10963 S Birch Creek Rd South Jordan, UT 84095

Estimated Value: $436,000 - $485,000

3

Beds

3

Baths

1,958

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 10963 S Birch Creek Rd, South Jordan, UT 84095 and is currently estimated at $461,172, approximately $235 per square foot. 10963 S Birch Creek Rd is a home located in Salt Lake County with nearby schools including South Jordan School, South Jordan Middle School, and American Preparatory Academy - Draper 2 Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 3, 2021

Sold by

Howerton Matthew

Bought by

Howerton Matthew and Howerton Terence Kannon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,812

Outstanding Balance

$253,580

Interest Rate

3.1%

Mortgage Type

FHA

Estimated Equity

$207,592

Purchase Details

Closed on

Sep 6, 2019

Sold by

Mecham Aubrey and Anderson Aubrey

Bought by

Howerton Matthew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,710

Interest Rate

3.7%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 27, 2017

Sold by

Seirup Robert J and Seirup Lindsey M

Bought by

Anderson Aubrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,650

Interest Rate

4.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 21, 2013

Sold by

Twelves Travis Leland and Twelves Miriam G

Bought by

Seirup Robert J and Seirup Lindsey M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,739

Interest Rate

3.31%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 14, 2010

Sold by

Twelves Travis Leland

Bought by

Twelves Travis Leland and Twelves Miriam G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,715

Interest Rate

4.26%

Mortgage Type

VA

Purchase Details

Closed on

Aug 20, 2010

Sold by

Jpmorgan Chase Bank National Association

Bought by

Twelves Travis Leland

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,715

Interest Rate

4.26%

Mortgage Type

VA

Purchase Details

Closed on

Jul 19, 2010

Sold by

Heaps David R

Bought by

Jpmorgan Chase Bank National Association

Purchase Details

Closed on

May 15, 2007

Sold by

Castlewood Sterling Village I Llc

Bought by

Heaps David R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,515

Interest Rate

7.87%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Howerton Matthew | -- | Highland Title Agency | |

| Howerton Matthew | -- | First American Title | |

| Anderson Aubrey | -- | None Available | |

| Seirup Robert J | -- | South Valley Title Ins | |

| Twelves Travis Leland | -- | Metro National Title | |

| Twelves Travis Leland | -- | Metro National Title | |

| Jpmorgan Chase Bank National Association | $144,415 | None Available | |

| Heaps David R | -- | Utah Mountain Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Howerton Matthew | $279,812 | |

| Closed | Howerton Matthew | $283,710 | |

| Previous Owner | Anderson Aubrey | $237,650 | |

| Previous Owner | Seirup Robert J | $176,739 | |

| Previous Owner | Twelves Travis Leland | $153,715 | |

| Previous Owner | Heaps David R | $161,515 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,240 | $440,800 | $86,500 | $354,300 |

| 2024 | $2,240 | $424,400 | $68,000 | $356,400 |

| 2023 | $2,240 | $371,300 | $64,100 | $307,200 |

| 2022 | $2,220 | $388,900 | $62,900 | $326,000 |

| 2021 | $1,929 | $310,000 | $56,300 | $253,700 |

| 2020 | $1,829 | $275,500 | $45,900 | $229,600 |

| 2019 | $1,815 | $268,700 | $56,600 | $212,100 |

| 2018 | $1,705 | $251,100 | $56,600 | $194,500 |

| 2017 | $1,452 | $209,600 | $56,600 | $153,000 |

| 2016 | $1,429 | $195,400 | $87,600 | $107,800 |

| 2015 | $1,599 | $212,500 | $97,900 | $114,600 |

| 2014 | $1,528 | $199,600 | $93,100 | $106,500 |

Source: Public Records

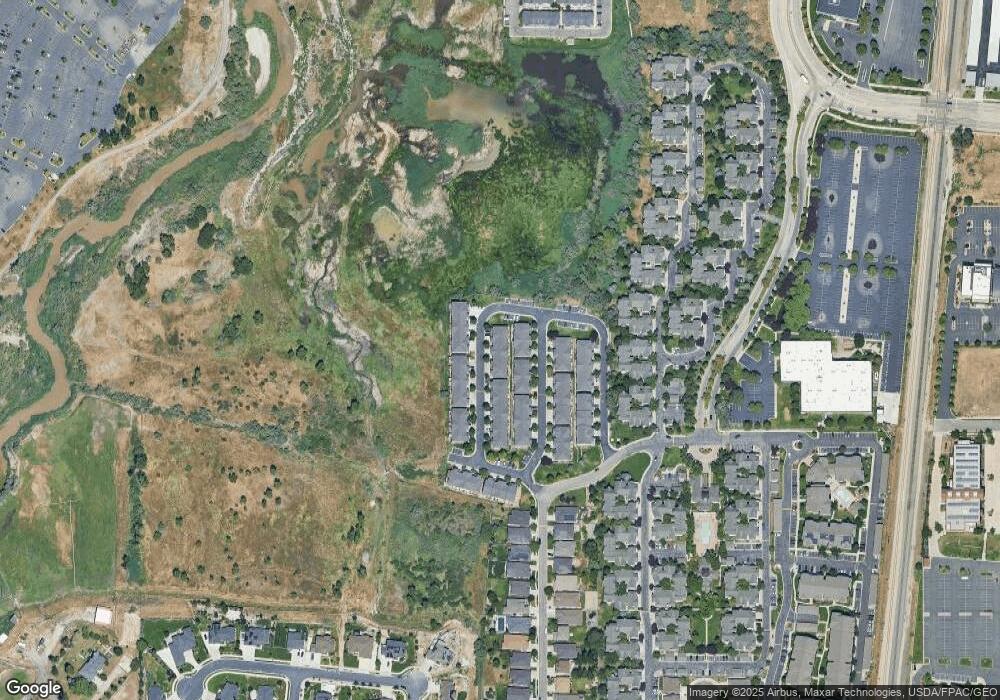

Map

Nearby Homes

- 456 Aspen Gate Ln

- 11187 S Devon View Dr

- 11173 S Aspen Peak Dr

- 11324 S Trent Dr

- Sonderborg Plan at Big Willow Creek - Collection & Cottage

- Lillehammer Plan at Big Willow Creek - Collection & Cottage

- Nyborg Plan at Big Willow Creek - Collection & Cottage

- Raleigh Traditional Plan at Big Willow Creek

- 498 W Maidengrass Way

- 504 W Maidengrass Way

- 724 W Maple Drift Ln

- 11534 Sweet Grass Ct

- 11552 S Sweet Grass Ct

- 10827 S 1055 W

- Bentley II Plan at Fox Landing

- Crescent Plan at Fox Landing

- Hensley Plan at Fox Landing

- Bayhill Plan at Fox Landing

- Rosamund Plan at Fox Landing

- Midway Plan at Fox Landing

- 10967 S Birch Creek Rd

- 10971 S Birch Creek Rd

- 10957 S Birch Creek Rd

- 10962 S Maple Forest Way

- 10966 S Maple Forest Way

- 10977 S Birch Creek Rd

- 10958 S Maple Forest Way

- 10958 S Maple Forest Way Unit 47

- 10972 S Maple Forest Way

- 10976 S Maple Forest Way

- 10981 S Birch Creek Rd

- 6228 Birch Creek Rd

- 10964 S Birch Creek Rd

- 10968 S Birch Creek Rd

- 10978 S Maple Forest Way

- 10974 S Birch Creek Rd

- 10956 S Birch Creek Rd

- 10954 S Birch Creek Rd

- 10983 S Birch Creek Rd

- 10976 S Birch Creek Rd