Estimated Value: $78,000 - $140,000

3

Beds

1

Bath

916

Sq Ft

$119/Sq Ft

Est. Value

About This Home

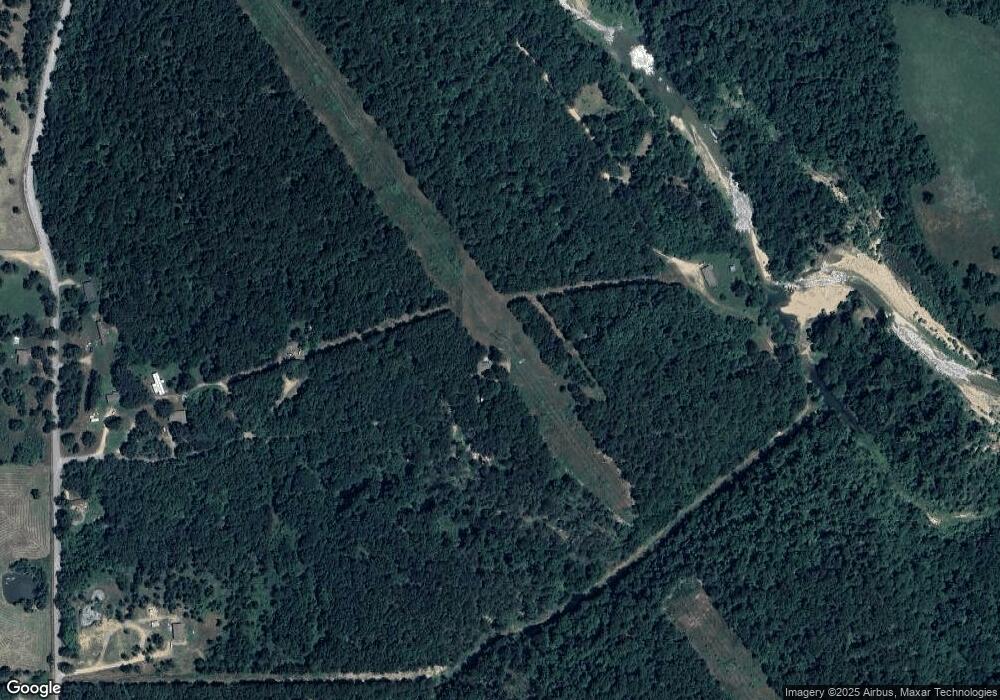

This home is located at 11067 E 636 Rd, Peggs, OK 74452 and is currently estimated at $109,000, approximately $118 per square foot. 11067 E 636 Rd is a home located in Cherokee County with nearby schools including Peggs Public School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $251 | $4,522 | $497 | $4,025 |

| 2024 | $242 | $4,390 | $482 | $3,908 |

| 2023 | $242 | $4,263 | $476 | $3,787 |

| 2022 | $224 | $4,138 | $468 | $3,670 |

| 2021 | $215 | $4,018 | $454 | $3,564 |

| 2020 | $207 | $3,901 | $440 | $3,461 |

| 2019 | $199 | $3,787 | $427 | $3,360 |

| 2018 | $191 | $3,677 | $414 | $3,263 |

| 2017 | $183 | $3,570 | $363 | $3,207 |

| 2016 | $176 | $3,466 | $164 | $3,302 |

| 2015 | $158 | $3,365 | $382 | $2,983 |

| 2014 | $158 | $3,267 | $370 | $2,897 |

Source: Public Records

Map

Nearby Homes

- 10015 E 632 Rd

- 11838 E 650 Rd

- 4100 N 430 Rd

- 14356 S Hwy 82

- 6947 N 460 Rd

- 0 E 630 Rd Unit 2551216

- 8683 N 436 Rd

- 0 E 610 Rd Unit 2542638

- 5969 E 620 Rd

- 8465 W 660 Rd Hulbert Unit OK 74441

- 8465 W 660 Rd

- 5747 E 620 Rd

- 0 S 4409 Rd

- 14000 Highway 82c

- 8030 N Shiloh Rd

- 7373 N 485 Rd

- 14311 E 668 Rd

- 7700 N 485 Rd

- 58 Oak

- 13037 E 590 Rd

- 11097 E 636 Rd

- 11097 E 636 Rd

- 11225 E 620 Rd

- 11034 E 636 Rd

- 11018 E 636 Rd

- 11012 E 636 Rd

- 5524 N 440 Rd

- 0 E 620 Rd Unit 634625

- 0 E 620 Rd Unit 615195

- 0 E 620 Rd Unit 7-334

- 0 E 620 Rd Unit 1821147

- 0 N 440 Rd Unit 926215

- 0 N 440 Rd Unit 1036841

- 0 N 440 Rd Unit 1118108

- 0 N 440 Rd Unit 1916632

- 0 N 440 Rd Unit 1939297

- 0 N 440 Rd Unit 1942513

- 5525 N 440 Rd

- 5700 N 440 Rd

- 10775 E 635 Rd

Your Personal Tour Guide

Ask me questions while you tour the home.