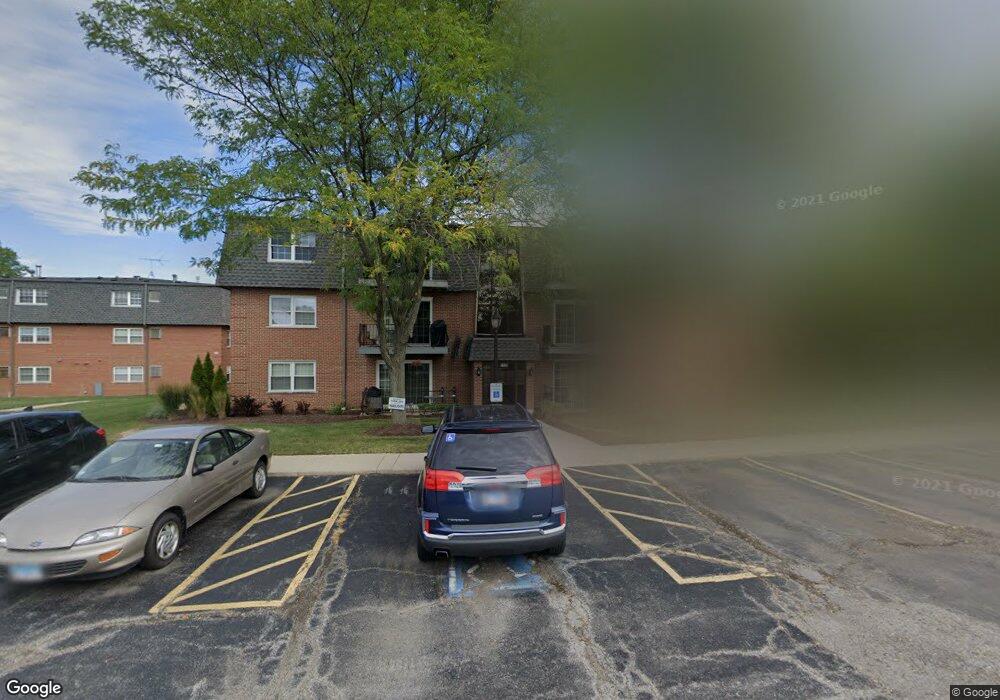

1120 64th St Unit 112012 La Grange Highlands, IL 60525

Estimated Value: $191,612 - $208,000

2

Beds

1

Bath

41,140

Sq Ft

$5/Sq Ft

Est. Value

About This Home

This home is located at 1120 64th St Unit 112012, La Grange Highlands, IL 60525 and is currently estimated at $197,153, approximately $4 per square foot. 1120 64th St Unit 112012 is a home located in Cook County with nearby schools including Highlands Elementary School, Highlands Middle School, and Lyons Township High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 2, 2016

Sold by

Szule Casey A and Szule Barbara A

Bought by

Melcher Thomas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,999

Outstanding Balance

$74,624

Interest Rate

4.12%

Mortgage Type

New Conventional

Estimated Equity

$122,529

Purchase Details

Closed on

May 2, 2007

Sold by

Gonzalez Jorge and Gonzalez Kimberly Anne

Bought by

Szulc Casey A and Szulc Barbara A

Purchase Details

Closed on

Jun 6, 1997

Sold by

Eul Geraldi Barbara E and Eulvance Lisa M

Bought by

Gonzalez Jorge and Gonzalez Kimberly Anne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Interest Rate

7.5%

Purchase Details

Closed on

Oct 13, 1993

Sold by

State Bank Of Countryside

Bought by

Eul Barbara E and Eul Lisa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,000

Interest Rate

4.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Melcher Thomas | $100,000 | Fidelity National Title Insu | |

| Szulc Casey A | $151,000 | Pntn | |

| Gonzalez Jorge | $90,000 | -- | |

| Eul Barbara E | $54,333 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Melcher Thomas | $90,999 | |

| Previous Owner | Gonzalez Jorge | $81,000 | |

| Previous Owner | Eul Barbara E | $47,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,144 | $13,489 | $1,565 | $11,924 |

| 2023 | $1,135 | $13,489 | $1,565 | $11,924 |

| 2022 | $1,135 | $7,966 | $1,702 | $6,264 |

| 2021 | $1,100 | $7,964 | $1,701 | $6,263 |

| 2020 | $1,129 | $7,964 | $1,701 | $6,263 |

| 2019 | $1,469 | $9,732 | $1,565 | $8,167 |

| 2018 | $1,441 | $9,732 | $1,565 | $8,167 |

| 2017 | $1,417 | $9,732 | $1,565 | $8,167 |

| 2016 | $2,541 | $10,308 | $1,361 | $8,947 |

| 2015 | $2,500 | $10,308 | $1,361 | $8,947 |

| 2014 | $2,467 | $10,308 | $1,361 | $8,947 |

| 2013 | $2,200 | $9,480 | $1,361 | $8,119 |

Source: Public Records

Map

Nearby Homes

- 1140 64th St Unit 6

- 6220 Sunset Ave

- 116 Country Dr

- 94 Hawthorne Dr

- 7445 Willow Springs Rd

- 6630 S Brainard Ave Unit PT203

- 6670 S Brainard Ave Unit 402

- 6660 S Brainard Ave Unit 103

- 164 Cascade Dr

- 6700 S Brainard Ave Unit 428

- 170 Cascade Dr

- 10725 Forestview Rd

- 191 Cascade Dr

- 6262 Edgebrook Ln E

- 127 Acacia Cir Unit 505

- 111 Acacia Dr Unit 508

- 6213 Edgebrook Ln W

- 1901 W Plainfield Rd

- 6818 Joliet Rd Unit 9

- 7001 Sunset Ave

- 1120 64th St Unit 8

- 1120 64th St Unit 112010

- 1120 64th St Unit 11205

- 1120 64th St Unit 11206

- 1120 64th St Unit 11207

- 1120 64th St Unit 11204

- 1120 64th St Unit 112011

- 1120 64th St Unit 11202

- 1120 64th St Unit 11209

- 1120 64th St Unit 11201

- 1120 64th St Unit 11203

- 1120 64th St Unit 11208

- 1120 64th St Unit 6

- 1120 64th St Unit 1

- 1120 64th St Unit 2

- 1120 64th St Unit 4

- 1120 64th St Unit 12

- 1120 64th St Unit 3

- 1120 64th St Unit 5

- 1110 64th St Unit 11107