1110 NE 63rd Way Unit 153 Hillsboro, OR 97124

Orenco Station NeighborhoodEstimated Value: $384,000 - $403,536

2

Beds

2

Baths

1,405

Sq Ft

$279/Sq Ft

Est. Value

About This Home

This home is located at 1110 NE 63rd Way Unit 153, Hillsboro, OR 97124 and is currently estimated at $391,384, approximately $278 per square foot. 1110 NE 63rd Way Unit 153 is a home located in Washington County with nearby schools including Quatama Elementary School, J.W. Poynter Middle School, and Liberty High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2020

Sold by

Rogauskas Jerome

Bought by

Young In S

Current Estimated Value

Purchase Details

Closed on

Jan 17, 2020

Sold by

Chacon Anthony

Bought by

Rogauskas Jerome

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$246,500

Interest Rate

3.6%

Mortgage Type

Commercial

Purchase Details

Closed on

Nov 25, 2012

Sold by

Chacon Anthony

Bought by

Chacon Anthony and Thompson Nicole Hayes

Purchase Details

Closed on

Mar 29, 2012

Sold by

Greenebaum Robert

Bought by

Chacon Anthony

Purchase Details

Closed on

Oct 18, 2011

Sold by

Greenebaum Deley F

Bought by

Greenebaum Robert

Purchase Details

Closed on

Apr 13, 2006

Sold by

Ohara George D

Bought by

Greenebaum Robert and Greenebaum Delcy F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.2%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Sep 26, 2000

Sold by

Orenco East Village Llc

Bought by

Ohara George D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Young In S | $311,500 | First American | |

| Rogauskas Jerome | $275,000 | First American | |

| Chacon Anthony | -- | Accommodation | |

| Chacon Anthony | $130,000 | First American | |

| Greenebaum Robert | -- | None Available | |

| Greenebaum Robert | $225,000 | First American Title Insuran | |

| Ohara George D | $159,000 | Transnation Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rogauskas Jerome | $246,500 | |

| Previous Owner | Greenebaum Robert | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,977 | $243,280 | -- | -- |

| 2024 | $3,864 | $236,200 | -- | -- |

| 2023 | $3,864 | $229,330 | $0 | $0 |

| 2022 | $3,759 | $229,330 | $0 | $0 |

| 2021 | $3,683 | $216,180 | $0 | $0 |

| 2020 | $3,604 | $209,890 | $0 | $0 |

| 2019 | $3,283 | $191,110 | $0 | $0 |

| 2018 | $3,143 | $185,550 | $0 | $0 |

| 2017 | $3,029 | $180,150 | $0 | $0 |

| 2016 | $2,946 | $174,910 | $0 | $0 |

| 2015 | $2,827 | $169,820 | $0 | $0 |

| 2014 | $2,778 | $164,880 | $0 | $0 |

Source: Public Records

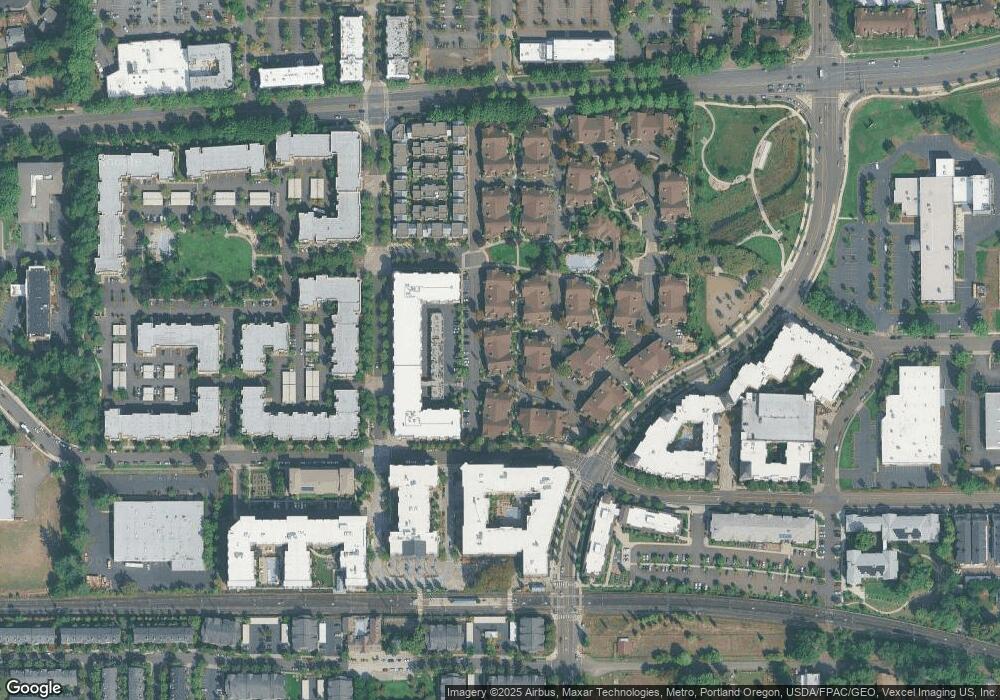

Map

Nearby Homes

- 1110 NE 63rd Way Unit 2007

- 1110 NE 63rd Way Unit 2003

- 1145 NE Horizon Loop Unit 1708

- 1145 NE Horizon Loop Unit 1704

- 1170 NE 64th Ln Unit 1209

- 1150 NE Horizon Loop Unit 1502

- 1150 NE Horizon Loop Unit 1501

- 1160 NE Horizon Loop

- 6267 NE Carillion Dr

- 6267 NE Carillion Dr Unit 103

- 1452 NE Orenco Station Pkwy

- 6614 NE Alder St

- 6650 NE Alder St

- 6055 NE Alder St

- 858 NE Caden Ave

- 6675 NE Birch St

- 6547 NE Brighton St Unit 67

- 6585 NE Brighton St

- 6023 NE Alder St

- 782 NE 61st Ave

- 1110 NE 63rd Way Unit 2005

- 1110 NE 63rd Way Unit 2006

- 1110 NE 63rd Way Unit 2004

- 1110 NE 63rd Way Unit 2001

- 1110 NE 63rd Way

- 1110 NE 63rd Way Unit 158

- 1110 NE 63rd Way

- 1110 NE 63rd Way Unit 156

- 1110 NE 63rd Way Unit 155

- 1110 NE 63rd Way Unit 154

- 1110 NE 63rd Way

- 1110 NE 63rd Way

- 1110 NE 63rd Way Unit 160

- 1110 NE 63rd Way Unit 2009

- 1110 NE 63rd Way Unit 2008

- 1110 NE 63rd Way Unit 2010

- 1111 NE 64th Ln Unit 1803

- 1111 NE 64th Ln Unit 149

- 1111 NE 64th Ln Unit 148

- 1111 NE 64th Ln Unit 147