1106 SE Cr 2210 Corsicana, TX 75109

Estimated Value: $319,000 - $806,000

3

Beds

2

Baths

1,952

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 1106 SE Cr 2210, Corsicana, TX 75109 and is currently estimated at $561,015, approximately $287 per square foot. 1106 SE Cr 2210 is a home located in Navarro County with nearby schools including Mildred Elementary School and Mildred High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 25, 2019

Sold by

Haga Christopher William and Haga Elizabeth

Bought by

Merrell Leslie Paul and Merrell Diana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,400

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 13, 2007

Sold by

Baty Dennis E and Baty Judy E

Bought by

Haga Christopher W and Haga Elizabethj B

Purchase Details

Closed on

Mar 24, 2005

Sold by

Hamilton Billy G

Bought by

Baty Dennis E and Baty Judy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Interest Rate

5.67%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Merrell Leslie Paul | -- | Navarre County Abstract | |

| Haga Christopher W | -- | None Available | |

| Baty Dennis E | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Merrell Leslie Paul | $330,400 | |

| Previous Owner | Baty Dennis E | $136,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,296 | $343,710 | $56,890 | $286,820 |

| 2024 | $5,384 | $349,400 | $56,900 | $292,500 |

| 2023 | $5,491 | $358,180 | $57,270 | $300,910 |

| 2022 | $4,984 | $296,880 | $363,780 | $277,590 |

| 2021 | $2,940 | $437,970 | $299,600 | $138,370 |

| 2020 | $3,067 | $437,970 | $299,600 | $138,370 |

| 2019 | $1,053 | $190,430 | $152,700 | $37,730 |

| 2018 | $998 | $190,430 | $152,700 | $37,730 |

| 2017 | $918 | $186,590 | $152,700 | $33,890 |

| 2016 | $895 | $185,450 | $152,700 | $32,750 |

| 2015 | -- | $185,450 | $152,700 | $32,750 |

| 2014 | -- | $185,450 | $152,700 | $32,750 |

Source: Public Records

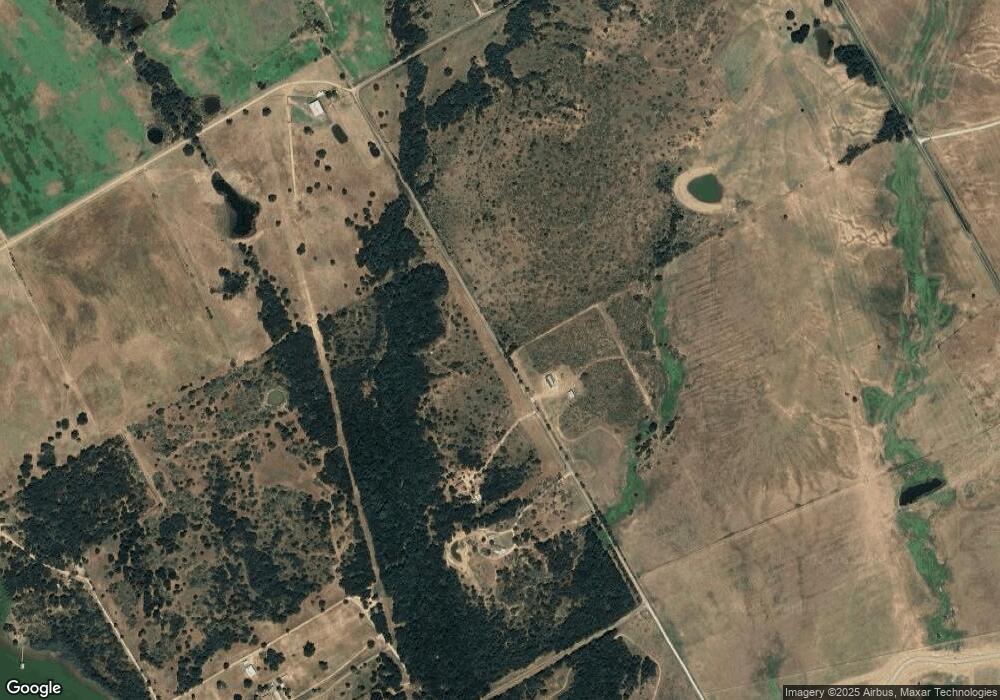

Map

Nearby Homes

- Lot 26 Richland Cove

- TBD Kayak Cove

- Lot 60 Kayak Cove

- Lot 53 Richland Cove

- Lot 53 Richland Cove

- 1564 Carter Dr

- Lot 82 Sunset Blvd

- Lot 87 Richland Cove

- Lot 35 Richland Cove

- LOT 61 Stillwater Cove

- Lot 63 Stillwater Cove

- Lot 37 Crestview Pointe

- Lot 38 Crestview Pointe

- 1865 SE County Road 2160

- 1879 SE County Road 2160

- Lot 23 & Boat Slip 1 Eagle Point

- Lot 1 SE County Road 2175

- Lot 5 SE County Road 2175

- 715 SE County Road 2190

- 87 Stillwater Shores Dr

- 1106 SE County Road 2210

- 502 SE County Road 2218

- 504 SE County Road 2218

- 510 SE County Road 2218

- Lot 37 Richland Cove

- 525 County Road 2218

- 525 SE County Rd 2218

- Lot 54 Kayak Cove

- 1006 SE County Road 2215

- 000 Tbd 2210 Se County Rd

- 1008 SE County Road 2210

- Lot 53 Richland Cove

- 1025 SE County Road 2215

- TBD Kayak Cove Lot 54

- 1012 SE County Road 2215

- 1020 SE County Road 2215

- Lot 35 Carter Dr

- 1026 SE County Road 2215

- 1562 Carter Dr

- 1000 SE County Rd 2210