1105 Old Mill Rd Unit 12 Salado, TX 76571

Estimated Value: $403,286 - $558,000

--

Bed

2

Baths

2,686

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 1105 Old Mill Rd Unit 12, Salado, TX 76571 and is currently estimated at $464,072, approximately $172 per square foot. 1105 Old Mill Rd Unit 12 is a home located in Bell County with nearby schools including Thomas Arnold Elementary School, Salado Junior High School, and Salado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 19, 2021

Sold by

Fulton Crystal

Bought by

Driskill Jill A and Wasik Russell

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$338,751

Interest Rate

2.7%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 8, 2019

Sold by

Robertson Virgiia P

Bought by

Fulton Crystal R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,905

Interest Rate

3.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 22, 2018

Sold by

L V Dry Land L P

Bought by

Robertson Virgnia P

Purchase Details

Closed on

Jun 17, 2016

Sold by

Robertson Virginia P

Bought by

Lv Dry Land Lp

Purchase Details

Closed on

May 8, 2015

Sold by

Schenkel Mary Lou

Bought by

Robertson Virginia P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Driskill Jill A | -- | Austin Title Company | |

| Fulton Crystal R | -- | None Available | |

| Robertson Virgnia P | -- | None Available | |

| Lv Dry Land Lp | -- | None Available | |

| Robertson Virginia P | -- | Monteith Abstract & Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Driskill Jill A | $338,751 | |

| Previous Owner | Fulton Crystal R | $170,905 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,565 | $463,265 | $19,454 | $443,811 |

| 2024 | $7,565 | $438,676 | -- | -- |

| 2023 | $7,851 | $398,796 | $0 | $0 |

| 2022 | $7,912 | $362,542 | $13,416 | $349,126 |

| 2021 | $4,524 | $193,563 | $13,416 | $180,147 |

| 2020 | $4,859 | $194,463 | $13,416 | $181,047 |

| 2019 | $3,919 | $169,939 | $13,416 | $156,523 |

| 2018 | $3,267 | $147,482 | $13,416 | $134,066 |

| 2017 | $3,218 | $144,913 | $13,416 | $131,497 |

| 2016 | $3,117 | $140,342 | $13,416 | $126,926 |

| 2015 | $1,433 | $137,910 | $13,416 | $124,494 |

| 2014 | $1,433 | $135,901 | $0 | $0 |

Source: Public Records

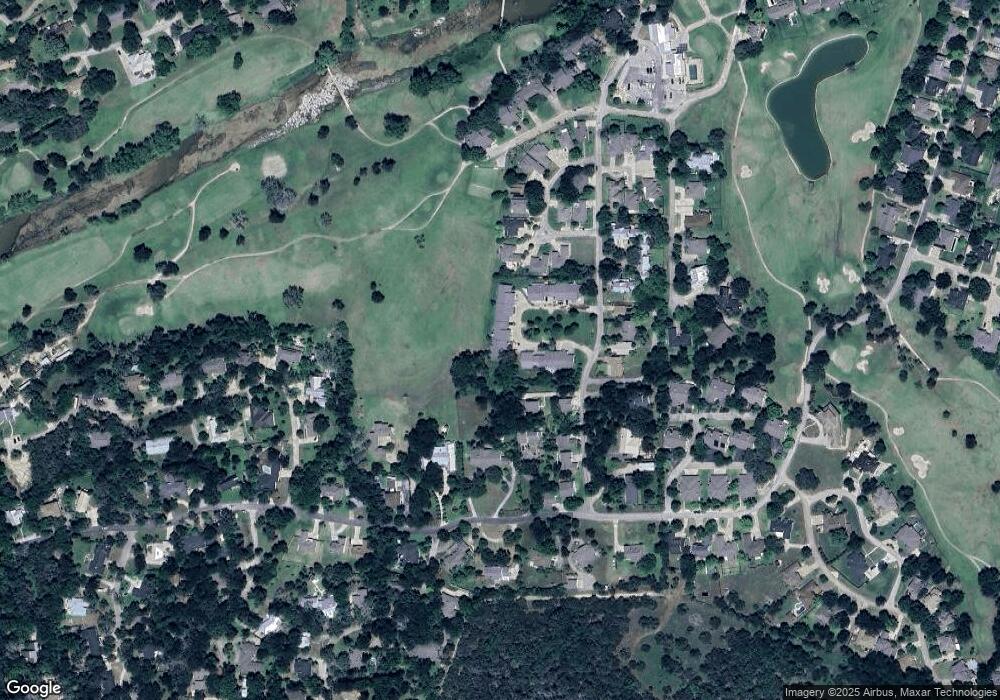

Map

Nearby Homes

- 1015 Old Mill Rd Unit 18

- 3 & 4 Park Dr

- 1120 Old Mill Rd

- 717 Willow Creek Rd

- 1412 Indian Trail

- 1111 Mill Creek Dr

- 910 Mill Creek Dr

- 1001 S Ridge Rd

- 19621a Farm To Market Road 2115

- 0 Hidden Springs Dr

- 913 Southridge

- 1219 Indian Trail

- 9249 Creekside Dr

- 800 Hillcrest Dr

- 418 Creekside Dr

- 1207 Rylee Ln

- 1231 Rylee Ln

- 413 Creekside Dr

- 1331 Rylee Ln

- 1112 Indian Trail

- 1105 Old Mill Rd Unit 10

- 1105 Old Mill Rd Unit 13

- 1105 Old Mill Rd Unit 17

- 1105 Old Mill Rd Unit 14

- 1105 Old Mill Rd Unit 16

- 1105 Old Mill Rd Unit 9

- 1105 Old Mill Rd Unit 15

- 1105 Old Mill Rd Unit 8

- 1102 Old Mill Rd

- 000 Old Mill Rd

- 716 Willow Creek Rd

- 1224 Southridge

- 700 Willow Creek Rd

- 701 Ridgecrest Dr

- 1114 Old Mill Rd

- 1015 Old Mill Rd Unit 3A

- 1015 Old Mill Rd Unit 4E

- 1015 Old Mill Rd Unit 1C

- 1015 Old Mill Rd Unit 5E

- 1015 Old Mill Rd Unit 4A