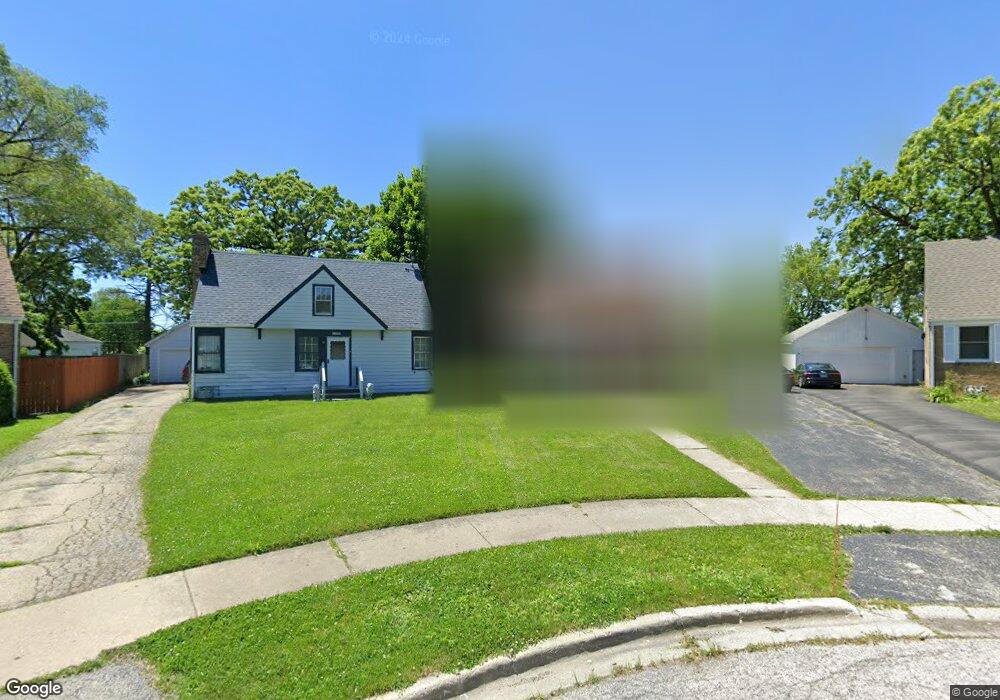

1113 Fairfield Cir Waukegan, IL 60085

Estimated Value: $227,000 - $287,000

3

Beds

2

Baths

1,248

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 1113 Fairfield Cir, Waukegan, IL 60085 and is currently estimated at $252,333, approximately $202 per square foot. 1113 Fairfield Cir is a home located in Lake County with nearby schools including Glen Flora Elementary School, Edith M Smith Middle School, and Waukegan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2022

Sold by

Carlos Rotger

Bought by

Nieves Jacqueline

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,800

Outstanding Balance

$76,830

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$175,503

Purchase Details

Closed on

Jul 18, 2017

Sold by

Garcia Jesus S and Garcia Laura A

Bought by

Rotger Carlos and Nieves Jacqueline

Purchase Details

Closed on

Jan 26, 1996

Sold by

Yancey Artis and Yancey Tamara K

Bought by

Garcia Jesus S and Garcia Laura A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,100

Interest Rate

7.19%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nieves Jacqueline | -- | Mortgage Information Services | |

| Rotger Carlos | $117,000 | Attorneys Title Guaranty Fun | |

| Garcia Jesus S | $88,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nieves Jacqueline | $82,800 | |

| Previous Owner | Garcia Jesus S | $86,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,496 | $61,814 | $9,851 | $51,963 |

| 2023 | $4,110 | $55,684 | $8,820 | $46,864 |

| 2022 | $4,110 | $50,043 | $7,872 | $42,171 |

| 2021 | $3,644 | $42,956 | $7,022 | $35,934 |

| 2020 | $3,630 | $40,019 | $6,542 | $33,477 |

| 2019 | $3,828 | $36,671 | $5,995 | $30,676 |

| 2018 | $3,814 | $35,883 | $7,635 | $28,248 |

| 2017 | $3,662 | $31,747 | $6,755 | $24,992 |

| 2016 | $3,336 | $27,587 | $5,870 | $21,717 |

| 2015 | $3,157 | $24,691 | $5,254 | $19,437 |

| 2014 | $2,814 | $22,169 | $4,345 | $17,824 |

| 2012 | $3,707 | $24,018 | $4,707 | $19,311 |

Source: Public Records

Map

Nearby Homes

- 1000 Pine St

- 1105 Woodlawn Cir

- 917 N Linden Ave

- 824 N Butrick St

- 1504 W Glen Flora Ave

- 1117 Judge Ave

- 968 Judge Ave

- 918 N Ash St

- 1110 N Ash St

- 1122 N Ash St

- 1335 Chestnut St

- 1038 Indiana Ave

- 1336 N Ash St

- 620 N Poplar St

- 702 Franklin St

- 1005 N Lewis Ave

- 1019 N Lewis Ave

- 522 N Poplar St

- 1018 W Atlantic Ave

- 509 N Butrick St

- 1114 Fairfield Cir

- 1109 Fairfield Cir

- 1105 Fairfield Cir

- 1110 Fairfield Cir

- 1101 Fairfield Cir

- 1106 Fairfield Cir

- 1102 Fairfield Cir

- 1110 W Ridgeland Ave

- 1114 W Ridgeland Ave

- 1019 Pine St

- 1023 Pine St

- 1017 Pine St

- 1102 W Ridgeland Ave

- 1027 Pine St

- 1015 Pine St

- 1023 Fairfield Ct

- 1035 Pine St

- 1105 Highland Cir

- 1011 Pine St

- 1109 Highland Cir