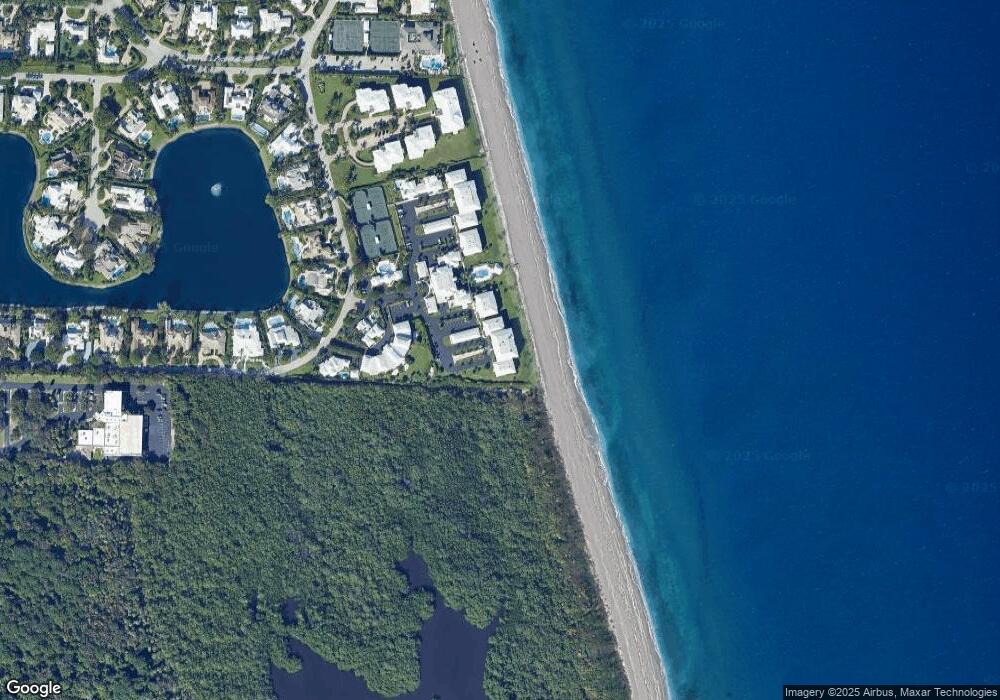

11050 Turtle Beach Rd Unit 1020 North Palm Beach, FL 33408

Estimated Value: $6,504,000 - $7,343,000

3

Beds

3

Baths

2,845

Sq Ft

$2,390/Sq Ft

Est. Value

About This Home

This home is located at 11050 Turtle Beach Rd Unit 1020, North Palm Beach, FL 33408 and is currently estimated at $6,800,068, approximately $2,390 per square foot. 11050 Turtle Beach Rd Unit 1020 is a home located in Palm Beach County with nearby schools including The Conservatory School at North Palm Beach, William T. Dwyer High School, and The Benjamin Private School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2024

Sold by

Elizabeth Z Chace Trust and Saltonstall William Zopfi

Bought by

Blue Sky Trust and Stone

Current Estimated Value

Purchase Details

Closed on

May 17, 2021

Sold by

Cleveland Robert and Cleveland Jillian

Bought by

Chace Elizabeth Z and The Elizabeth Z Chace Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$3,000,000

Interest Rate

3.12%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 11, 2020

Sold by

Greathouse Holdings Llc

Bought by

Cleveland Robert and Cleveland Jillian

Purchase Details

Closed on

Jun 3, 2014

Sold by

White Blair W and White Brian J

Bought by

Greathouse Llc

Purchase Details

Closed on

Feb 27, 2008

Sold by

White H Blair and White Joan V

Bought by

White Blair W

Purchase Details

Closed on

Mar 2, 2006

Sold by

White H Blair and White Joan V

Bought by

H Blair White Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blue Sky Trust | $7,000,000 | None Listed On Document | |

| Chace Elizabeth Z | $5,600,000 | Attorney | |

| Cleveland Robert | $3,650,000 | Legacy Title Agencyth | |

| Greathouse Llc | -- | Attorney | |

| White Blair W | -- | First American Title Ins Co | |

| White H Blair | -- | First American Title Ins Co | |

| H Blair White Trust | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Chace Elizabeth Z | $3,000,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $91,953 | $5,633,267 | -- | -- |

| 2023 | $92,747 | $5,633,267 | $0 | $5,633,267 |

| 2022 | $77,412 | $4,623,488 | $0 | $0 |

| 2021 | $59,760 | $3,427,488 | $0 | $3,427,488 |

| 2020 | $54,905 | $3,117,710 | $0 | $3,117,710 |

| 2019 | $60,375 | $3,447,912 | $0 | $3,447,912 |

| 2018 | $52,578 | $3,042,912 | $0 | $3,042,912 |

| 2017 | $56,240 | $3,202,912 | $0 | $0 |

| 2016 | $65,330 | $3,622,912 | $0 | $0 |

| 2015 | $67,550 | $3,622,912 | $0 | $0 |

| 2014 | $59,465 | $3,152,912 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 11354 Old Harbour Rd

- 1 Church Ln Unit 111-112

- 100 Lakeshore Dr Unit 1558

- 100 Lakeshore Dr Unit 1854

- 100 Lakeshore Dr Unit 754

- 100 Lakeshore Dr Unit 1154

- 100 Lakeshore Dr Unit 1757

- 100 Lakeshore Dr Unit 1454

- 100 Lakeshore Dr Unit 1557

- 100 Lakeshore Dr Unit 456

- 100 Lakeshore Dr Unit 351

- 100 Lakeshore Dr Unit 252

- 100 Lakeshore Dr Unit 1753

- 108 Lakeshore Dr Unit 3380

- 108 Lakeshore Dr Unit 7400

- 108 Lakeshore Dr Unit 140

- 108 Lakeshore Dr Unit 1441

- 108 Lakeshore Dr Unit 1641

- 108 Lakeshore Dr Unit 38T

- 115 Lakeshore Dr Unit 746

- 11050 Turtle Beach Rd Unit 2020

- 11050 Turtle Beach Rd Unit 2040

- 11050 Turtle Beach Rd Unit 1030

- 11050 Turtle Beach Rd Unit 2030

- 11050 Turtle Beach Rd Unit 2010

- 11050 Turtle Beach Rd Unit 3010

- 11050 Turtle Beach Rd Unit 3020

- 11050 Turtle Beach Rd Unit 1040

- 11060 Turtle Beach Rd Unit B-106 Greathouse

- 11060 Turtle Beach Rd Unit 2050

- 11060 Turtle Beach Rd Unit 1050

- 11042 Turtle Beach Rd Unit Greathouse D-304

- 11042 Turtle Beach Rd Unit 1050

- 11042 Turtle Beach Rd Unit 3030

- 11042 Turtle Beach Rd Unit 1020

- 11042 Turtle Beach Rd Unit 1030

- 11042 Turtle Beach Rd Unit 1010

- 11042 Turtle Beach Rd Unit 2040

- 11042 Turtle Beach Rd Unit 2030