11085 Bandol Place Las Vegas, NV 89141

Southern Highlands NeighborhoodEstimated Value: $367,000 - $419,000

3

Beds

2

Baths

1,606

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 11085 Bandol Place, Las Vegas, NV 89141 and is currently estimated at $400,180, approximately $249 per square foot. 11085 Bandol Place is a home located in Clark County with nearby schools including Charles & Phyllis Frias Elementary School, Lois & Jerry Tarkanian Middle School, and Desert Oasis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 6, 2009

Sold by

Indymac Federal Bank Fsb

Bought by

Doerksen Paul and Christiansen Brenda

Current Estimated Value

Purchase Details

Closed on

Nov 5, 2008

Sold by

Hanahan Deborah Jean

Bought by

Indymac Bank Fsb

Purchase Details

Closed on

Apr 30, 2005

Sold by

Hanahan Deborah J

Bought by

Marjo Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,900

Interest Rate

2%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 12, 2005

Sold by

Venable Sheila Ann

Bought by

Hanahan Deborah Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,900

Interest Rate

2%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 27, 2002

Sold by

Myers Delando S

Bought by

Venable Sheila Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,950

Interest Rate

6.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Doerksen Paul | $117,500 | Lsi Title Agency Inc | |

| Indymac Bank Fsb | $179,822 | Fidelity National | |

| Marjo Properties Llc | $299,900 | -- | |

| Hanahan Deborah Jean | $299,900 | Ticor Title Of Nevada Inc | |

| Venable Sheila Ann | -- | Lawyers Title | |

| Venable Sheila Ann | $155,776 | Lawyers Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hanahan Deborah Jean | $239,900 | |

| Previous Owner | Venable Sheila Ann | $147,950 | |

| Closed | Hanahan Deborah Jean | $44,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,959 | $100,393 | $36,750 | $63,643 |

| 2024 | $1,814 | $100,393 | $36,750 | $63,643 |

| 2023 | $1,814 | $90,260 | $32,200 | $58,060 |

| 2022 | $1,680 | $81,331 | $26,250 | $55,081 |

| 2021 | $1,556 | $69,645 | $24,850 | $44,795 |

| 2020 | $1,442 | $69,897 | $23,100 | $46,797 |

| 2019 | $1,351 | $67,436 | $21,000 | $46,436 |

| 2018 | $1,289 | $61,285 | $16,800 | $44,485 |

| 2017 | $1,756 | $59,740 | $15,400 | $44,340 |

| 2016 | $1,208 | $57,615 | $11,550 | $46,065 |

| 2015 | $1,205 | $39,644 | $8,050 | $31,594 |

| 2014 | $1,167 | $38,537 | $9,975 | $28,562 |

Source: Public Records

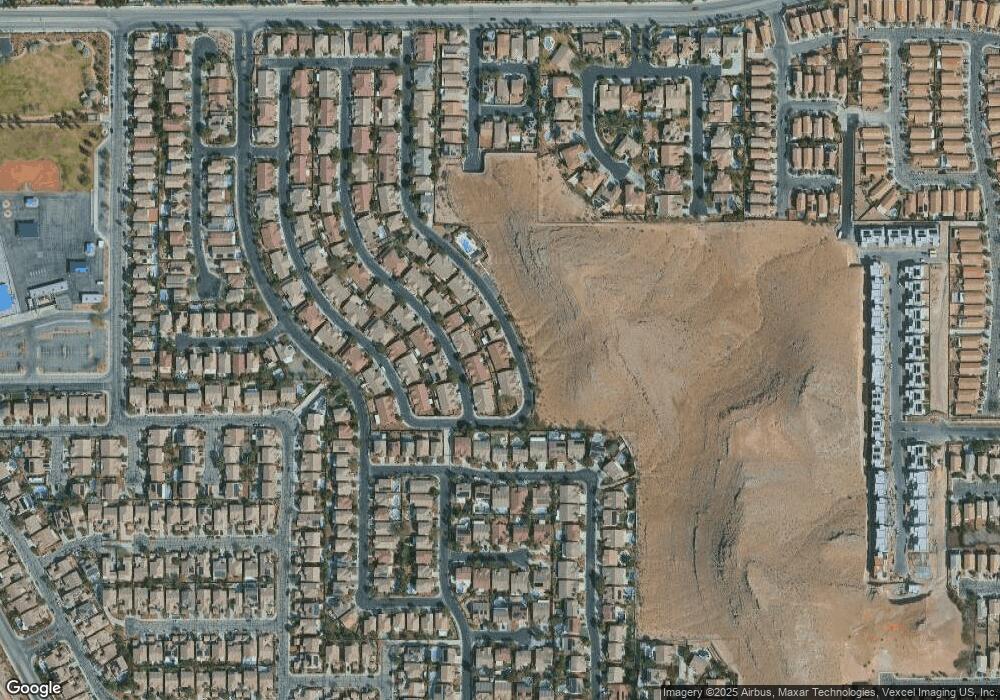

Map

Nearby Homes

- 11152 Montagne Marron Blvd

- 11022 Saint Rafael St

- 11145 Montagne Marron Blvd

- 5600 Nimes Ave

- 5567 Cortu Ave

- 5573 Villa Paola Ct

- 10798 Tapestry Winds St

- 5672 Bracana Ct

- 10840 Villa Torre St

- 5220 Melbourne Ridge Ct

- 5214 Melbourne Ridge Ct

- 10942 Civiletti St

- 5100 Ivy Creek Ct

- 0 Starr Hills Ave Unit 2535931

- 11024 Vallerosa St

- 5832 Ivy Vine Ct

- 10918 Lampione St Unit 1

- 5823 Lazy Days Ct

- 11334 Patores St

- 5785 Farmhouse Ct Unit 2

- 11089 Bandol Place

- 11081 Bandol Place

- 11086 Ampus Place

- 11082 Ampus Place

- 11093 Bandol Place

- 11090 Ampus Place

- 11077 Bandol Place

- 11078 Ampus Place

- 11094 Ampus Place

- 11073 Bandol Place

- 11097 Bandol Place

- 11074 Ampus Place

- 11098 Ampus Place

- 11069 Bandol Place

- 11087 Ampus Place

- 11083 Ampus Place

- 11070 Ampus Place

- 11079 Ampus Place

- 11095 Ampus Place