110 Shadow Creek Ct Fairburn, GA 30213

Estimated Value: $314,505 - $338,000

3

Beds

3

Baths

2,564

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 110 Shadow Creek Ct, Fairburn, GA 30213 and is currently estimated at $326,376, approximately $127 per square foot. 110 Shadow Creek Ct is a home located in Fulton County with nearby schools including E. C. West Elementary School, Bear Creek Middle School, and Creekside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2014

Sold by

Forte Levy

Bought by

Forte Beverly N

Current Estimated Value

Purchase Details

Closed on

Oct 25, 2010

Sold by

Atlanta Nbrhd Dev Ptshp

Bought by

Forte Levy and Forte Beverly N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,137

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 23, 2010

Sold by

Mortgage Invs Trust 2006 & 3

Bought by

Atlanta Nbrhd Dev Ptshp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,157

Interest Rate

10%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Nov 3, 2009

Sold by

Mcgrue Iphigenia

Bought by

Mortgage Invs Ii In Trust 2006

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Forte Beverly N | -- | -- | |

| Forte Levy | $110,000 | -- | |

| Atlanta Nbrhd Dev Ptshp | $105,900 | -- | |

| Mortgage Invs Ii In Trust 2006 | $164,467 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Forte Levy | $97,137 | |

| Previous Owner | Atlanta Nbrhd Dev Ptshp | $162,157 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,194 | $121,920 | $24,920 | $97,000 |

| 2023 | $3,202 | $113,440 | $35,240 | $78,200 |

| 2022 | $855 | $100,920 | $22,760 | $78,160 |

| 2021 | $842 | $93,000 | $18,160 | $74,840 |

| 2020 | $839 | $65,240 | $15,360 | $49,880 |

| 2019 | $613 | $64,080 | $15,080 | $49,000 |

| 2018 | $936 | $62,600 | $14,720 | $47,880 |

| 2017 | $814 | $53,880 | $13,920 | $39,960 |

| 2016 | $811 | $53,880 | $13,920 | $39,960 |

| 2015 | $814 | $53,880 | $13,920 | $39,960 |

| 2014 | $817 | $53,880 | $13,920 | $39,960 |

Source: Public Records

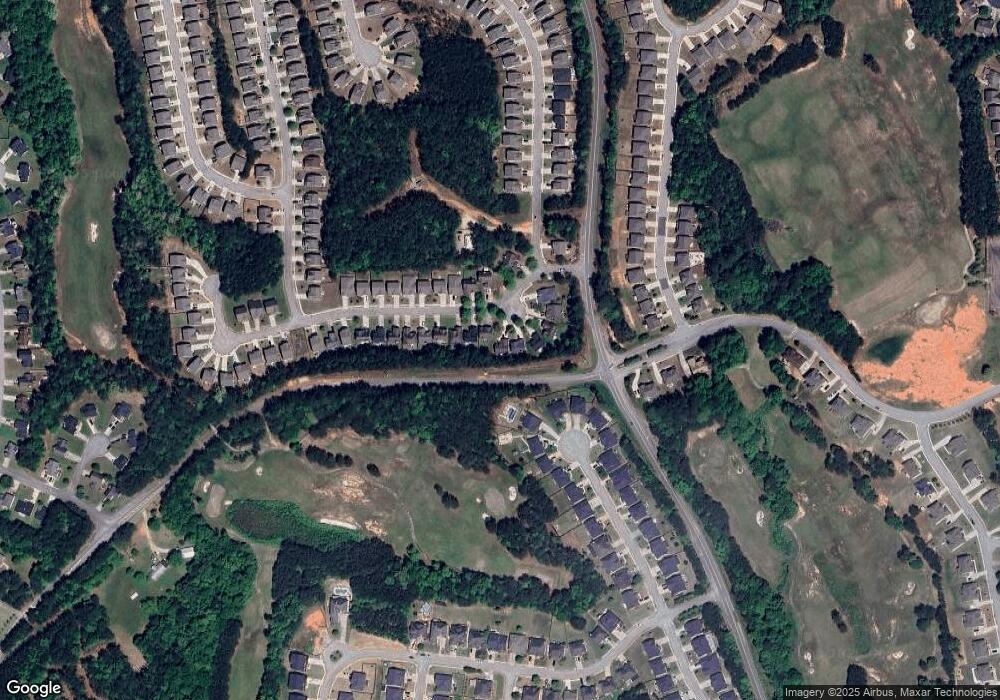

Map

Nearby Homes

- 6945 John Rivers Rd

- 7200 Mahogany Dr

- 700 Buckingham Terrace

- 925 Buckingham Cove

- 5120 Blackheath Way

- 6990 Oak Leaf Dr

- 6835 Tell Rd

- 338 Champions Dr

- 7215 Cane Leaf Dr

- 100 Grande Bishop Dr

- 75 Fanleaf Dr

- 7055 Rivertown Rd Unit 301

- 210 Fanleaf Dr

- 7000 Bishop Rd

- 799 Grande Bishop Dr Unit 27

- 782 Grande Bishop Dr Unit 65

- The Baylor II 3-ME Plan at Bishop Meadows

- Ramsey II 3-M Plan at Bishop Meadows

- The Florence I 3-ME Plan at Bishop Meadows

- The Cahaba 3-M Plan at Bishop Meadows

- 112 Shadow Creek Ct

- 112 Shadow Creek Ct Unit 1

- 108 Shadow Creek Ct Unit 1/5

- 108 Shadow Creek Ct

- 114 Shadow Creek Ct

- 114 Shadow Creek Ct

- 106 Shadow Creek Ct Unit 1

- 106 Shadow Creek Ct

- 106 Shadow Creek Ct

- 116 Shadow Creek Ct

- 118 Shadow Creek Ct

- 102 Shadow Creek Ct

- 105 Shadow Creek Ct Unit 1

- 105 Shadow Creek Ct

- 1105 Vintage Ct

- 107 Shadow Creek Ct

- 100 Shadow Creek Ct

- 109 Shadow Creek Ct

- 120 Shadow Creek Ct

- 103 Shadow Creek Ct