1115 Stone Run Ct Lancaster, OH 43130

Estimated Value: $476,000 - $623,000

3

Beds

3

Baths

2,525

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 1115 Stone Run Ct, Lancaster, OH 43130 and is currently estimated at $560,585, approximately $222 per square foot. 1115 Stone Run Ct is a home located in Fairfield County with nearby schools including Medill Elementary School, Thomas Ewing Junior High School, and Lancaster High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2018

Sold by

Scoles Bradley E

Bought by

Dunbar Alan and Dunbar Tiffany

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,850

Outstanding Balance

$287,354

Interest Rate

4.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$273,231

Purchase Details

Closed on

Aug 1, 2017

Sold by

Scoles Patricia S

Bought by

Scoles Bradley E

Purchase Details

Closed on

Apr 20, 2006

Sold by

Scoles Patricia S

Bought by

Scoles Patricia S

Purchase Details

Closed on

Feb 25, 2005

Sold by

Fairfield Homes Inc

Bought by

Scoles Ralph A and Scoles Patricia S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dunbar Alan | $343,000 | Valmer Land Title Agency | |

| Scoles Bradley E | -- | None Available | |

| Scoles Patricia S | -- | Attorney | |

| Scoles Ralph A | $65,200 | Hocking Valley Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dunbar Alan | $325,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,441 | $149,510 | $27,760 | $121,750 |

| 2023 | $5,555 | $149,510 | $27,760 | $121,750 |

| 2022 | $5,588 | $149,510 | $27,760 | $121,750 |

| 2021 | $4,787 | $120,050 | $24,130 | $95,920 |

| 2020 | $4,593 | $120,050 | $24,130 | $95,920 |

| 2019 | $4,372 | $120,050 | $24,130 | $95,920 |

| 2018 | $5,585 | $143,690 | $25,240 | $118,450 |

| 2017 | $5,350 | $151,790 | $24,130 | $127,660 |

| 2016 | $5,211 | $151,790 | $24,130 | $127,660 |

| 2015 | $5,157 | $146,150 | $24,130 | $122,020 |

| 2014 | $4,913 | $146,150 | $24,130 | $122,020 |

| 2013 | $4,913 | $146,150 | $24,130 | $122,020 |

Source: Public Records

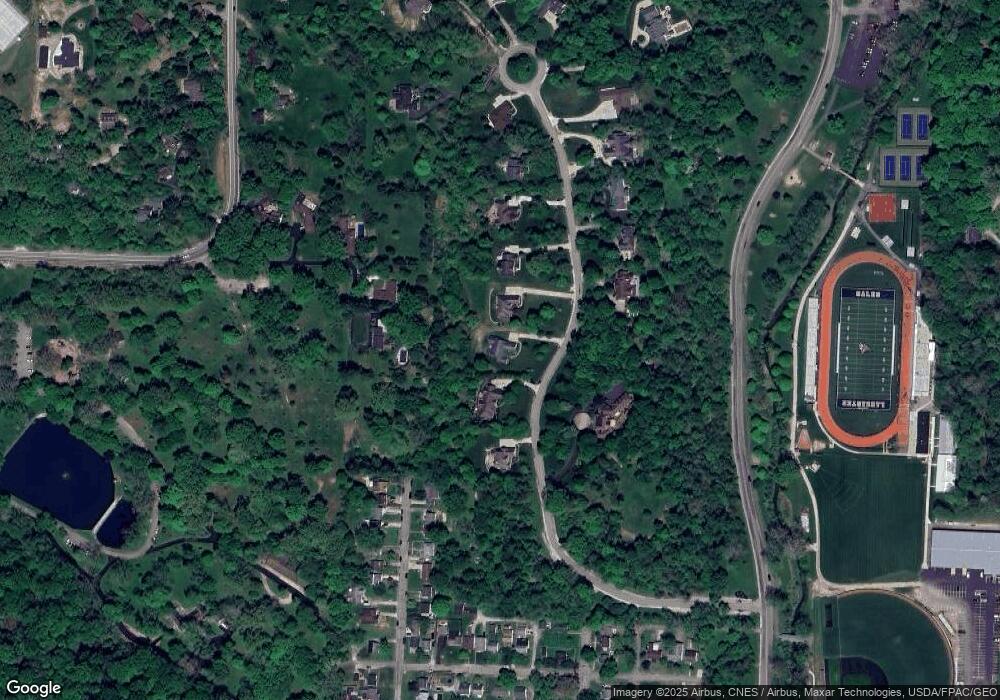

Map

Nearby Homes

- 716 N Mount Pleasant Ave

- 534 Overlook Dr NE

- 831 Franklin Ave

- 521 E Allen St

- 632 N Eastwood Ave

- 700 E Allen St

- 806 N High St

- 230 Lake St

- 1150 E Fair Ave

- 619 N Maple St

- 737 Medill Ave

- 600 N Maple St

- 708 N High St

- 100 Wilson Ave

- 711 N High St

- 404 E 6th Ave

- 620 E 5th Ave

- 1271 Huffer Ave

- 1275 Wetsell Ave

- 1285 Huffer Ave

- 1129 Stone Run Ct

- 1099 Stone Run Ct

- 0 Stone Run

- 0 Stone Run Ct Lot 2 Unit 9909065

- 0 Stone Run Ct Lot 1 Unit 9909064

- 000 Stone Run Ct

- 0 Stone Run Ct Unit 9917060

- 0 Stone Run Ct Unit L-12 2343062

- 0 Stone Run Ct Unit Lot 12 2910321

- 0 Stone Run Ct Unit LOT 12 2810939

- 0 Stone Run Ct Unit 2909580

- 0 Stone Run Ct Unit 9922897

- 0 Stone Run Ct Unit 219045915

- 0 Stone Run Ct Unit 215013270

- 1145 Stone Run Ct

- 1085 Stone Run Ct

- 550 Orchard Hill Dr

- 1100 Stone Run Ct

- 548 Orchard Hill Dr

- 1159 Stone Run Ct