Estimated Value: $130,000 - $149,019

2

Beds

1

Bath

912

Sq Ft

$157/Sq Ft

Est. Value

About This Home

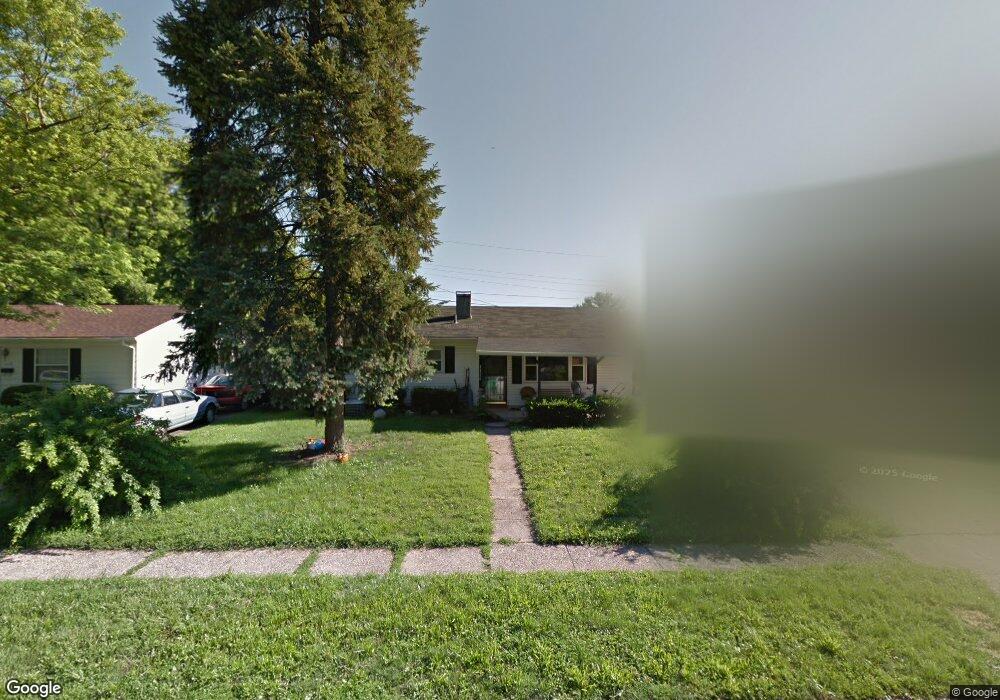

This home is located at 1120 Reid Ave, Xenia, OH 45385 and is currently estimated at $143,505, approximately $157 per square foot. 1120 Reid Ave is a home located in Greene County with nearby schools including Xenia High School, Summit Academy Community School for Alternative Learners - Xenia, and Legacy Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 24, 2007

Sold by

Wise Robert S and Wise Stacy L

Bought by

Wise Bruce R and Wise Deborah A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,800

Outstanding Balance

$12,249

Interest Rate

6.31%

Mortgage Type

Unknown

Estimated Equity

$131,256

Purchase Details

Closed on

Oct 27, 2005

Sold by

Cox David W and Mcintosh Beatrice A

Bought by

Wise Robert S and Wise Stacy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,440

Interest Rate

7.99%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Feb 20, 1998

Sold by

Estate Of Jack W Mcintosh

Bought by

Mcintosh Beatrice A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wise Bruce R | $87,500 | Vantage Land Title Inc | |

| Wise Robert S | $71,800 | Vantage Land Title Inc | |

| Mcintosh Beatrice A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wise Bruce R | $68,800 | |

| Previous Owner | Wise Robert S | $57,440 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,489 | $34,800 | $7,940 | $26,860 |

| 2023 | $1,489 | $34,800 | $7,940 | $26,860 |

| 2022 | $1,230 | $24,520 | $5,670 | $18,850 |

| 2021 | $1,247 | $24,520 | $5,670 | $18,850 |

| 2020 | $1,194 | $24,520 | $5,670 | $18,850 |

| 2019 | $1,348 | $21,350 | $4,250 | $17,100 |

| 2018 | $1,109 | $21,350 | $4,250 | $17,100 |

| 2017 | $1,077 | $21,350 | $4,250 | $17,100 |

| 2016 | $1,060 | $20,020 | $4,250 | $15,770 |

| 2015 | $1,063 | $20,020 | $4,250 | $15,770 |

| 2014 | $1,018 | $20,020 | $4,250 | $15,770 |

Source: Public Records

Map

Nearby Homes

- 1223 June Dr

- 1233 June Dr

- 1283 June Dr

- 343 Sheelin Rd

- 1391 June Dr

- 1342 Kylemore Dr

- 1351 Omard Dr

- 883 Omard Dr

- 912 Omard Dr

- 509 Antrim Rd

- 1144 Rockwell Dr

- 305-325 Bellbrook Ave

- 121 S Progress Dr

- 453 Walnut St

- 613 N West St

- 0 W Church St

- 1568 Cheyenne Dr

- 1208 Bellbrook Ave

- 137 Pleasant St

- 516 N King St

- 1132 Reid Ave

- 1110 Reid Ave

- 1119 Frost Circle Dr

- 1105 Frost Circle Dr

- 1144 Reid Ave

- 1096 Reid Ave

- 1131 Frost Circle Dr

- 1093 Frost Circle Dr

- 1117 Reid Ave

- 1129 Reid Ave

- 1105 Reid Ave

- 1156 Reid Ave

- 78 Franklin Ave

- 1141 Frost Circle Dr

- 1141 Reid Ave

- 102 Franklin Ave

- 1091 Reid Ave

- 1168 Reid Ave

- 1104 Frost Circle Dr

- 1116 Frost Circle Dr