10925 Kley Rd Vandalia, OH 45377

Estimated Value: $510,000 - $613,000

5

Beds

4

Baths

3,166

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 10925 Kley Rd, Vandalia, OH 45377 and is currently estimated at $574,864, approximately $181 per square foot. 10925 Kley Rd is a home located in Montgomery County with nearby schools including Helke Elementary School, Morton Middle School, and Butler High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 2, 2013

Sold by

Valdespino Jorge A and Ramirez Valdespino Monica

Bought by

Valdespino Jorge A and Ramirez Valdespino Monica

Current Estimated Value

Purchase Details

Closed on

Mar 31, 2009

Sold by

Weber Gilbert Tammy A

Bought by

Valdespino Jorge A and Ramirez Valdespino Monica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Outstanding Balance

$204,131

Interest Rate

5.11%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$370,733

Purchase Details

Closed on

Apr 20, 2006

Sold by

Beal Douglas Raymond and Beal Janice R

Bought by

Beal David Dean

Purchase Details

Closed on

Nov 3, 2005

Sold by

Gilbert Heath B and Weber Gilbert Tammy A

Bought by

Weber Gilbert Tammy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,000

Interest Rate

5.62%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

May 31, 2000

Sold by

Robinson James L and Robinson Margaret A

Bought by

Gilbert Heath B and Weber Gilbert Tammy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

7.62%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Valdespino Jorge A | -- | None Available | |

| Valdespino Jorge A | $400,000 | Attorney | |

| Beal David Dean | -- | None Available | |

| Weber Gilbert Tammy A | -- | -- | |

| Gilbert Heath B | $350,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Valdespino Jorge A | $320,000 | |

| Previous Owner | Weber Gilbert Tammy A | $263,000 | |

| Previous Owner | Gilbert Heath B | $280,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,455 | $153,175 | $19,635 | $133,540 |

| 2023 | $9,455 | $154,939 | $21,399 | $133,540 |

| 2022 | $9,145 | $118,080 | $15,060 | $103,020 |

| 2021 | $9,148 | $118,080 | $15,060 | $103,020 |

| 2020 | $9,125 | $118,080 | $15,060 | $103,020 |

| 2019 | $10,014 | $118,280 | $12,050 | $106,230 |

| 2018 | $10,033 | $118,280 | $12,050 | $106,230 |

| 2017 | $9,967 | $118,280 | $12,050 | $106,230 |

| 2016 | $9,875 | $115,000 | $13,070 | $101,930 |

| 2015 | $9,346 | $115,000 | $13,070 | $101,930 |

| 2014 | $9,346 | $115,000 | $13,070 | $101,930 |

| 2012 | -- | $114,560 | $33,740 | $80,820 |

Source: Public Records

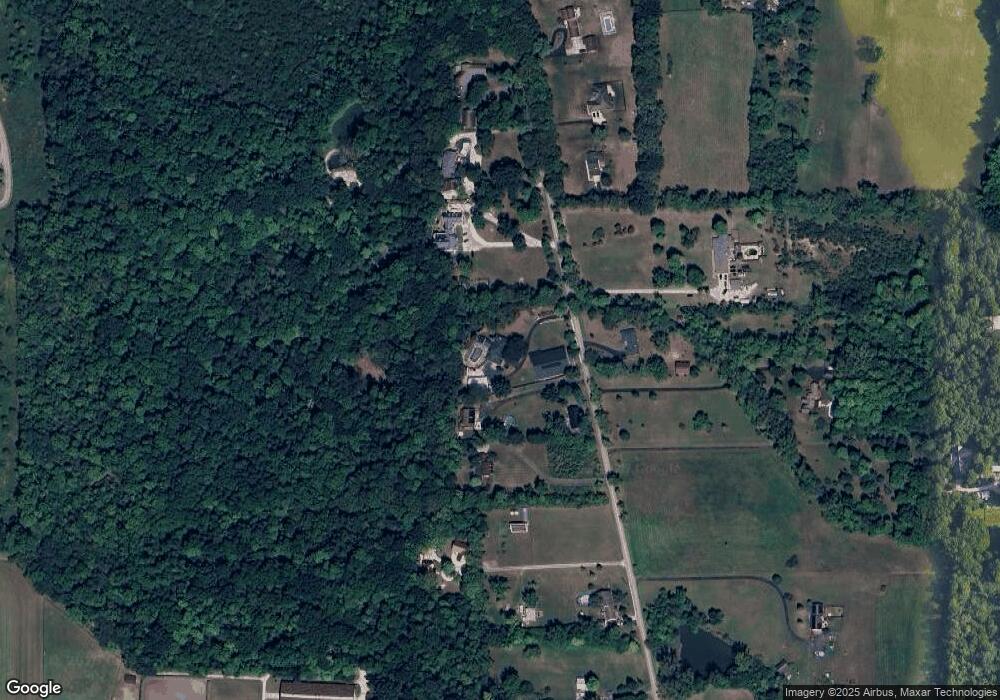

Map

Nearby Homes

- 10515 Kley Rd

- 0 Old Springfield Rd

- 671 Martindale Rd

- 892 Old Springfield Rd

- 925 Old Springfield Rd

- 182 Preakness Ct

- 212 Triple Crown Dr

- 1237 Old Springfield Rd

- 411 N Main St

- 300 Carol Ln

- 308 Lang Ct

- 129 Phillipsburg Union Rd

- 200 Sheets St

- 63 Sweet Potato Ridge Rd

- 110 W Boitnott Dr

- 402 Bramlage Ln

- 106 Rebecca Cir

- 113 Marrett Farm Rd

- 105 Rebecca Cir

- 123 Marrett Farm Rd