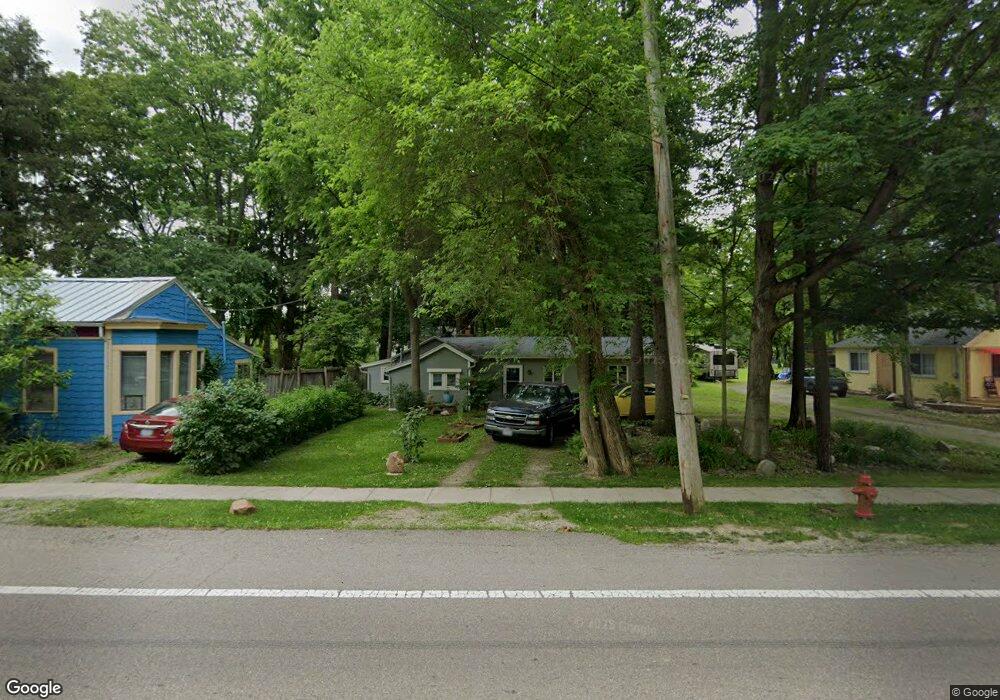

1119 Xenia Ave Yellow Springs, OH 45387

Estimated Value: $168,648 - $256,000

1

Bed

1

Bath

432

Sq Ft

$514/Sq Ft

Est. Value

About This Home

This home is located at 1119 Xenia Ave, Yellow Springs, OH 45387 and is currently estimated at $221,912, approximately $513 per square foot. 1119 Xenia Ave is a home located in Greene County with nearby schools including Mills Lawn Elementary School, Yellow Springs High School & McKinney Middle School, and The Antioch School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 12, 2012

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Hahn Geoffery T

Current Estimated Value

Purchase Details

Closed on

Jul 27, 2011

Sold by

Noon Christopher P

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Dec 10, 2007

Sold by

Toole Phil

Bought by

Noon Christopher P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,700

Interest Rate

6.31%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 1, 1998

Sold by

Koehler Karl G and Koehler Nancy J

Bought by

Toole Phil

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,000

Interest Rate

6.98%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hahn Geoffery T | $57,000 | Attorney | |

| Federal Home Loan Mortgage Corporation | $66,000 | Attorney | |

| Noon Christopher P | $108,700 | Attorney | |

| Toole Phil | $50,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Noon Christopher P | $108,700 | |

| Previous Owner | Toole Phil | $28,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,412 | $43,240 | $23,890 | $19,350 |

| 2023 | $2,412 | $43,240 | $23,890 | $19,350 |

| 2022 | $2,274 | $38,670 | $23,890 | $14,780 |

| 2021 | $2,187 | $38,670 | $23,890 | $14,780 |

| 2020 | $2,195 | $38,670 | $23,890 | $14,780 |

| 2019 | $1,668 | $26,730 | $13,650 | $13,080 |

| 2018 | $1,663 | $26,730 | $13,650 | $13,080 |

| 2017 | $1,534 | $26,730 | $13,650 | $13,080 |

| 2016 | $1,534 | $25,020 | $13,650 | $11,370 |

| 2015 | $1,559 | $25,020 | $13,650 | $11,370 |

| 2014 | $1,505 | $25,020 | $13,650 | $11,370 |

Source: Public Records

Map

Nearby Homes

- 117 Allen St

- 00 Xenia Ave

- 1302 Shawnee Dr

- 310 Allen St

- 517 Iris Dr

- 117 E North College St

- 510 Iris Dr

- 504 Phillips St

- 675 Wright St

- 1645 Randall Rd

- 414 S High St

- 425 Suncrest Dr Unit 1 & 2

- 420 Spring Glen Dr

- 750 W South College St

- 345 E Enon Rd

- 125 Park Meadows Dr

- 1315 Corry St

- 137 Kenneth Hamilton Way

- 134 Kenneth Hamilton Way

- Fairfax Plan at Spring Meadows - Maple Street Collection