1102 Old Hammond Chase Atlanta, GA 30350

Estimated Value: $221,000 - $249,000

2

Beds

2

Baths

1,273

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 1102 Old Hammond Chase, Atlanta, GA 30350 and is currently estimated at $235,632, approximately $185 per square foot. 1102 Old Hammond Chase is a home located in Fulton County with nearby schools including Woodland Elementary School, Sandy Springs Middle School, and North Springs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2019

Sold by

Lucas Tamara

Bought by

Emery Cynthia Darlene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,920

Outstanding Balance

$126,273

Interest Rate

4.4%

Mortgage Type

New Conventional

Estimated Equity

$109,359

Purchase Details

Closed on

Aug 15, 2006

Sold by

First Franklin Mtg Trust 2003

Bought by

Lucas Tamara

Purchase Details

Closed on

Feb 7, 2006

Sold by

Abrams Stephen

Bought by

First Franklin Mtg Loan Trust

Purchase Details

Closed on

Dec 21, 2000

Sold by

Old Hammond Chase Fulton 1102 Tu

Bought by

Abrams Stephen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,813

Interest Rate

7.53%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 25, 1997

Sold by

Spraker Thomas W

Bought by

Old Hammond Chase Fulton 1102 Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Emery Cynthia Darlene | $179,900 | -- | |

| Lucas Tamara | -- | -- | |

| Lucus Tammy | $72,000 | -- | |

| First Franklin Mtg Loan Trust | $94,265 | -- | |

| Abrams Stephen | $79,500 | -- | |

| Old Hammond Chase Fulton 1102 Trust | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Emery Cynthia Darlene | $143,920 | |

| Previous Owner | Abrams Stephen | $86,813 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,044 | $106,520 | $13,920 | $92,600 |

| 2023 | $2,785 | $98,680 | $12,160 | $86,520 |

| 2022 | $2,307 | $74,320 | $10,160 | $64,160 |

| 2021 | $2,006 | $62,960 | $8,080 | $54,880 |

| 2020 | $2,195 | $67,480 | $9,120 | $58,360 |

| 2019 | $1,946 | $59,600 | $8,960 | $50,640 |

| 2018 | $1,581 | $47,960 | $6,520 | $41,440 |

| 2017 | $1,145 | $33,760 | $4,160 | $29,600 |

| 2016 | $1,145 | $33,760 | $4,160 | $29,600 |

| 2015 | $1,149 | $33,760 | $4,160 | $29,600 |

| 2014 | $1,095 | $30,960 | $3,800 | $27,160 |

Source: Public Records

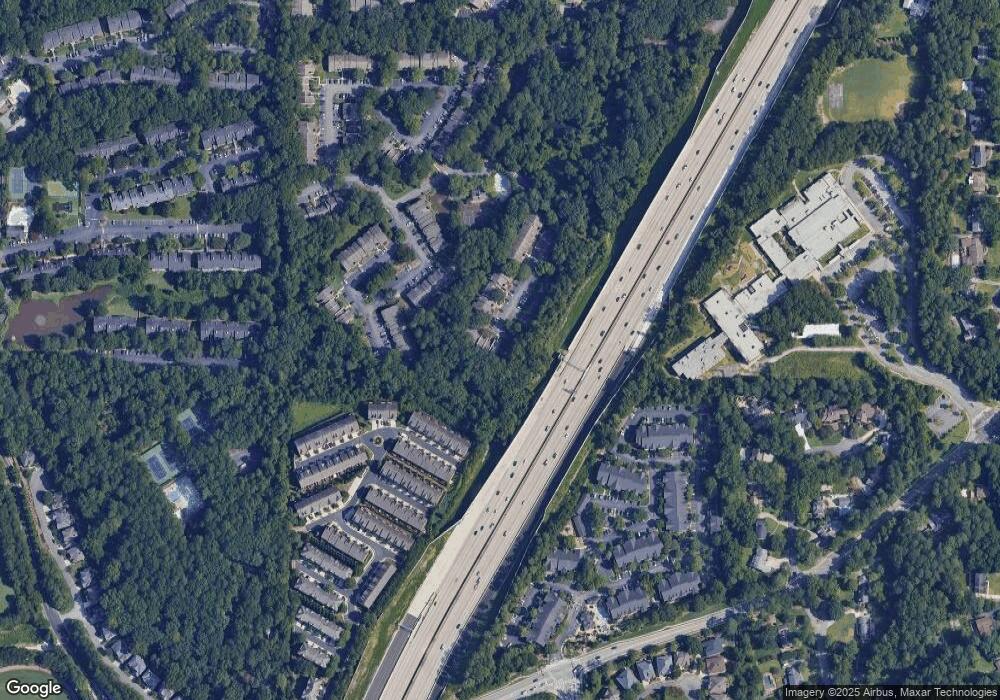

Map

Nearby Homes

- 1912 Huntingdon Chase

- 2504 Huntingdon Chase Unit 2504

- 1502 Huntingdon Chase

- 1201 Old Hammond Chase

- 1404 Huntingdon Chase

- 1401 Huntingdon Chase Unit 1401

- 915 Dumaine Trace

- 7632 Auden Trail

- 525 Spender Trace

- 1804 Wingate Way Unit 1804

- 1503 Wingate Way

- 1512 Wingate Way

- 4006 Wingate Way

- 4008 Wingate Way

- 3020 Wingate Way

- 2015 Wingate Way

- 7249 Village Creek Trace

- 2508 Huntingdon Chase Unit 8

- 2512 Huntingdon Chase Unit 2512

- 2408 Huntingdon Chase Unit 2408

- 2607 Huntingdon Chase Unit 2607

- 1705 Huntingdon Chase Unit 1705

- 2015 Huntingdon Chase Unit 2015

- 2508 Huntingdon Chase Unit 2508

- 2015 Huntingdon Chase Unit UPPER

- 2501 Huntingdon Chase Unit 2501

- 1502 Huntingdon Chase Unit 1502

- 2013 Huntingdon Chase Unit 2013

- 1820 Huntingdon Chase

- 1803 Huntingdon Chase Unit 1803

- 2012 Huntingdon Chase Unit 2012

- 2710 Huntingdon Chase Unit 2710

- 2709 Huntingdon Chase

- 2708 Huntingdon Chase

- 2706 Huntingdon Chase

- 2705 Huntingdon Chase

- 2704 Huntingdon Chase