930 SW 153rd Ct

- 15224 SW 111th St

- 15256 SW 108th Terrace

- 11027 SW 152nd Ct

- 15351 SW 114th Terrace

- 15295 SW 107th Ln Unit 1020

- 15325 SW 106th Terrace Unit 632

- 15290 SW 106th Ln Unit 316

- 15444 SW 114th St

- 11504 SW 152nd Ct

- 15011 SW 112th Terrace

- 15320 SW 106th Terrace Unit 1108

- 15565 SW 114th St

- 10889 SW 149th Place

- 11230 SW 156th Ave

- 15075 SW 113th Terrace

- 15602 SW 109th Terrace

- 10505 SW 153rd Ct Unit 2

- 10830 SW 153rd Ct

- 15337 SW 111th St Unit X

- 15337 SW 111th St Unit .

- 15337 SW 111th St

- 15372 SW 111th St Unit 15372

- 15372 SW 111th St

- 15372 SW 111th St

- 15321 SW 111th St

- 11090 SW 153rd Ct

- 15323 SW 111th St

- 11028 SW 153rd Ct

- 15325 SW 111th St

- 11082 SW 153rd Ct

- 15376 SW 111th St

- 11100 SW 153rd Ct

- 10890 SW 153rd Ct

- 10920 SW 153rd Ct

- 10913 SW 153rd Ct

- 11076 SW 153rd Ct

- 11036 SW 153rd Ct