10993 S Maple Forest Way South Jordan, UT 84095

Estimated Value: $463,462 - $496,000

3

Beds

3

Baths

2,241

Sq Ft

$213/Sq Ft

Est. Value

About This Home

This home is located at 10993 S Maple Forest Way, South Jordan, UT 84095 and is currently estimated at $477,116, approximately $212 per square foot. 10993 S Maple Forest Way is a home located in Salt Lake County with nearby schools including South Jordan School, South Jordan Middle School, and American Preparatory Academy - Draper 2 Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2025

Sold by

Hunt Wenfang and Hunt Scott Lyman

Bought by

Hunt Family Revocable Trust and Hunt

Current Estimated Value

Purchase Details

Closed on

Jan 12, 2011

Sold by

Us Bank National Association

Bought by

Iorg Kenneth

Purchase Details

Closed on

Feb 22, 2010

Sold by

Lew Billy Wah and Lew Shirley

Bought by

Us Bank National Association

Purchase Details

Closed on

Mar 30, 2007

Sold by

Castlewood Sterling Village I Llc

Bought by

Lew Billy Wah and Lew Shirley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,682

Interest Rate

6.29%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hunt Family Revocable Trust | -- | None Listed On Document | |

| Iorg Kenneth | -- | Inwest Title Services | |

| Us Bank National Association | $156,000 | None Available | |

| Lew Billy Wah | -- | Utah Mountain Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lew Billy Wah | $165,682 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,251 | $441,900 | $95,400 | $346,500 |

| 2024 | $2,251 | $426,400 | $75,000 | $351,400 |

| 2023 | $2,085 | $372,700 | $70,700 | $302,000 |

| 2022 | $2,230 | $390,600 | $69,400 | $321,200 |

| 2021 | $1,971 | $316,700 | $62,100 | $254,600 |

| 2020 | $2,088 | $284,000 | $50,600 | $233,400 |

| 2019 | $2,243 | $280,600 | $63,700 | $216,900 |

| 2018 | $2,103 | $258,900 | $63,700 | $195,200 |

| 2017 | $1,652 | $230,600 | $63,700 | $166,900 |

| 2016 | $1,566 | $214,200 | $89,700 | $124,500 |

| 2015 | $1,704 | $226,500 | $100,300 | $126,200 |

| 2014 | $1,627 | $212,600 | $95,300 | $117,300 |

Source: Public Records

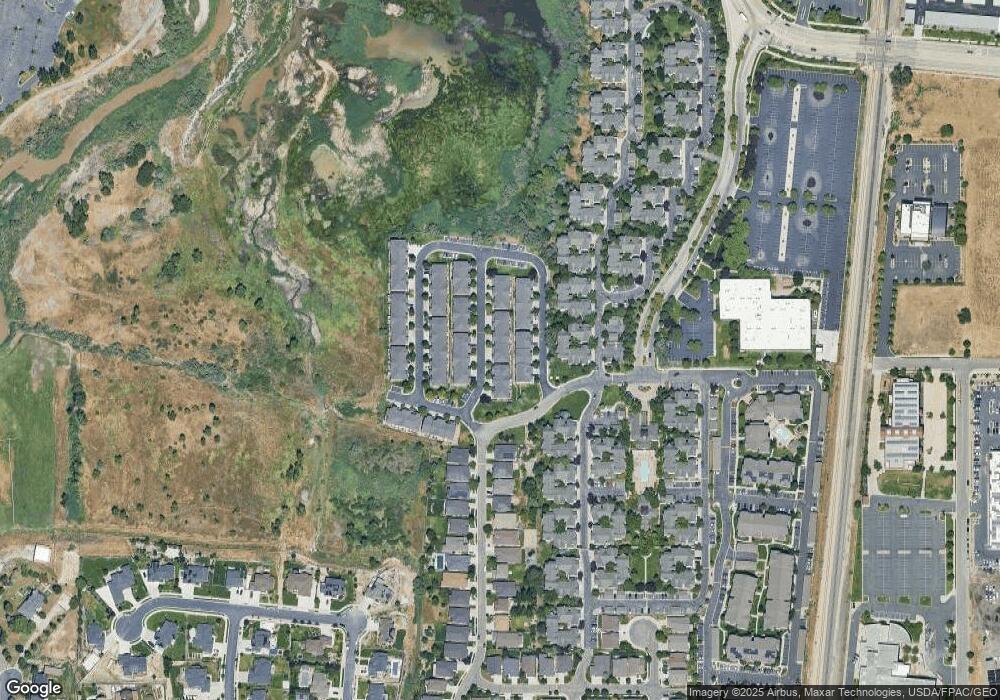

Map

Nearby Homes

- 456 Aspen Gate Ln

- 11187 S Devon View Dr

- 11173 S Aspen Peak Dr

- 11324 S Trent Dr

- Sonderborg Plan at Big Willow Creek - Collection & Cottage

- Lillehammer Plan at Big Willow Creek - Collection & Cottage

- Nyborg Plan at Big Willow Creek - Collection & Cottage

- Raleigh Traditional Plan at Big Willow Creek

- 498 W Maidengrass Way

- 504 W Maidengrass Way

- 724 W Maple Drift Ln

- 11534 Sweet Grass Ct

- 11552 S Sweet Grass Ct

- 10827 S 1055 W

- Bentley II Plan at Fox Landing

- Crescent Plan at Fox Landing

- Hensley Plan at Fox Landing

- Bayhill Plan at Fox Landing

- Rosamund Plan at Fox Landing

- Midway Plan at Fox Landing

- 10989 S Maple Forest Way

- 10987 S Maple Forest Way

- 11001 S Maple Forest Way

- 10994 S Maple Farms Ln

- 10992 S Maple Farms Ln

- 10983 S Maple Forest Way

- 10988 S Maple Farms Ln

- 10998 S Maple Farms Ln

- 11003 S Maple Forest Way

- 10977 S Maple Forest Way

- 11002 S Maple Farms Ln

- 10982 S Maple Farms Ln

- 11009 S Maple Forest Way

- 10996 S Maple Forest Way

- 10988 S Maple Forest Way

- 10992 S Maple Forest Way

- 11006 S Maple Farms Ln

- 10998 S Maple Forest Way

- 10982 S Maple Forest Way

- 10978 S Maple Farms Ln