10856 N Fairway Ct E Unit 218 Sun City, AZ 85351

Estimated Value: $169,255 - $234,000

2

Beds

2

Baths

1,349

Sq Ft

$140/Sq Ft

Est. Value

About This Home

This home is located at 10856 N Fairway Ct E Unit 218, Sun City, AZ 85351 and is currently estimated at $189,314, approximately $140 per square foot. 10856 N Fairway Ct E Unit 218 is a home located in Maricopa County with nearby schools including Desert Mirage Elementary School, Ombudsman - Northwest Charter, and Peoria Accelerated High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2016

Sold by

Kadin Lawrence D

Bought by

Kadin Lawrence D and The Lawrence D Kadin Living Trust

Current Estimated Value

Purchase Details

Closed on

Feb 24, 2009

Sold by

Hsbc Bank

Bought by

Kadin Lawrence D

Purchase Details

Closed on

Mar 7, 2008

Sold by

Kurzmann Nancy R

Bought by

Maia Mortgage Finance Statutory Trust

Purchase Details

Closed on

Oct 28, 2004

Sold by

Handyside Sherman E

Bought by

Kurzmann Nancy R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,000

Interest Rate

5.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 2, 2003

Sold by

Anderson Robert F

Bought by

Handyside Sherman E

Purchase Details

Closed on

Apr 1, 1994

Sold by

Parker Henry B

Bought by

Anderson Robert F and Anderson Mary J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kadin Lawrence D | -- | None Available | |

| Kadin Lawrence D | $35,400 | Chicago Title | |

| Maia Mortgage Finance Statutory Trust | $85,500 | Security Title Agency | |

| Kurzmann Nancy R | $67,000 | Old Republic Title Agency | |

| Handyside Sherman E | $52,000 | Chicago Title Insurance Co | |

| Anderson Robert F | $56,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kurzmann Nancy R | $67,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $540 | $6,397 | -- | -- |

| 2024 | $489 | $6,092 | -- | -- |

| 2023 | $489 | $13,560 | $2,710 | $10,850 |

| 2022 | $455 | $11,330 | $2,260 | $9,070 |

| 2021 | $470 | $9,380 | $1,870 | $7,510 |

| 2020 | $457 | $8,320 | $1,660 | $6,660 |

| 2019 | $459 | $7,020 | $1,400 | $5,620 |

| 2018 | $443 | $6,210 | $1,240 | $4,970 |

| 2017 | $429 | $5,560 | $1,110 | $4,450 |

| 2016 | $400 | $5,050 | $1,010 | $4,040 |

| 2015 | $378 | $4,230 | $840 | $3,390 |

Source: Public Records

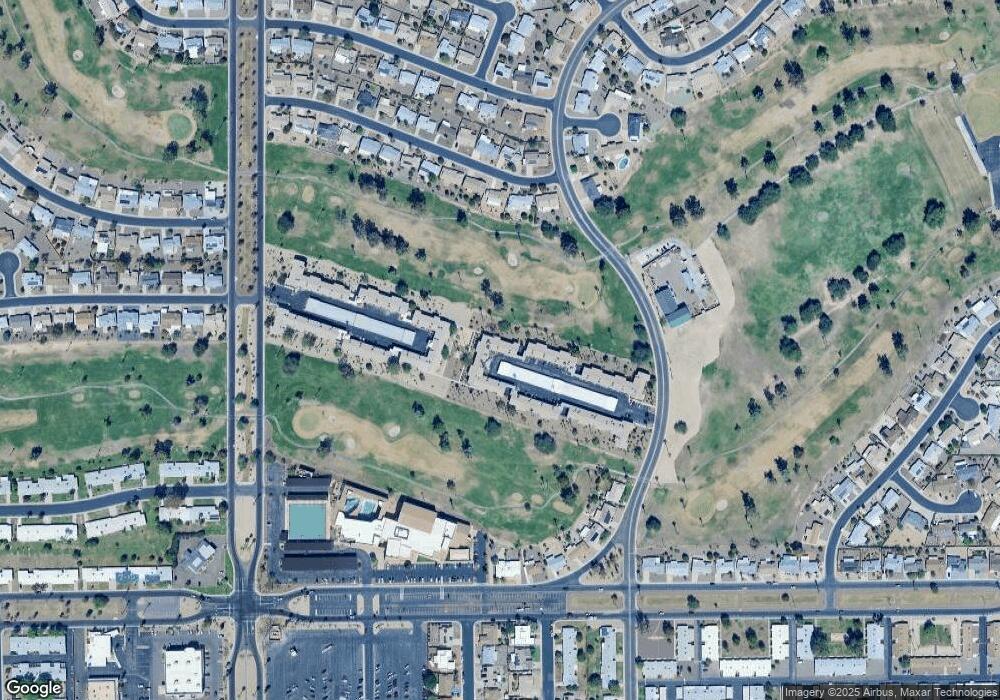

Map

Nearby Homes

- 10847 N Fairway Ct E Unit 211

- 10821 N Fairway Ct E

- 10810 N Fairway Ct W

- 10516 W Peoria Ave

- 10829 N Fairway Ct W Unit 106

- 10851 N Fairway Ct W

- 10711 W Abbott Ave Unit 2

- 10426 W Deanne Dr Unit 15

- 10509 W Snead Dr

- 10351 W Pinehurst Dr

- 10417 W Deanne Dr Unit 5

- 10345 W Peoria Ave Unit 5

- 10236 N 105th Dr Unit 8

- 10617 W Deanne Dr

- 10516 W Snead Dr

- 10222 N 105th Dr Unit 5

- 10419 W Snead Dr

- 10323 W Deanne Dr

- 10230 N 106th Dr

- 10414 W Audrey Dr

- 10856 N Fairway Ct E

- 10850 N Fairway Ct E Unit 119

- 10852 N Fairway Ct E Unit 218

- 10852 N Fairway Ct E Unit 219

- 10852 N Fairway Ct E Unit 226

- 10860 N Fairway Ct E

- 10858 N Fairway Ct E Unit 3

- 10858 N Fairway Ct E Unit 117

- 10864 N Fairway Ct E Unit 216

- 10862 N Fairway Ct E

- 10864 N Fairway Ct E

- 10861 N Fairway Ct E Unit 115

- 10861 N Fairway Ct E

- 10863 N Fairway Ct E

- 10846 N Fairway Ct E Unit 125

- 10848 N Fairway Ct E

- 10857 N Fairway Ct E

- 10853 N Fairway Ct E

- 10859 N Fairway Ct E

- 10849 N Fairway Ct E Unit 112