1115 Molitor Rd Aurora, IL 60505

Indian Creek NeighborhoodEstimated Value: $325,650

Studio

--

Bath

7,970

Sq Ft

$41/Sq Ft

Est. Value

About This Home

This home is located at 1115 Molitor Rd, Aurora, IL 60505 and is currently estimated at $325,650, approximately $40 per square foot. 1115 Molitor Rd is a home located in Kane County with nearby schools including Mabel O Donnell Elementary School, Simmons Middle School, and East Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 24, 2022

Sold by

John Oconnell Trust

Bought by

Wilworcs Llc

Current Estimated Value

Purchase Details

Closed on

Sep 17, 2019

Sold by

Oconnell John

Bought by

Oconnell John L and Oconnell Debra L

Purchase Details

Closed on

Jul 22, 2011

Sold by

Loveless Richard

Bought by

Oconnell John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Interest Rate

4.52%

Mortgage Type

Commercial

Purchase Details

Closed on

May 31, 2005

Sold by

Valley Maid Ice Cream Corp

Bought by

Loveless Richard and Schwarz Karl

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Interest Rate

5.91%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilworcs Llc | $250,000 | None Listed On Document | |

| Oconnell John L | -- | Attorney | |

| Oconnell John | $205,000 | First American Title | |

| Loveless Richard | -- | First American Title | |

| Loveless Richard | $310,000 | Chicago Title Insurance Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Oconnell John | $215,000 | |

| Previous Owner | Loveless Richard | $248,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,688 | $131,371 | $63,456 | $67,915 |

| 2023 | $6,828 | $117,380 | $56,698 | $60,682 |

| 2022 | $6,319 | $107,099 | $51,732 | $55,367 |

| 2021 | $6,308 | $99,710 | $48,163 | $51,547 |

| 2020 | $5,722 | $92,615 | $44,736 | $47,879 |

| 2019 | $5,688 | $85,810 | $41,449 | $44,361 |

| 2018 | $5,657 | $81,270 | $38,340 | $42,930 |

| 2017 | $5,684 | $74,883 | $35,327 | $39,556 |

| 2016 | $5,773 | $69,712 | $30,282 | $39,430 |

| 2015 | -- | $74,741 | $26,040 | $48,701 |

| 2014 | -- | $70,771 | $23,932 | $46,839 |

| 2013 | -- | $68,599 | $19,660 | $48,939 |

Source: Public Records

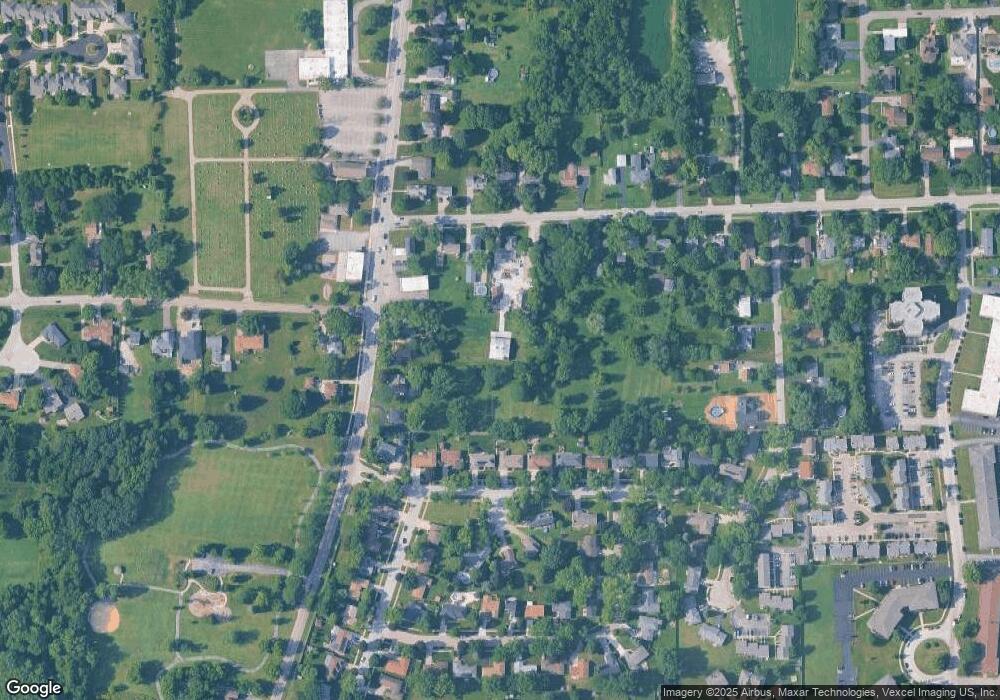

Map

Nearby Homes

- 1923 Schomer Ct

- 1826 N Farnsworth Ave

- 1567 Galway Dr

- 1751 Gary Ave

- 1942 Tall Oaks Dr Unit 3B

- Lot 1 Reckinger Rd

- 440 Woodlyn Dr

- 341 Woodlyn Dr Unit 3

- 0000 N Farnsworth Ave

- 2315 Nan St

- 1220 Mitchell Rd

- 907 Harley Ct

- 1009 Assell Ave

- 1771 Briarheath Dr

- 769 Chesterfield Ln

- 1671 Sheffer Rd

- 304 Hankes Ave

- 2752 Preserve Cir Unit 13006

- 2748 Preserve Cir Unit 13005

- 2732 Preserve Cir Unit 13001

- 1095 Molitor Rd

- 1125 Molitor Rd

- 1125 Molitor Rd Unit B

- 1085 Molitor Rd

- 1145 Molitor Rd

- 1110 Molitor Rd

- 1120 Molitor Rd

- 1090 Molitor Rd

- 1835 Church Rd

- 1130 Molitor Rd

- 1065 Molitor Rd

- 1861 Church Rd

- 1155 Molitor Rd

- 1791 Church Rd

- 1140 Molitor Rd

- 1865 Church Rd

- 1165 Molitor Rd

- 1150 Molitor Rd

- 1771 Church Rd

- 1875 Church Rd

Your Personal Tour Guide

Ask me questions while you tour the home.