10905 W Okeechobee Rd Unit 201 Hialeah, FL 33018

Estimated Value: $303,405 - $329,000

2

Beds

2

Baths

1,029

Sq Ft

$308/Sq Ft

Est. Value

About This Home

This home is located at 10905 W Okeechobee Rd Unit 201, Hialeah, FL 33018 and is currently estimated at $316,601, approximately $307 per square foot. 10905 W Okeechobee Rd Unit 201 is a home located in Miami-Dade County with nearby schools including West Hialeah Gardens Elementary School, Hialeah Gardens Middle School, and Hialeah Gardens Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2020

Sold by

Garden Villas Investments Llc

Bought by

Medina Yuliet

Current Estimated Value

Purchase Details

Closed on

Oct 30, 2019

Sold by

Gainza Rosmery

Bought by

Garden Villas Investments Llc

Purchase Details

Closed on

Jan 23, 2012

Sold by

Gainza Rosemary and Rivero Armando

Bought by

Gainza Rosmery

Purchase Details

Closed on

Jul 25, 2003

Sold by

Castro Juan E and Martinez Aurora N

Bought by

Rivero Armando and Gainza Rosmery

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,100

Interest Rate

5.42%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 10, 1999

Sold by

Nitram Investments Inc

Bought by

Castro Juan E and Martinez Aurora N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,100

Interest Rate

7.66%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Medina Yuliet | -- | Attorney | |

| Garden Villas Investments Llc | -- | Attorney | |

| Gainza Rosmery | -- | Attorney | |

| Rivero Armando | $118,000 | -- | |

| Castro Juan E | $79,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rivero Armando | $112,100 | |

| Previous Owner | Castro Juan E | $81,950 | |

| Previous Owner | Castro Juan E | $78,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,850 | $258,646 | -- | -- |

| 2024 | $4,614 | $239,580 | -- | -- |

| 2023 | $4,614 | $217,800 | $0 | $0 |

| 2022 | $4,125 | $198,000 | $0 | $0 |

| 2021 | $3,751 | $180,000 | $0 | $0 |

| 2020 | $3,331 | $159,461 | $0 | $0 |

| 2019 | $723 | $75,982 | $0 | $0 |

| 2018 | $678 | $74,566 | $0 | $0 |

| 2017 | $680 | $73,033 | $0 | $0 |

| 2016 | $686 | $71,531 | $0 | $0 |

| 2015 | $697 | $71,034 | $0 | $0 |

| 2014 | $710 | $70,471 | $0 | $0 |

Source: Public Records

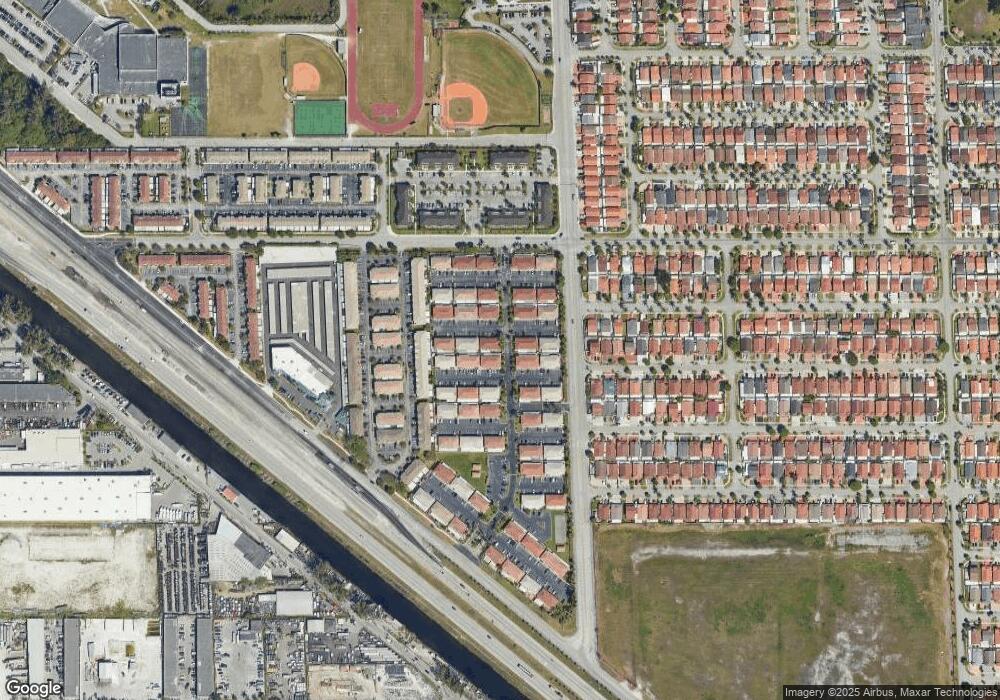

Map

Nearby Homes

- 11041 W Okeechobee Rd Unit 102

- 11115 W Okeechobee Rd Unit 119

- 8945 NW 114th St

- 11465 NW 88th Ct

- 5689 W 28th Ave Unit 5689

- 11562 NW 87th Place

- 2765 W 54th St

- 8962 NW 119th St

- 2775 W 61st St Unit 203

- 2775 W 61st Place Unit 207

- 2730 W 60th St Unit 66

- 2735 W 61st Place Unit 204

- 2760 W 61st Place Unit 202

- 2740 W 61st St Unit 204

- 2760 W 62nd Place Unit 203

- 2740 W 62nd St Unit 104

- 2740 W 62nd Place Unit 202

- 9371 NW 120th Terrace Unit 127

- 8851 NW 119th St Unit 6117

- 8851 NW 119th St Unit 5222

- 10905 W Okeechobee Rd Unit 102

- 10905 W Okeechobee Rd Unit 101

- 10905 W Okeechobee Rd Unit 202

- 10907 W Okeechobee Rd Unit 102

- 10907 W Okeechobee Rd Unit 101

- 10901 W Okeechobee Rd Unit 201

- 10901 W Okeechobee Rd Unit 102

- 10901 W Okeechobee Rd Unit 101

- 10901 W Okeechobee Rd Unit 202

- 10913 W Okeechobee Rd Unit 102

- 10913 W Okeechobee Rd Unit 101

- 10913 W Okeechobee Rd Unit 202

- 10913 W Okeechobee Rd Unit 201

- 10951 W Okeechobee Rd Unit 102

- 10951 W Okeechobee Rd Unit 201

- 10951 W Okeechobee Rd Unit 202

- 10951 W Okeechobee Rd Unit 101

- 10917 W Okeechobee Rd Unit 101