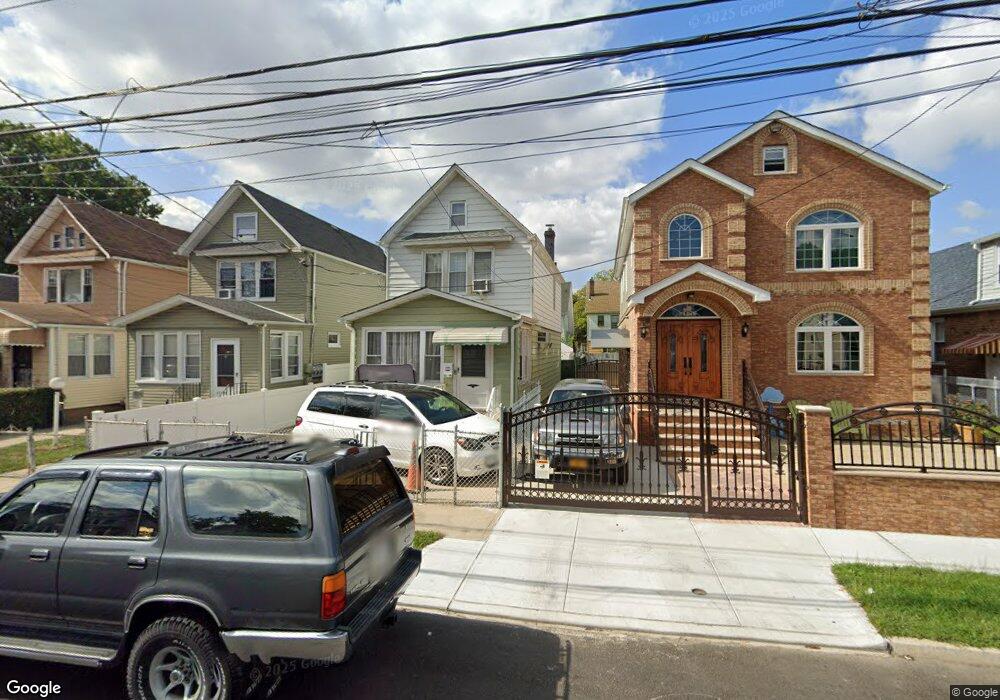

11130 133rd St South Ozone Park, NY 11420

South Ozone Park NeighborhoodEstimated Value: $662,000 - $777,000

--

Bed

--

Bath

1,200

Sq Ft

$584/Sq Ft

Est. Value

About This Home

This home is located at 11130 133rd St, South Ozone Park, NY 11420 and is currently estimated at $700,805, approximately $584 per square foot. 11130 133rd St is a home located in Queens County with nearby schools including P.S. 155, J.H.S. 226 Virgil I. Grisson, and Al-Ihsan Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 8, 2018

Sold by

Ally Muhammad A and Ally Safeyah

Bought by

Ally Muhammad A and Ally Safeyah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$411,375

Outstanding Balance

$347,342

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$353,463

Purchase Details

Closed on

Feb 28, 2017

Sold by

Khan Fazimoon and Khan Mustaf M

Bought by

Ally Muhammad A and Ally Safeyah

Purchase Details

Closed on

Dec 14, 2016

Sold by

Santana Jose

Bought by

Khan Fazimoon and Khan Mustaf M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$396,316

Interest Rate

4.03%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ally Muhammad A | -- | -- | |

| Ally Muhammad A | -- | -- | |

| Khan Fazimoon | $410,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ally Muhammad A | $411,375 | |

| Previous Owner | Khan Fazimoon | $396,316 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,440 | $28,708 | $5,515 | $23,193 |

| 2024 | $4,038 | $27,083 | $5,922 | $21,161 |

| 2023 | $5,132 | $25,550 | $5,412 | $20,138 |

| 2022 | $4,812 | $34,980 | $8,160 | $26,820 |

| 2021 | $5,073 | $34,500 | $8,160 | $26,340 |

| 2020 | $5,064 | $33,840 | $8,160 | $25,680 |

| 2019 | $4,721 | $31,200 | $8,160 | $23,040 |

| 2018 | $4,340 | $21,292 | $6,911 | $14,381 |

| 2017 | $4,095 | $20,088 | $6,071 | $14,017 |

| 2016 | $1,387 | $20,088 | $6,071 | $14,017 |

| 2015 | $704 | $19,936 | $7,943 | $11,993 |

| 2014 | $704 | $18,808 | $8,137 | $10,671 |

Source: Public Records

Map

Nearby Homes

- 111-17 133rd St

- 109-49 132nd St

- 134-01 Linden Blvd

- 11143 130th St

- 11406 135th St

- 109-41 132nd St

- 114-33 133rd St

- 109-35 131st St

- 11409 135th St

- 114-39 134th St

- 10922 132nd St

- 114-29 130th St

- 111-41 128th St

- 11455 131st St

- 11158 128th St

- 131-16 115th Ave

- 114-50 130th St

- 132-11 109th Ave

- 114-09 127th St

- 107-47 132nd St