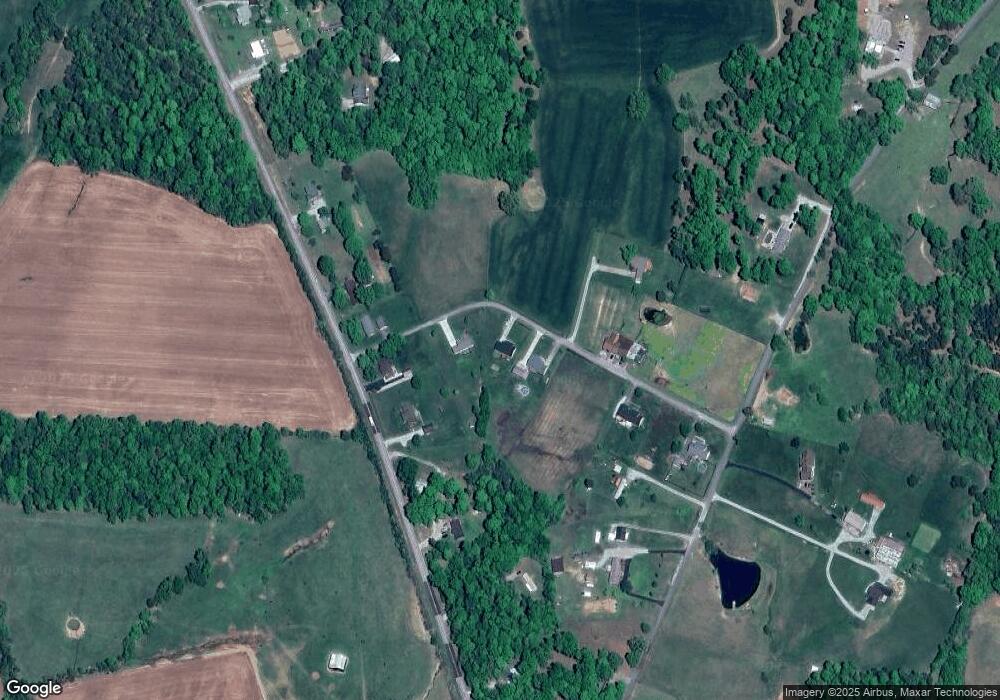

112 Probus Rd Leitchfield, KY 42754

Estimated Value: $227,000 - $369,000

--

Bed

--

Bath

--

Sq Ft

0.57

Acres

About This Home

This home is located at 112 Probus Rd, Leitchfield, KY 42754 and is currently estimated at $276,519. 112 Probus Rd is a home with nearby schools including Grayson County High School, First Baptist Church Preschool & Kindergarden, and Leitchfield Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2022

Sold by

Decker Mason T

Bought by

Decker Mason T and Pierce Shelby

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$135,845

Interest Rate

4.67%

Mortgage Type

New Conventional

Estimated Equity

$140,674

Purchase Details

Closed on

Apr 4, 2022

Sold by

Frank and Devon

Bought by

Deckr Mason T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$135,845

Interest Rate

4.67%

Mortgage Type

New Conventional

Estimated Equity

$140,674

Purchase Details

Closed on

Oct 6, 2015

Sold by

Troy Armstrong and Troy Theresa

Bought by

Chad Frank and Chad Devon Frank

Purchase Details

Closed on

Oct 25, 2013

Bought by

Armstrong Troy and Armstrong Theresa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Decker Mason T | -- | Bluegrass Land Title | |

| Deckr Mason T | $382 | None Listed On Document | |

| Chad Frank | $100,000 | -- | |

| Armstrong Troy | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Deckr Mason T | $144,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,565 | $160,000 | $160,000 | $0 |

| 2023 | $1,606 | $160,000 | $160,000 | $0 |

| 2022 | $963 | $100,000 | $15,000 | $85,000 |

| 2021 | $971 | $100,000 | $15,000 | $85,000 |

| 2020 | $974 | $100,000 | $15,000 | $85,000 |

| 2019 | $972 | $100,000 | $100,000 | $0 |

| 2018 | $959 | $100,000 | $100,000 | $0 |

| 2017 | $957 | $100,000 | $100,000 | $0 |

| 2016 | $937 | $100,000 | $100,000 | $0 |

| 2015 | $805 | $95,000 | $95,000 | $0 |

| 2014 | $805 | $95,000 | $95,000 | $0 |

| 2013 | $735 | $89,500 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 64 Probus Rd

- 42 Shelton Dr

- 244 Noah Ln

- 1371 Sunbeam Rd

- 1738 Sunbeam Rd

- 3157 Brandenburg Rd

- 3157 Brandenburg Rd

- 15 Serena Cir

- 3155 Brandenburg Rd

- 605 Hilltop Rd

- 0 Wyandotte Rd Unit SC46821

- 1414 Sycamore Ln

- 0 Old Scout Dr

- 690 Old Scout Dr

- 77 Charlie Kiper Rd

- 403 Hilltop Rd

- 614 Lilac Rd

- 1351 Sunbeam Rd

- 1606 Parkview Dr

- 1608 Parkview Dr