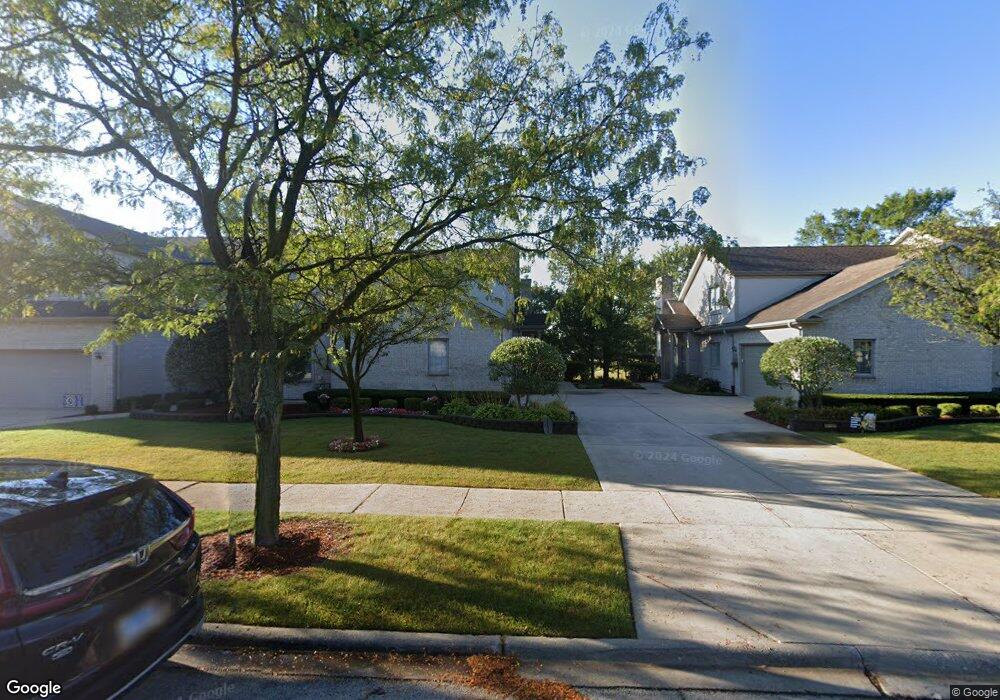

11145 Karen Dr Unit 11145 Orland Park, IL 60467

Centennial NeighborhoodEstimated Value: $380,000 - $497,000

2

Beds

2

Baths

1,717

Sq Ft

$254/Sq Ft

Est. Value

About This Home

This home is located at 11145 Karen Dr Unit 11145, Orland Park, IL 60467 and is currently estimated at $435,812, approximately $253 per square foot. 11145 Karen Dr Unit 11145 is a home located in Cook County with nearby schools including Centennial School, Meadow Ridge School, and Century Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 15, 2023

Sold by

Versetto Nicholas J and Versetto Lois A

Bought by

Trust Agreement Of Nicholas J Versetto And Lo and Versetto

Current Estimated Value

Purchase Details

Closed on

Sep 28, 2007

Sold by

Cordero Antonio S and Cordero Ophelia A

Bought by

Versetto Nicholas J and Versetto Lois A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Interest Rate

6.49%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 21, 2003

Sold by

Osullivan Patrick and Osullivan Teresa L

Bought by

Cordero Antonio S and Cordero Ophelia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,125

Interest Rate

5.37%

Mortgage Type

Balloon

Purchase Details

Closed on

Oct 16, 2000

Sold by

Standard Bank & Trust Company

Bought by

Osullivan Patrick L and Osullivan Teresa L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,500

Interest Rate

7.9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trust Agreement Of Nicholas J Versetto And Lo | -- | None Listed On Document | |

| Versetto Nicholas J | $375,000 | Republic Title Co | |

| Cordero Antonio S | $349,500 | Ticor Title Insurance | |

| Osullivan Patrick L | $276,000 | Integrity Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Versetto Nicholas J | $296,000 | |

| Previous Owner | Cordero Antonio S | $262,125 | |

| Previous Owner | Osullivan Patrick L | $247,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,015 | $31,863 | $1,275 | $30,588 |

| 2023 | $6,348 | $34,000 | $1,275 | $32,725 |

| 2022 | $6,348 | $27,349 | $3,507 | $23,842 |

| 2021 | $6,428 | $28,213 | $3,506 | $24,707 |

| 2020 | $6,301 | $28,213 | $3,506 | $24,707 |

| 2019 | $5,579 | $26,500 | $3,188 | $23,312 |

| 2018 | $7,604 | $31,919 | $3,188 | $28,731 |

| 2017 | $7,448 | $31,919 | $3,188 | $28,731 |

| 2016 | $6,443 | $25,588 | $2,869 | $22,719 |

| 2015 | $6,346 | $25,588 | $2,869 | $22,719 |

| 2014 | $6,267 | $25,588 | $2,869 | $22,719 |

| 2013 | $6,718 | $28,842 | $2,869 | $25,973 |

Source: Public Records

Map

Nearby Homes

- 11156 Karen Dr

- 16400 Lee Ave

- 16221 Kingsport Rd

- 11138 Alpine Ln

- 16430 Stuart Ave

- 16540 Pear Ave

- 16546 Pear Ave

- 16464 Nottingham Ct Unit 19

- 16626 Pear Ave

- 16705 Wolf Rd

- 10700 165th St

- 16620 Grants Trail

- 15212 Penrose Ct

- 15160 Penrose Ct

- 15125 Penrose Ct

- 15106 Penrose Ct

- 15245 Penrose Ct

- 16230 107th Ave

- 11349 W 167th St

- 16629 Grants Trail

- 11145 Karen Dr Unit 45

- 11141 Karen Dr

- 11151 Karen Dr

- 11137 Karen Dr Unit 11137

- 11155 Karen Dr

- 11133 Karen Dr Unit 11133

- 11159 Karen Dr

- 11138 Karen Dr

- 11163 Karen Dr Unit 11163

- 11142 Karen Dr

- 11123 Karen Dr Unit 11123

- 11152 Karen Dr

- 11128 Karen Dr

- 11146 Karen Dr

- 11119 Karen Dr Unit 11119

- 11132 Karen Dr

- 11160 Karen Dr

- 11110 Karen Dr Unit 11110

- 11113 Karen Dr Unit 11113

- 11114 Karen Dr