1109 Yankee Trace Dr Dayton, OH 45458

Estimated Value: $411,564 - $540,000

2

Beds

2

Baths

1,762

Sq Ft

$265/Sq Ft

Est. Value

About This Home

This home is located at 1109 Yankee Trace Dr, Dayton, OH 45458 and is currently estimated at $466,391, approximately $264 per square foot. 1109 Yankee Trace Dr is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2010

Sold by

Jacobs Frank S and Jacobs Debra J

Bought by

Limbert Stephen E and Limbert Diana K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,400

Outstanding Balance

$122,315

Interest Rate

4.44%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$344,076

Purchase Details

Closed on

Jan 9, 2003

Sold by

Pizza Jeffrey G

Bought by

Jacobs Frank S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Interest Rate

6.3%

Purchase Details

Closed on

Jun 23, 1998

Sold by

Dunnington Koepfer Builders Inc

Bought by

Pizza Jeffrey G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,600

Interest Rate

6.25%

Purchase Details

Closed on

Nov 20, 1997

Sold by

Yankee Trace Development Inc

Bought by

Dunnington Koepfer Builders Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Limbert Stephen E | $228,000 | Attorney | |

| Jacobs Frank S | $275,000 | Evans Title Agency Inc | |

| Pizza Jeffrey G | $246,000 | -- | |

| Pizza Jeffrey G | $246,000 | -- | |

| Dunnington Koepfer Builders Inc | $61,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Limbert Stephen E | $182,400 | |

| Closed | Jacobs Frank S | $220,000 | |

| Previous Owner | Pizza Jeffrey G | $233,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,813 | $107,090 | $40,360 | $66,730 |

| 2023 | $6,813 | $107,090 | $40,360 | $66,730 |

| 2022 | $6,995 | $87,070 | $32,810 | $54,260 |

| 2021 | $7,012 | $87,070 | $32,810 | $54,260 |

| 2020 | $7,004 | $87,070 | $32,810 | $54,260 |

| 2019 | $7,470 | $83,420 | $32,810 | $50,610 |

| 2018 | $6,692 | $83,420 | $32,810 | $50,610 |

| 2017 | $6,621 | $83,420 | $32,810 | $50,610 |

| 2016 | $6,874 | $82,060 | $32,810 | $49,250 |

| 2015 | $6,788 | $82,060 | $32,810 | $49,250 |

| 2014 | $6,788 | $82,060 | $32,810 | $49,250 |

| 2012 | -- | $79,800 | $35,000 | $44,800 |

Source: Public Records

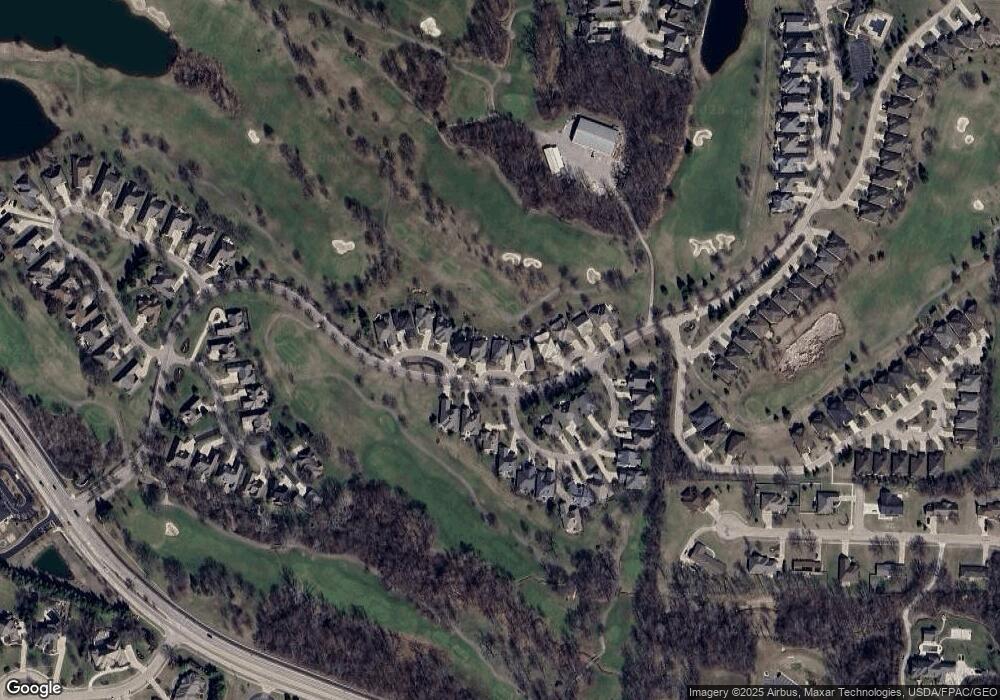

Map

Nearby Homes

- 981 Eagle Run Dr

- 985 Gardenwood Place

- 1198 W Social Row Rd

- 1384 Courtyard Place

- 835 Vintage Green Way

- 1267 Club View Dr

- 1010 Villa Vista Place

- 1248 Club View Dr

- 10612 Falls Creek Ln

- 10500 Wallingsford Cir

- 9725 Southern Belle Ct

- 10679 Chestnut Hill Ln

- 10014 Washington Glen Dr

- 1512 Dell Glen Rd

- 900 Hidden Branches Dr

- 812 Hidden Branches Dr

- 0 Austin Pike

- 10030 Washington Glen Dr

- 9508 Magnolia Ct

- 2010 Glen Valley Dr Unit 217

- 1121 Yankee Trace Dr

- 1097 Yankee Trace Dr

- 1133 Yankee Trace Dr

- 1085 Yankee Trace Dr

- 1145 Yankee Trace Dr

- 1073 Yankee Trace Dr

- 1061 Yankee Trace Dr

- 1085 Greenskeeper Way

- 1120 Yankee Trace Dr

- 1128 Yankee Trace Dr

- 1157 Yankee Trace Dr

- 1112 Greenskeeper Way

- 1061 Greenskeeper Way

- 1037 Greenskeeper Way

- 1169 Yankee Trace Dr

- 1049 Yankee Trace Dr

- 1181 Yankee Trace Dr

- 1104 Greenskeeper Way

- 1096 Greenskeeper Way

- 1088 Greenskeeper Way