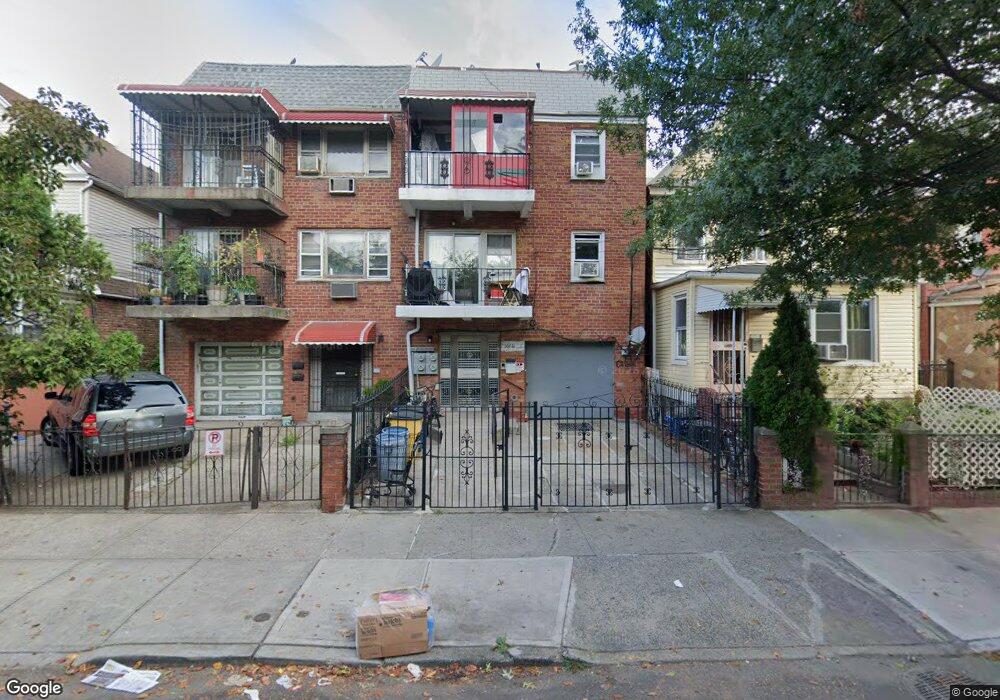

10861 41st Ave Corona, NY 11368

Corona NeighborhoodEstimated Value: $1,666,000 - $1,921,000

8

Beds

5

Baths

3,265

Sq Ft

$546/Sq Ft

Est. Value

About This Home

This home is located at 10861 41st Ave, Corona, NY 11368 and is currently estimated at $1,781,333, approximately $545 per square foot. 10861 41st Ave is a home located in Queens County with nearby schools including Is 61 Leonardo Da Vinci, Flushing High School, and Our World Neighborhood Charter School 3.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2024

Sold by

Haniph Mohammed As Trustee and Mohammed Family Trust Dated Sept 4 1996

Bought by

Haniph Mohammed As Trustee and Mohammed Family Trust B Dated Sept 4 19

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2004

Sold by

Bastian Camill M and Mohammed Haniph

Bought by

The Mohammed Family Trust Dated /96

Purchase Details

Closed on

Mar 27, 1998

Sold by

Mohammed Haniph and Bastian Camill M

Bought by

Mohammed Haniph and Mohammed Zafeena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$4,342

Interest Rate

7.04%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haniph Mohammed As Trustee | -- | -- | |

| Haniph Mohammed As Trustee | -- | -- | |

| The Mohammed Family Trust Dated /96 | -- | -- | |

| The Mohammed Family Trust Dated /96 | -- | -- | |

| Mohammed Haniph | -- | First American Title Ins Co | |

| Mohammed Haniph | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mohammed Haniph | $4,342 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,995 | $63,301 | $7,149 | $56,152 |

| 2024 | $11,995 | $59,719 | $7,781 | $51,938 |

| 2023 | $11,995 | $59,719 | $7,350 | $52,369 |

| 2022 | $11,218 | $94,740 | $12,000 | $82,740 |

| 2021 | $11,767 | $84,420 | $12,000 | $72,420 |

| 2020 | $11,166 | $74,640 | $12,000 | $62,640 |

| 2019 | $10,411 | $70,680 | $12,000 | $58,680 |

| 2018 | $10,145 | $49,766 | $8,132 | $41,634 |

| 2017 | $10,068 | $49,389 | $8,501 | $40,888 |

| 2016 | $9,315 | $49,389 | $8,501 | $40,888 |

| 2015 | $5,620 | $43,959 | $13,205 | $30,754 |

| 2014 | $5,620 | $41,472 | $10,595 | $30,877 |

Source: Public Records

Map

Nearby Homes

- 41-08 111th St

- 10844 41st Ave

- 10842 41st Ave

- 108-38 41st Ave Unit 1A

- 108-38 41st Ave Unit 4A

- 31-15 102 St

- 10849 43rd Ave

- 11149 41st Ave

- 11214 Roosevelt Ave

- 43-10 111th St

- 111-16 43rd Ave

- 4211 108th St Unit 1A

- 108-20 38th Ave

- 108-22 38th Ave

- 104-65 42nd Ave

- 108-11 44th Ave

- 104-60 Roosevelt Ave

- 104-61 Roosevelt Ave

- 104-68 39th Ave

- 112-01 38th Ave

- 10861 41st Ave

- 10859 41st Ave

- 10865 41st Ave

- 10857 41st Ave

- 10867 41st Ave

- 10855 41st Ave

- 10869 41st Ave

- 10853 41st Ave

- 10873 41st Ave

- 10856 Roosevelt Ave

- 108-75 41st Ave

- 108-75 41st Ave Unit Fl 3

- 10875 41st Ave

- 10847 41st Ave

- 10864 41st Ave

- 108-54 Roosevelt Ave Unit 1FL&Ba

- 108-60 Roosevelt Ave Unit 1FL&Ba

- 108-60 Roosevelt Ave Unit 1B

- 108-60 Roosevelt Ave Unit 2B

- 108-60 Roosevelt Ave Unit 1A