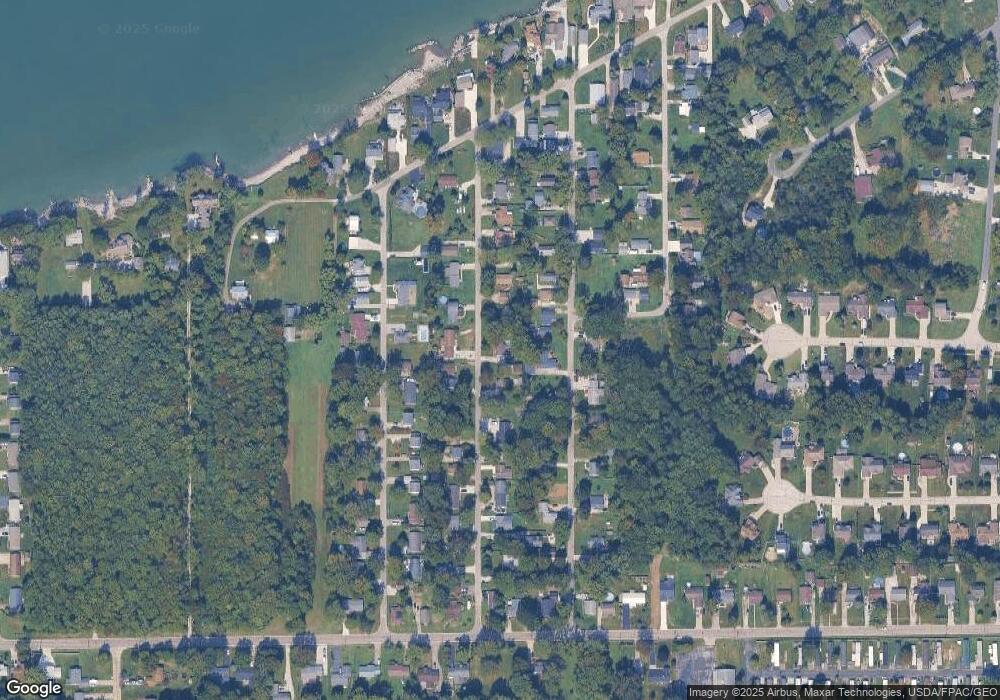

1107 Grand Ave Madison, OH 44057

Estimated Value: $121,000 - $201,000

2

Beds

1

Bath

820

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 1107 Grand Ave, Madison, OH 44057 and is currently estimated at $152,046, approximately $185 per square foot. 1107 Grand Ave is a home located in Lake County with nearby schools including North Elementary School, Madison Middle School, and Madison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 26, 2021

Sold by

Selwyn June A and Selwyn John

Bought by

Selwyn June A and Selwyn John

Current Estimated Value

Purchase Details

Closed on

Jun 21, 2005

Sold by

Va

Bought by

Selwyn June Anne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,999

Interest Rate

5.24%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 1, 2004

Sold by

Figer Albert V

Bought by

Va

Purchase Details

Closed on

Aug 14, 2003

Sold by

Eichhorn George W and Eichhorn Christine

Bought by

Figer Albert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,454

Interest Rate

5.47%

Mortgage Type

VA

Purchase Details

Closed on

Apr 1, 1985

Bought by

Eichhorn George

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Selwyn June A | -- | Conway Neil J | |

| Selwyn June Anne | -- | Fidelity Land Title Agency I | |

| Va | -- | -- | |

| Figer Albert | $87,700 | Enterprise Title | |

| Eichhorn George | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Selwyn June Anne | $62,999 | |

| Previous Owner | Figer Albert | $89,454 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $40,160 | $8,110 | $32,050 |

| 2023 | $2,511 | $22,590 | $6,790 | $15,800 |

| 2022 | $1,475 | $22,590 | $6,790 | $15,800 |

| 2021 | $1,472 | $22,750 | $6,950 | $15,800 |

| 2020 | $1,418 | $19,280 | $5,890 | $13,390 |

| 2019 | $1,419 | $19,280 | $5,890 | $13,390 |

| 2018 | $1,237 | $14,890 | $3,830 | $11,060 |

| 2017 | $1,103 | $14,890 | $3,830 | $11,060 |

| 2016 | $1,007 | $14,890 | $3,830 | $11,060 |

| 2015 | $915 | $14,890 | $3,830 | $11,060 |

| 2014 | $936 | $14,890 | $3,830 | $11,060 |

| 2013 | $938 | $14,890 | $3,830 | $11,060 |

Source: Public Records

Map

Nearby Homes

- V/L 10 Norton Dr

- V/L 20 Norton Dr

- V/L 11 Norton Dr

- V/L 21 Norton Dr

- 153 Marilyn Dr

- 125 Marilyn Dr

- 0 Ashview Dr

- 44 Eddie Rd

- 20 Eddie Rd

- 15 Eddie Rd

- 1180 Hearn Dr

- 1180 N County Line Rd

- 7084 Lake Rd E

- 6800 Lake Rd W Unit 4664 NCL

- 7052 Whitesands Blvd

- 1478 Bennett Rd

- 7000 Lake Rd

- 1338 Ormond Ave

- 7014 Madison Ave

- 1344 Davista Ave