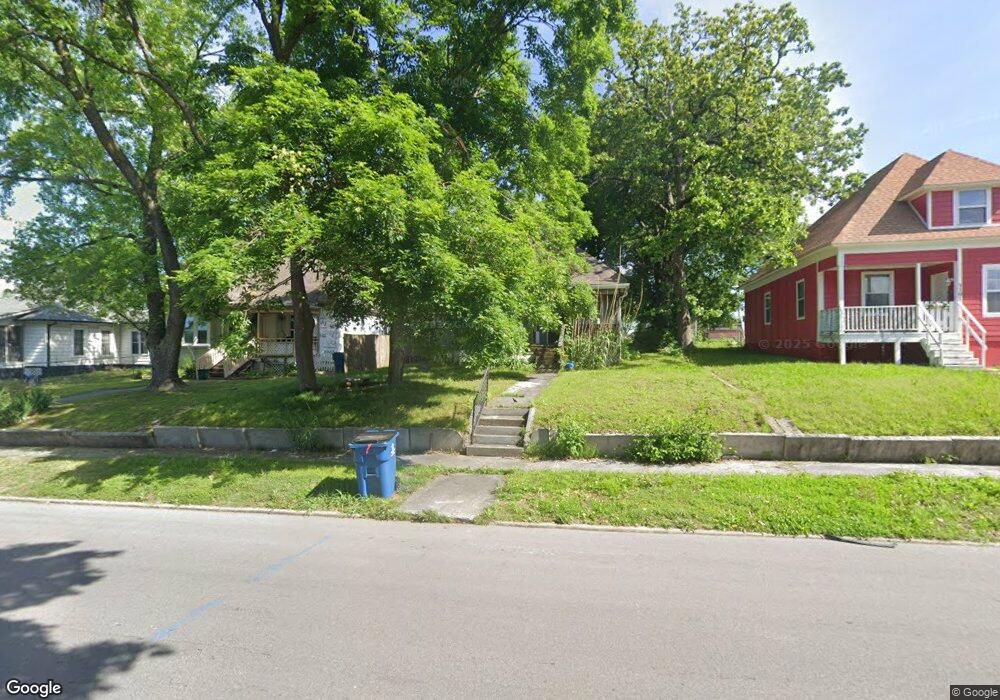

1105 Oak St Carthage, MO 64836

Estimated Value: $78,473 - $119,000

2

Beds

1

Bath

900

Sq Ft

$112/Sq Ft

Est. Value

About This Home

This home is located at 1105 Oak St, Carthage, MO 64836 and is currently estimated at $100,618, approximately $111 per square foot. 1105 Oak St is a home located in Jasper County with nearby schools including Carthage High School, Victory Academy, and St. Ann's Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2018

Sold by

Jasco Properties Llc

Bought by

Emerald Properties Llc

Current Estimated Value

Purchase Details

Closed on

Feb 28, 2014

Sold by

Zimmerman Derek

Bought by

Jasco Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$23,375

Interest Rate

4.47%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Feb 19, 2010

Sold by

Tiffany April

Bought by

Zimmerman Derek

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$19,500

Interest Rate

5.11%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Emerald Properties Llc | -- | -- | |

| Jasco Properties Llc | -- | Cb Title Inc | |

| Zimmerman Derek | $15,000 | Jct |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jasco Properties Llc | $23,375 | |

| Previous Owner | Zimmerman Derek | $19,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $317 | $6,900 | $1,030 | $5,870 |

| 2024 | $317 | $6,150 | $1,030 | $5,120 |

| 2023 | $317 | $6,150 | $1,030 | $5,120 |

| 2022 | $332 | $6,470 | $1,030 | $5,440 |

| 2021 | $328 | $6,470 | $1,030 | $5,440 |

| 2020 | $320 | $6,040 | $1,030 | $5,010 |

| 2019 | $320 | $6,040 | $1,030 | $5,010 |

| 2018 | $320 | $6,040 | $0 | $0 |

| 2017 | $320 | $6,040 | $0 | $0 |

| 2016 | $319 | $6,040 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1324 W Central Ave

- 1014 Sycamore St

- 802 Oak St

- 703 W Central Tract 2

- 431 S Orner St

- 424 Walnut St

- 514 Poplar St

- 1506 Sophia St

- 1143 S Case St

- 1103 Ash St

- 1615 W Budlong St

- 300 N Maple St

- 903 S Main St

- 1112 S Garrison Ave

- 1131 Lyon St

- 1014 S Main St

- 1160 S Maple St

- 1007 Grant St

- 112 E 11th St

- 831 Rombauer Ave