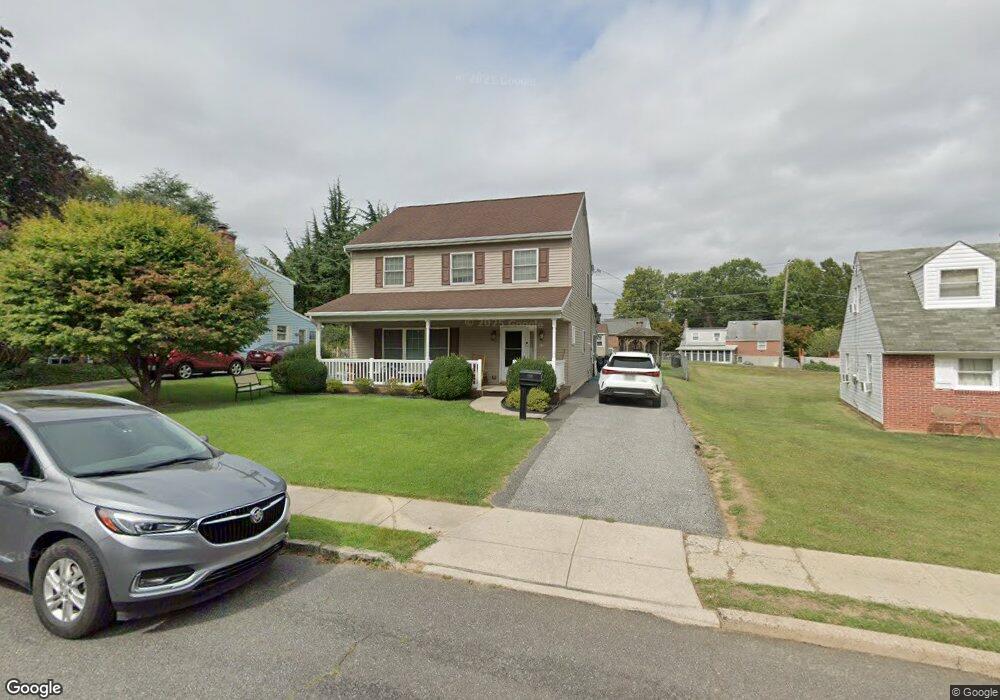

110 Roberts Rd Brookhaven, PA 19015

Estimated Value: $282,000 - $368,000

3

Beds

2

Baths

2,059

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 110 Roberts Rd, Brookhaven, PA 19015 and is currently estimated at $332,965, approximately $161 per square foot. 110 Roberts Rd is a home located in Delaware County with nearby schools including Widener Partnership Charter School, Drexel Newman Academy, and The Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 20, 2007

Sold by

Scott Peggy and Flythe Preston

Bought by

Scott Peggy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,700

Outstanding Balance

$116,416

Interest Rate

6.23%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$216,549

Purchase Details

Closed on

Nov 27, 1995

Sold by

Landin Jack T and Landin Ann B

Bought by

Flythe Preston and Scott Peggy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,816

Interest Rate

6.99%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott Peggy | -- | None Available | |

| Flythe Preston | $110,000 | T A Title Insurance Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Scott Peggy | $191,700 | |

| Previous Owner | Flythe Preston | $109,816 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,501 | $213,420 | $63,770 | $149,650 |

| 2024 | $5,501 | $213,420 | $63,770 | $149,650 |

| 2023 | $5,278 | $213,420 | $63,770 | $149,650 |

| 2022 | $4,969 | $213,420 | $63,770 | $149,650 |

| 2021 | $7,758 | $213,420 | $63,770 | $149,650 |

| 2020 | $5,083 | $127,110 | $38,770 | $88,340 |

| 2019 | $4,984 | $127,110 | $38,770 | $88,340 |

| 2018 | $4,831 | $127,110 | $0 | $0 |

| 2017 | $4,728 | $127,110 | $0 | $0 |

| 2016 | $698 | $127,110 | $0 | $0 |

| 2015 | $698 | $127,110 | $0 | $0 |

| 2014 | $698 | $127,110 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 17 Upland Rd

- 200 Harvin Way Unit 231

- 3228 Tom Sweeney Dr

- 200 E Roland Rd

- 12 Trimble Blvd

- 157 Meadowbrook Ln

- 204 E Avon Rd

- 100 E Roland Rd

- 250 E Avon Rd

- 261 E Avon Rd

- 231 Creekside Dr Unit A21

- 113 Creekside Dr Unit 3

- 114 E Parkway Ave

- 4105 Mount Vernon Ave

- 433 Saybrook Ln Unit 176

- 1000 Putnam Blvd Unit 205

- 987 Putnam Blvd

- 368 Saybrook Ln

- 900 Main St

- 338A Saybrook Ln

- 108 Roberts Rd

- 112 Roberts Rd

- 106 Roberts Rd

- 114 Roberts Rd

- 5 Meadowbrook Ln

- 7 Meadowbrook Ln

- 104 Roberts Rd

- 109 Roberts Rd

- 9 Meadowbrook Ln

- 115 Roberts Rd

- 107 Roberts Rd

- 1 Meadowbrook Ln

- 105 Roberts Rd

- 116 Roberts Rd

- 103 Roberts Rd

- 13 Meadowbrook Ln

- 118 Roberts Rd

- 3303 Edgmont Ave

- 120 Roberts Rd

- 110 E Garrison Rd