11006 Lakeland Cir Fort Myers, FL 33913

Gateway NeighborhoodEstimated Value: $466,594 - $512,000

4

Beds

2

Baths

2,139

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 11006 Lakeland Cir, Fort Myers, FL 33913 and is currently estimated at $482,149, approximately $225 per square foot. 11006 Lakeland Cir is a home located in Lee County with nearby schools including Gateway Elementary School, Tice Elementary School, and Orange River Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 14, 2022

Sold by

Turner Debra A

Bought by

Lutz Steven L and Kale Deborah M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,000

Interest Rate

3.22%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 21, 2005

Sold by

Jourdan Catherine M and Jourdan Raymond L

Bought by

Turner Debra A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

5.62%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 17, 2002

Sold by

Lawrence Anthony and Verduchi Alice E

Bought by

Jourdan Catherine M and Jourdan Raymond L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,631

Interest Rate

6.77%

Mortgage Type

VA

Purchase Details

Closed on

Apr 7, 2000

Sold by

Colonial Homes Inc

Bought by

Lawrence Anthony and Verduchi Alice E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lutz Steven L | $475,000 | Madden Law Firm Llc | |

| Turner Debra A | $365,000 | -- | |

| Jourdan Catherine M | $215,000 | -- | |

| Lawrence Anthony | $237,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Lutz Steven L | $375,000 | |

| Previous Owner | Turner Debra A | $60,000 | |

| Previous Owner | Jourdan Catherine M | $172,631 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,289 | $407,301 | $65,408 | $300,199 |

| 2024 | $7,134 | $430,619 | $163,985 | $232,353 |

| 2023 | $7,134 | $432,089 | $170,659 | $240,732 |

| 2022 | $6,447 | $389,034 | $56,045 | $332,989 |

| 2021 | $3,333 | $276,040 | $56,045 | $219,995 |

| 2020 | $3,350 | $191,952 | $0 | $0 |

| 2019 | $3,233 | $187,636 | $0 | $0 |

| 2018 | $3,490 | $184,137 | $0 | $0 |

| 2017 | $3,402 | $180,350 | $0 | $0 |

| 2016 | $3,296 | $253,771 | $41,000 | $212,771 |

| 2015 | $3,262 | $208,217 | $41,500 | $166,717 |

| 2014 | -- | $206,393 | $28,500 | $177,893 |

| 2013 | -- | $188,598 | $30,001 | $158,597 |

Source: Public Records

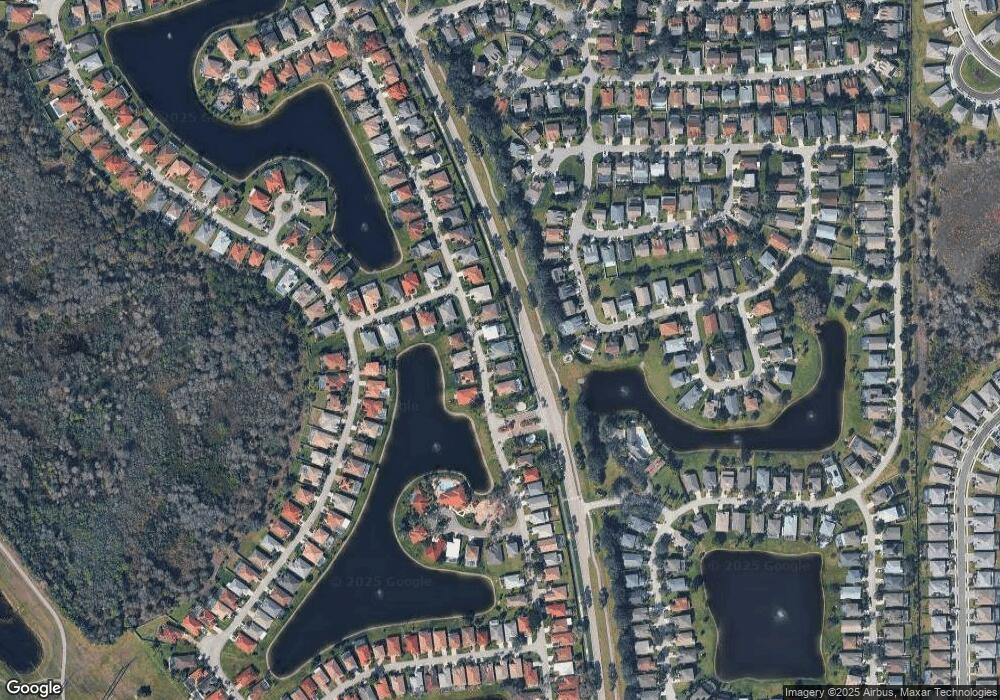

Map

Nearby Homes

- 11005 Lakeland Cir

- 13011 Silver Sands Dr

- 11141 Lakeland Cir

- 11169 Lakeland Cir

- 11317 Lakeland Cir

- 11302 Lakeland Cir

- 13246 Highland Chase Place

- 13255 Highland Chase Place

- 13356 Highland Chase Place

- 13274 Highland Chase Place

- 11404 Lake Cypress Loop

- 11544 Lake Cypress Loop

- 11091 Lakeland Cir

- 13483 Little Gem Cir

- 12711 Fairington Way

- 11432 Waterford Village Dr

- 13229 Little Gem Cir

- 11436 Canopy Loop

- 12725 Vista Pine Cir

- 11035 Pebble Springs Run

- 11008 Lakeland Cir

- 11004 Lakeland Cir

- 11002 Lakeland Cir

- 11010 Lakeland Cir

- 11007 Lakeland Cir

- 11003 Lakeland Cir

- 11012 Lakeland Cir

- 11001 Lakeland Cir

- 13060 Silver Sands Dr

- 13348 Bristol Park Way

- 13340 Bristol Park Way

- 13332 Bristol Park Way

- 13050 Silver Sands Dr

- 13324 Bristol Park Way

- 13040 Silver Sands Dr

- 13316 Bristol Park Way

- 11016 Lakeland Cir

- 13365 Bristol Park Way

- 13364 Bristol Park Way

- 13020 Silver Sands Dr