Estimated Value: $404,000

--

Bed

--

Bath

--

Sq Ft

0.5

Acres

About This Home

This home is located at 1088 S 150 W, Lehi, UT 84043 and is currently estimated at $404,000. 1088 S 150 W is a home located in Utah County with nearby schools including Meadow Elementary School, Lehi Junior High School, and Lehi High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2025

Sold by

Whittington Jarren D and Whittington Kassi

Bought by

Carson Dan and Carson Cami

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Outstanding Balance

$268,766

Interest Rate

6.5%

Mortgage Type

Seller Take Back

Estimated Equity

$135,234

Purchase Details

Closed on

May 12, 2017

Sold by

Felt Matthew and Felt Christen

Bought by

Whittington Jarren D and Whittington Kassi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,720

Interest Rate

4.14%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 29, 2016

Sold by

Solitude Construction Llc

Bought by

Felt Matthew and Felt Christen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,000

Interest Rate

3.94%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carson Dan | -- | Rudd & Hawkes Title | |

| Whittington Jarren D | -- | Old Republic Title | |

| Felt Matthew | -- | Select Title Ins Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carson Dan | $270,000 | |

| Previous Owner | Whittington Jarren D | $140,720 | |

| Previous Owner | Felt Matthew | $96,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,576 | $322,600 | $322,600 | $0 |

| 2024 | $2,576 | $301,500 | $0 | $0 |

| 2023 | $2,304 | $292,700 | $0 | $0 |

| 2022 | $2,425 | $298,700 | $298,700 | $0 |

| 2021 | $1,823 | $186,700 | $186,700 | $0 |

| 2020 | $1,708 | $172,900 | $172,900 | $0 |

| 2019 | $1,643 | $172,900 | $172,900 | $0 |

| 2018 | $1,695 | $168,700 | $168,700 | $0 |

| 2017 | $1,535 | $147,600 | $0 | $0 |

| 2016 | $1,607 | $143,400 | $0 | $0 |

Source: Public Records

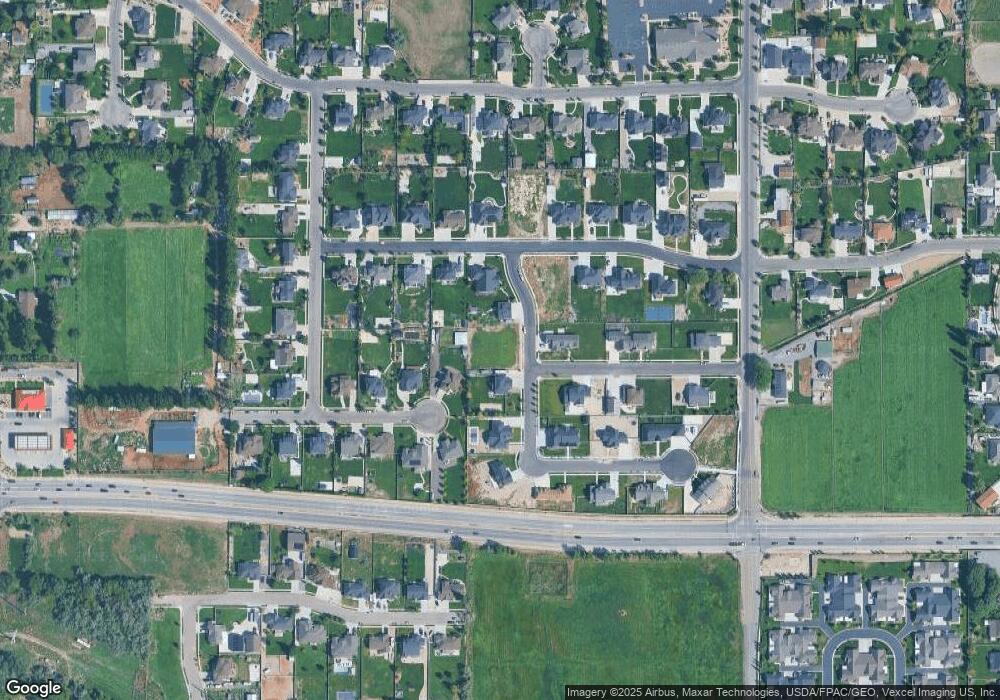

Map

Nearby Homes

- 1204 S 50 E Unit 1

- 1812 N Lake Rd

- 736 S 300 W

- 911 S Chappel Valley Loop

- 743 S 560 W

- 652 S 500 W

- Adagio Plan at Grandeur Estates

- Ballad Plan at Grandeur Estates

- Interlude Plan at Grandeur Estates

- Trio Plan at Grandeur Estates

- Forte Plan at Grandeur Estates

- Tenor Plan at Grandeur Estates

- Staccato Plan at Grandeur Estates

- Prelude Plan at Grandeur Estates

- Octave Plan at Grandeur Estates

- Finale Plan at Grandeur Estates

- Harrison Plan at Grandeur Estates

- Crescendo Plan at Grandeur Estates

- Timpani Plan at Grandeur Estates

- Harvard Plan at Grandeur Estates