111 Patrick Rd Tewksbury, MA 01876

Estimated Value: $494,390 - $596,000

2

Beds

2

Baths

1,240

Sq Ft

$421/Sq Ft

Est. Value

About This Home

This home is located at 111 Patrick Rd, Tewksbury, MA 01876 and is currently estimated at $522,598, approximately $421 per square foot. 111 Patrick Rd is a home located in Middlesex County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 7, 2025

Sold by

Sacco David A

Bought by

Kent Lindsey and Kent Ryan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$404,000

Outstanding Balance

$404,000

Interest Rate

6.3%

Mortgage Type

New Conventional

Estimated Equity

$118,598

Purchase Details

Closed on

Sep 30, 2004

Sold by

Winthrop David J

Bought by

Sacco David A

Purchase Details

Closed on

Aug 1, 1996

Sold by

Cunningham Beverly

Bought by

Winthrop David J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,250

Interest Rate

8.27%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 30, 1987

Sold by

F I C Assoc Inc

Bought by

Cunningham Beverly K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,300

Interest Rate

10.59%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kent Lindsey | $505,000 | -- | |

| Sacco David A | $266,900 | -- | |

| Sacco David A | $266,900 | -- | |

| Winthrop David J | $104,500 | -- | |

| Cunningham Beverly K | $142,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kent Lindsey | $404,000 | |

| Previous Owner | Cunningham Beverly K | $107,249 | |

| Previous Owner | Cunningham Beverly K | $102,100 | |

| Previous Owner | Cunningham Beverly K | $99,250 | |

| Previous Owner | Cunningham Beverly K | $114,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,670 | $428,900 | $0 | $428,900 |

| 2024 | $5,393 | $402,800 | $0 | $402,800 |

| 2023 | $5,303 | $376,100 | $0 | $376,100 |

| 2022 | $4,742 | $312,000 | $0 | $312,000 |

| 2021 | $4,645 | $295,500 | $0 | $295,500 |

| 2020 | $4,614 | $288,900 | $0 | $288,900 |

| 2019 | $4,071 | $257,000 | $0 | $257,000 |

| 2018 | $3,912 | $242,500 | $0 | $242,500 |

| 2017 | $3,673 | $225,200 | $0 | $225,200 |

| 2016 | $3,486 | $213,200 | $0 | $213,200 |

| 2015 | $3,127 | $191,000 | $0 | $191,000 |

| 2014 | $2,979 | $184,900 | $0 | $184,900 |

Source: Public Records

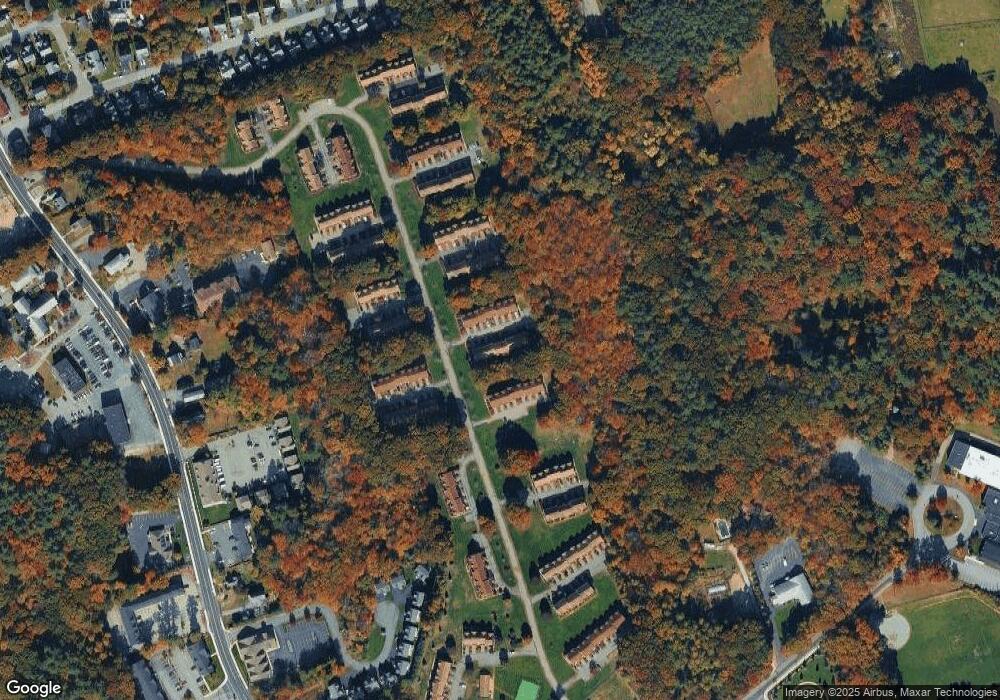

Map

Nearby Homes

- 61 Patrick Rd

- 43 Patrick Rd

- 172 Patrick Rd

- 1418 Main St Unit 201

- 11 Orchard St

- 1325 Main

- 1455 Main St Unit 8

- 12 Hillcrest Rd

- 20 Sophie Ruth Way

- 13 Berkeley

- 14 Hinckley Rd

- 1 Tremblay Ave

- 15 Pinewood Rd

- 107 Eagle Dr Unit 107

- 93 Fairway Dr

- 127 Caddy Ct

- 16 Eagle Dr

- 9 Tomahawk Dr

- 177 Apache Way Unit 177

- 71 Apache Way Unit 71

- 112 Patrick Rd

- 110 Patrick Rd

- 109 Patrick Rd

- 108 Patrick Rd

- 107 Patrick Rd

- 106 Patrick Rd

- 105 Patrick Rd

- 111 Patrick Rd Unit 111 13

- 104 Patrick Rd

- 103 Patrick Rd

- 101 Patrick Rd

- 100 Patrick Rd

- 99 Patrick Rd

- 98 Patrick Rd

- 97 Patrick Rd

- 131 Patrick Rd Unit 131

- 131 Patrick Rd Unit Road

- 136 Patrick Rd

- 135 Patrick Rd

- 133 Patrick Rd