11001 11001 Nw 43rd Ln # 11001 Unit 11001 Doral, FL 33178

Doral Park NeighborhoodEstimated Value: $514,000 - $564,000

3

Beds

3

Baths

1,590

Sq Ft

$338/Sq Ft

Est. Value

About This Home

This home is located at 11001 11001 Nw 43rd Ln # 11001 Unit 11001, Doral, FL 33178 and is currently estimated at $537,183, approximately $337 per square foot. 11001 11001 Nw 43rd Ln # 11001 Unit 11001 is a home located in Miami-Dade County with nearby schools including Ruben Dario Middle School, Ronald W. Reagan/Doral Senior High School, and Robert Morgan Educational Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 18, 2022

Sold by

Hgm Investment Llc

Bought by

Brennan Dean and Brennan Silvia P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$376,360

Outstanding Balance

$346,863

Interest Rate

3.11%

Mortgage Type

New Conventional

Estimated Equity

$190,320

Purchase Details

Closed on

Oct 11, 2013

Sold by

Ramon Sandra and Ramon Raquel

Bought by

Hgm Investments Llc

Purchase Details

Closed on

Aug 5, 2005

Sold by

Arreaza Roberto and Arreaza Rosa

Bought by

Ramon Raquel and Ramon Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,500

Interest Rate

5.48%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Aug 12, 1999

Sold by

Adrian Home Comm At Eagle Cove

Bought by

Arreaza Roberto and Arreaza Rosa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brennan Dean | $388,000 | New Title Company Name | |

| Hgm Investments Llc | $265,000 | Attorney | |

| Ramon Raquel | $350,000 | United Title & Escrow Llc | |

| Arreaza Roberto | $136,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brennan Dean | $376,360 | |

| Previous Owner | Ramon Raquel | $227,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,034 | $407,232 | -- | -- |

| 2024 | $6,726 | $407,232 | -- | -- |

| 2023 | $6,726 | $395,400 | $0 | $0 |

| 2022 | $5,847 | $300,300 | $0 | $0 |

| 2021 | $5,443 | $273,000 | $0 | $0 |

| 2020 | $5,128 | $260,000 | $0 | $0 |

| 2019 | $5,161 | $261,000 | $0 | $0 |

| 2018 | $4,649 | $242,000 | $0 | $0 |

| 2017 | $5,054 | $261,200 | $0 | $0 |

| 2016 | $4,812 | $244,340 | $0 | $0 |

| 2015 | $4,501 | $222,390 | $0 | $0 |

| 2014 | $4,597 | $222,390 | $0 | $0 |

Source: Public Records

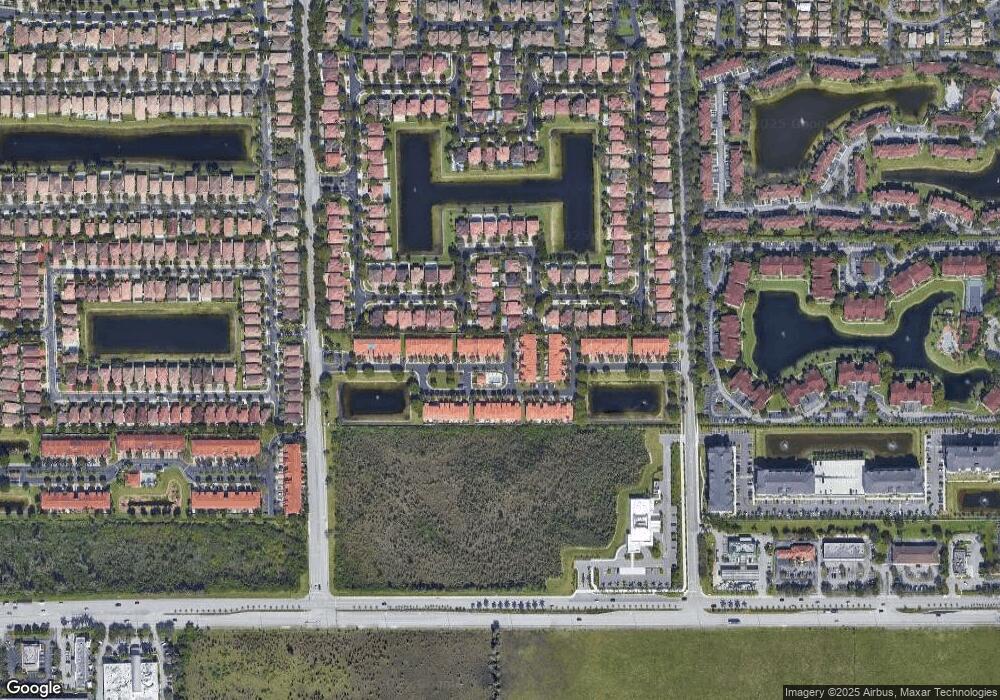

Map

Nearby Homes

- 4450 NW 109th Ct

- 4854 NW 110th Place

- 4440 NW 107th Ave Unit 1017

- 11258 NW 47th Ln

- 4863 NW 109th Path

- 11270 NW 47th Ln

- 4370 NW 107th Ave Unit 205

- 4849 NW 108th Path

- 4366 NW 113th Place

- 4350 NW 107th Ave Unit 2012

- 4560 NW 107th Ave Unit 20712

- 4580 NW 107th Ave Unit 20713

- 4580 NW 107th Ave Unit 10413

- 5134 NW 113th Ave

- 10878 NW 51st Ln

- 4384 NW 115th Ct

- 11512 NW 48th Terrace

- 11530 NW 48th Terrace

- 5323 NW 109th Ct

- 5343 NW 111th Ct

- 11001 NW 43rd Ln

- 11005 NW 43rd Ln

- 11009 NW 43rd Ln

- 11013 NW 43rd Ln

- 11013 NW 43rd Ln

- 11017 NW 43rd Ln Unit 11017

- 11017 NW 43rd Ln

- 11017 NW 43rd Ln Unit x

- 4369 NW 110th Ave

- 4361 NW 110th Ave Unit 4361

- 4361 NW 110th Ave

- 4377 NW 110th Ave

- 4353 NW 110th Ave

- 4404 NW 109th Passage

- 4385 NW 110th Ave

- 4385 NW 110th Ave

- 4405 NW 110th Ct

- 4345 NW 110th Ave

- 11025 NW 43rd Ln

- 11025 NW 43rd Ln