1093 SW 158th Ave Unit 6 Pembroke Pines, FL 33027

Hollywood Lakes Country Club NeighborhoodEstimated Value: $475,802 - $567,000

2

Beds

2

Baths

1,292

Sq Ft

$391/Sq Ft

Est. Value

About This Home

This home is located at 1093 SW 158th Ave Unit 6, Pembroke Pines, FL 33027 and is currently estimated at $504,951, approximately $390 per square foot. 1093 SW 158th Ave Unit 6 is a home located in Broward County with nearby schools including Silver Palms Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 10, 2015

Sold by

Acphes Corp

Bought by

Perez Gustavo Enrique and Galindo Luz Angela Poveda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,109

Outstanding Balance

$205,717

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$299,234

Purchase Details

Closed on

Oct 23, 2013

Sold by

Valcarcel Danilo and Gomez Jenny

Bought by

Acphes Corp

Purchase Details

Closed on

Jun 26, 2012

Sold by

Valcarcel Danilo and Gomez Jenny

Bought by

Valcarcel Danilo and Gomez Jenny

Purchase Details

Closed on

May 29, 2002

Sold by

Yap Elise

Bought by

Rice Christopher B

Purchase Details

Closed on

Jun 9, 1999

Sold by

Shelby Homes At The Courtyards Ltd

Bought by

Yap Elise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,730

Interest Rate

6.94%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Perez Gustavo Enrique | $270,000 | Bankers Title & Escrow Svcs | |

| Acphes Corp | -- | Title Associates Usa Llc | |

| Valcarcel Danilo | -- | None Available | |

| Valcarcel Danilo | $210,000 | Coastal Title Inc | |

| Rice Christopher B | $180,000 | -- | |

| Yap Elise | $133,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Perez Gustavo Enrique | $265,109 | |

| Previous Owner | Yap Elise | $93,730 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,863 | $282,660 | -- | -- |

| 2024 | $4,713 | $274,700 | -- | -- |

| 2023 | $4,713 | $266,700 | $0 | $0 |

| 2022 | $4,442 | $258,940 | $0 | $0 |

| 2021 | $4,334 | $250,370 | $0 | $0 |

| 2020 | $4,287 | $246,920 | $0 | $0 |

| 2019 | $4,209 | $241,370 | $52,790 | $188,580 |

| 2018 | $4,093 | $239,190 | $52,790 | $186,400 |

| 2017 | $4,128 | $238,700 | $0 | $0 |

| 2016 | $4,109 | $233,800 | $0 | $0 |

| 2015 | $4,663 | $213,930 | $0 | $0 |

| 2014 | $4,266 | $194,490 | $0 | $0 |

| 2013 | -- | $183,050 | $56,630 | $126,420 |

Source: Public Records

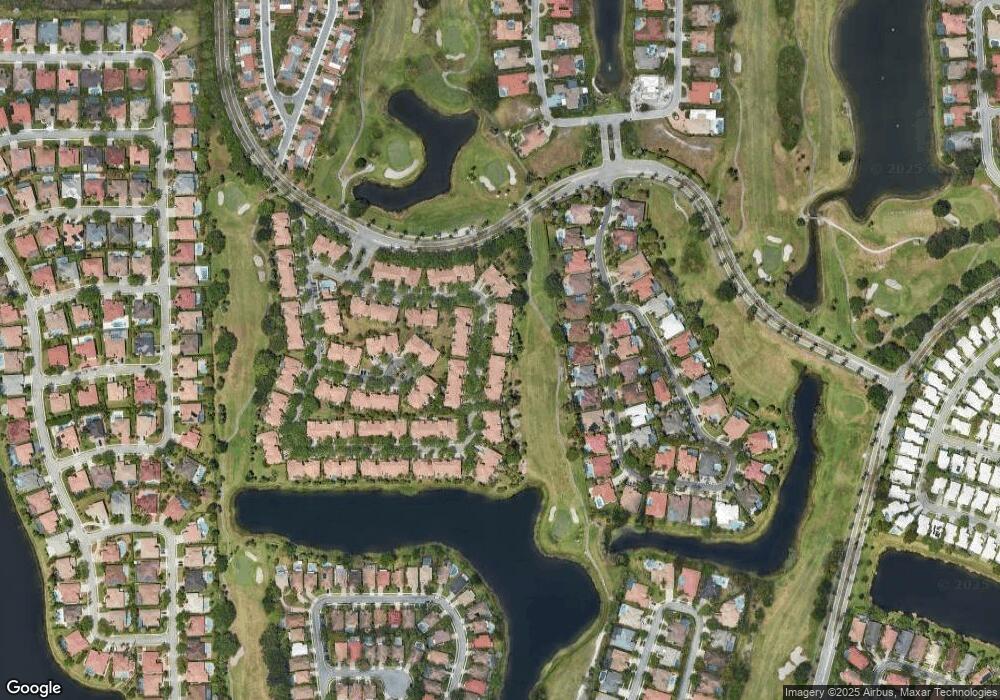

Map

Nearby Homes

- 1102 SW 158th Ave Unit 6

- 15822 SW 10th St

- 15827 SW 12th St

- 15831 SW 10th St

- 1113 SW 156th Terrace

- 1100 SW 156th Ave

- 1091 SW 156th Ave

- 15899 SW 12th St

- 1423 SW 158th Ave

- 561 Enclave Cir E

- 1490 SW 159th Ave

- 541 Enclave Cir E

- 1601 SW 158th Ave

- 15281 Wilshire Ct

- 238 SW 159th Ct

- 1040 Wilshire Cir W

- 1485 Lacosta Dr W

- 1170 Wilshire Cir E

- 15830 SW 3rd Ct Unit 1027

- 301 SW 158th Terrace Unit 104

- 1093 SW 158th Ave Unit 1093

- 1081 SW 158th Ave Unit 5

- 1101 SW 158th Ave

- 1073 SW 158th Ave

- 1113 SW 158th Ave Unit 404

- 1113 SW 158th Ave Unit 1113

- 1113 SW 158th Ave

- 1061 SW 158th Ave

- 1121 SW 158th Ave

- 1053 SW 158th Ave

- 1123 SW 158th Ave Unit 1123

- 1123 SW 158th Ave Unit 4

- 1084 SW 158th Ave

- 1092 SW 158th Ave

- 1041 SW 158th Ave

- 1082 SW 158th Ave Unit 1082

- 1082 SW 158th Ave Unit 3

- 1131 SW 158th Ave

- 1074 SW 158th Ave

- 1062 SW 158th Ave