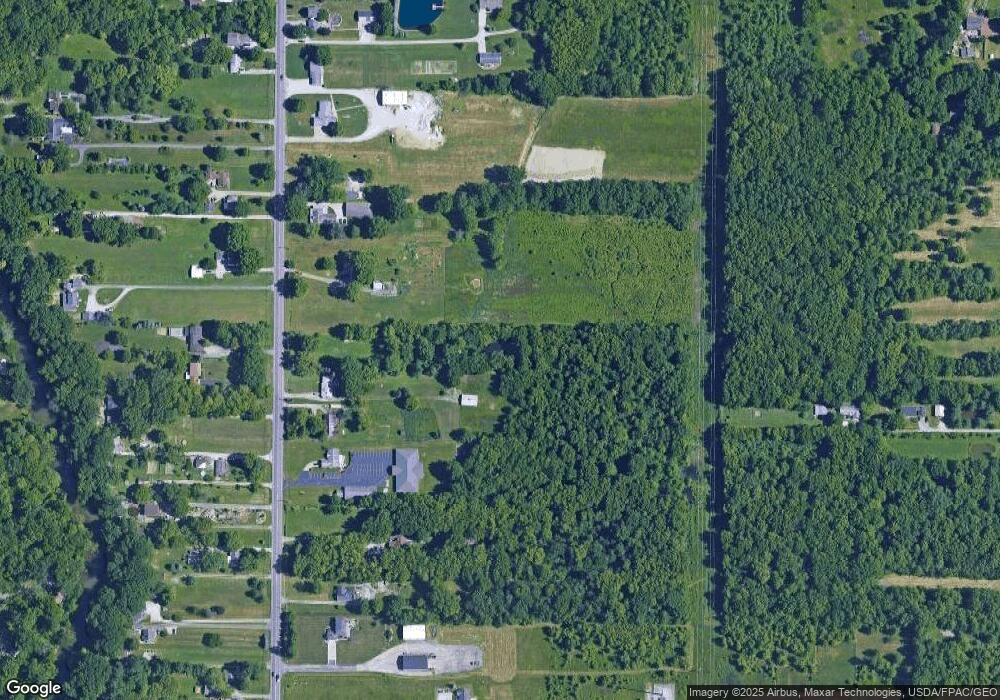

11143 Lagrange Rd Elyria, OH 44035

Estimated Value: $107,728 - $328,000

Studio

--

Bath

--

Sq Ft

2.93

Acres

About This Home

This home is located at 11143 Lagrange Rd, Elyria, OH 44035 and is currently estimated at $189,576. 11143 Lagrange Rd is a home located in Lorain County with nearby schools including Keystone Elementary School, Keystone Middle School, and Keystone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2007

Sold by

Matthews Timothy B and Matthews Kelly C

Bought by

Cameron William W and Cameron Nicole M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,200

Outstanding Balance

$32,215

Interest Rate

6.26%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$157,361

Purchase Details

Closed on

Nov 15, 2006

Sold by

Ervin Judith D

Bought by

Matthews Timothy B and Matthews Kelly C

Purchase Details

Closed on

May 2, 2003

Sold by

Ervin Judith D

Bought by

Ervin Judith D and The Judith D Ervin Trust

Purchase Details

Closed on

Nov 9, 1999

Sold by

Skorvanik Andrew and Skorvanik Elaine

Bought by

Ervin Judith D

Purchase Details

Closed on

Mar 27, 1997

Sold by

Rock Rita B

Bought by

Skorvanik Andrew and Skorvanik Elaine

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cameron William W | $58,000 | Elyria Land Title | |

| Matthews Timothy B | $25,000 | Attorney | |

| Ervin Judith D | -- | -- | |

| Ervin Judith D | $45,000 | Lorain County Title Co Inc | |

| Skorvanik Andrew | $15,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cameron William W | $52,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $262 | $6,454 | $6,454 | -- |

| 2023 | $855 | $17,339 | $17,339 | $0 |

| 2022 | $849 | $17,339 | $17,339 | $0 |

| 2021 | $849 | $17,339 | $17,339 | $0 |

| 2020 | $855 | $15,820 | $15,820 | $0 |

| 2019 | $850 | $15,820 | $15,820 | $0 |

| 2018 | $931 | $15,820 | $15,820 | $0 |

| 2017 | $1,007 | $17,430 | $17,430 | $0 |

| 2016 | $1,001 | $17,430 | $17,430 | $0 |

| 2015 | $985 | $17,430 | $17,430 | $0 |

| 2014 | $865 | $17,430 | $17,430 | $0 |

| 2013 | $845 | $17,430 | $17,430 | $0 |

Source: Public Records

Map

Nearby Homes

- 114 River Run Dr

- 40000 Myrtle Ct

- 158 River Run Dr

- 221 River Run Dr

- 229 River Run Dr

- 214 Leather Leaf Dr

- 502 Cedarwood Trail

- 238 Leather Leaf Dr

- 437 Pheasant Run

- 250 Leather Leaf Dr

- 425 Pheasant Run

- 421 Pheasant Run

- 417 Pheasant Run

- 413 Pheasant Run

- 409 Pheasant Run

- 430 Pheasant Run

- 426 Pheasant Run

- 422 Pheasant Run

- 418 Pheasant Run

- 160 Kentucky Dr

- 11109 Lagrange Rd

- 11205 Lagrange Rd

- 11181 Lagrange Rd

- 11211 Lagrange Rd

- 11237 Lagrange Rd

- 11083 Lagrange Rd

- 11057 Lagrange Rd

- 11108 Lagrange Rd

- 11293 Lagrange Rd

- 11055 Lagrange Rd

- 200 Centurion Dr

- 262 Lake Ave

- 11305 Lagrange Rd

- 11222 Lagrange Rd

- 11172 Lagrange Rd

- 11064 Lagrange Rd

- 11188 Lagrange Rd

- 11061 Lagrange Rd

- 40640 Carl Dr

- 100 Centurion Dr