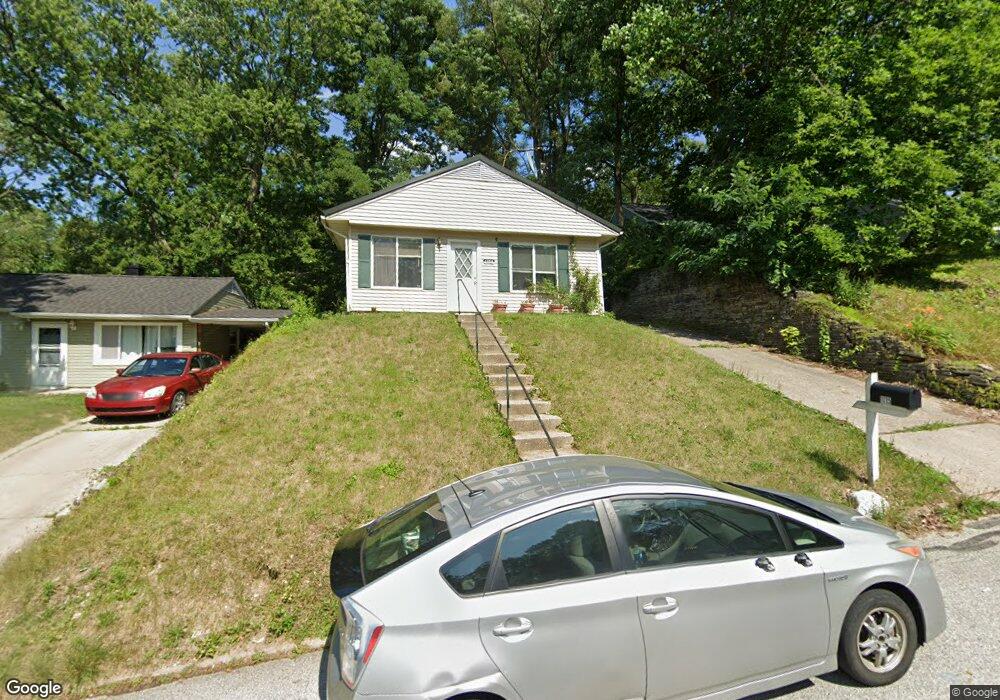

1115 Wayne Terrace Lafayette, IN 47904

Elmwood NeighborhoodEstimated Value: $140,000 - $179,000

2

Beds

1

Bath

1,032

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 1115 Wayne Terrace, Lafayette, IN 47904 and is currently estimated at $162,062, approximately $157 per square foot. 1115 Wayne Terrace is a home located in Tippecanoe County with nearby schools including Vinton Elementary School, Sunnyside Intermediate School, and Lafayette Tecumseh Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2020

Sold by

Christianson Leslie L and Christianson Judith C

Bought by

Miramontes Jose J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,000

Interest Rate

3.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 13, 2015

Sold by

Clerico Madeline R

Bought by

Christianson Leslie L and Christianson Judith C

Purchase Details

Closed on

Aug 11, 2010

Sold by

Secretary Of Housing & Urban Development

Bought by

Clerico Madeline R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,960

Interest Rate

4.63%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 26, 2009

Sold by

Everhome Mortgage Company

Bought by

Secretary Of Housing & Urban Development

Purchase Details

Closed on

Feb 13, 2009

Sold by

Carter Nathan T

Bought by

Regions Bank and Union Planters Bank Na

Purchase Details

Closed on

Dec 13, 2002

Sold by

Stout Lynn A

Bought by

Carter Nathan T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,313

Interest Rate

6.23%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miramontes Jose J | $115,000 | None Listed On Document | |

| Christianson Leslie L | -- | -- | |

| Clerico Madeline R | -- | None Available | |

| Secretary Of Housing & Urban Development | -- | None Available | |

| Regions Bank | $78,305 | None Available | |

| Carter Nathan T | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Miramontes Jose J | $92,000 | |

| Previous Owner | Clerico Madeline R | $20,960 | |

| Previous Owner | Carter Nathan T | $75,313 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,091 | $104,400 | $13,000 | $91,400 |

| 2023 | $2,043 | $101,900 | $13,000 | $88,900 |

| 2022 | $1,734 | $87,800 | $13,000 | $74,800 |

| 2021 | $1,561 | $77,700 | $13,000 | $64,700 |

| 2020 | $1,417 | $70,500 | $13,000 | $57,500 |

| 2019 | $1,353 | $67,300 | $12,000 | $55,300 |

| 2018 | $1,303 | $64,800 | $12,000 | $52,800 |

| 2017 | $1,280 | $63,700 | $12,000 | $51,700 |

| 2016 | $1,241 | $61,700 | $12,000 | $49,700 |

| 2014 | $1,142 | $56,800 | $12,000 | $44,800 |

| 2013 | $281 | $57,800 | $12,000 | $45,800 |

Source: Public Records

Map

Nearby Homes

- 60 Sunrise Dr

- 2410 Union St

- 1400 N 28th St

- 1931 Morton St

- 2711 Sleepy Hollow Dr

- 2707 Union St

- 2103 Union St

- 1325 Hedgewood Dr

- 1000 Berkley Rd

- 2205 Vinton St

- 1925 Maple St

- 2131 Vinton St

- 70 Collins Dr

- 1904 Greenbush St

- 1803 Pierce St

- 1729 Arlington Rd

- 2127 Perrine St

- 1908 Whitcomb Ave

- 2232 Charles St

- 2716 Longlois Dr

- 1119 Wayne Terrace

- 1111 Wayne Terrace

- 1107 Wayne Terrace

- 1123 Wayne Terrace

- 1103 Wayne Terrace

- 1110 Wayne Terrace

- 1114 Wayne Terrace

- 2506 Rainbow Dr

- 2505 Roselawn Ave

- 2224 Rainbow Dr

- 2233 Roselawn Ave

- 2220 Rainbow Dr

- 2229 Roselawn Ave

- 1203 Wayne Terrace

- 928 Snowy Owl Ct

- 926 Snowy Owl Ct

- 2225 Roselawn Ave

- 2240 Roselawn Ave

- 930 Snowy Owl Ct

- 2216 Rainbow Dr