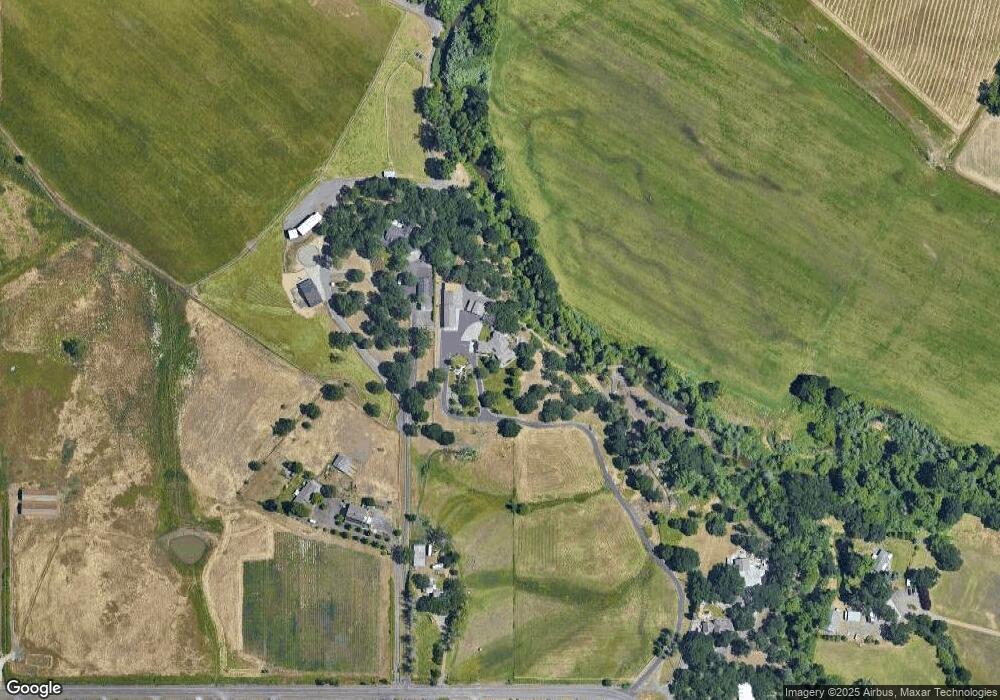

1121 E Dutton Rd Eagle Point, OR 97524

Estimated Value: $1,522,000 - $1,771,325

4

Beds

4

Baths

4,280

Sq Ft

$384/Sq Ft

Est. Value

About This Home

This home is located at 1121 E Dutton Rd, Eagle Point, OR 97524 and is currently estimated at $1,645,108, approximately $384 per square foot. 1121 E Dutton Rd is a home located in Jackson County with nearby schools including White Mountain Middle School, Eagle Point Middle School, and Eagle Point High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2007

Sold by

Meilicke Shirley M

Bought by

Joelson Gordon A and Joelson Elaine M

Current Estimated Value

Purchase Details

Closed on

Sep 7, 2005

Sold by

Brewer Aimee

Bought by

Meilicke Shirley M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$720,000

Interest Rate

5.76%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 14, 2004

Sold by

Brewer Aimee E

Bought by

Brewer Aimee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$645,000

Interest Rate

8.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 21, 2000

Sold by

Negley Ron L and Negley Susan

Bought by

Brewer Aimee E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$513,750

Interest Rate

7.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Joelson Gordon A | $998,000 | None Available | |

| Meilicke Shirley M | $900,000 | Amerititle | |

| Brewer Aimee | -- | -- | |

| Brewer Aimee E | $685,000 | Jackson County Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Meilicke Shirley M | $720,000 | |

| Previous Owner | Brewer Aimee | $645,000 | |

| Previous Owner | Brewer Aimee E | $513,750 | |

| Closed | Brewer Aimee E | $183,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $8,553 | $736,533 | -- | -- |

| 2025 | $8,349 | $715,085 | $26,765 | $688,320 |

| 2024 | $8,349 | $694,259 | $25,989 | $668,270 |

| 2023 | $8,063 | $674,045 | $25,235 | $648,810 |

| 2022 | $7,787 | $674,045 | $59,585 | $614,460 |

| 2021 | $7,556 | $654,414 | $57,844 | $596,570 |

| 2020 | $8,152 | $635,356 | $56,156 | $579,200 |

| 2019 | $8,046 | $598,896 | $52,936 | $545,960 |

| 2018 | $5,735 | $323,773 | $45,173 | $278,600 |

| 2017 | $4,261 | $323,773 | $45,173 | $278,600 |

| 2016 | $4,076 | $308,506 | $43,006 | $265,500 |

| 2015 | $3,687 | $283,186 | $39,636 | $243,550 |

| 2014 | $3,321 | $254,965 | $35,805 | $219,160 |

Source: Public Records

Map

Nearby Homes

- 3973 Cole Dr

- 13 Portabello Way

- 135 Hidden Valley Dr

- 210 Bogey Ln

- 597 Bigham Brown Rd

- 179 Skyhawk Dr

- 188 Maple St Unit 4

- 198 Prairie Landing Dr

- 160 Valemont Dr Unit 9

- 154 Valemont Dr Unit 10

- 708 Old Waverly Way Unit 30

- 148 Valemont Dr Unit 11

- 187 Prairie Landing Dr

- 151 Valemont Dr Unit 39

- The 1890 Plan at Quail Run

- The 1998 Plan at Quail Run

- The 1594 Plan at Quail Run

- The 2539 Plan at Quail Run

- The 2050 Plan at Quail Run

- The 2366 Plan at Quail Run

- 1041 E Dutton Rd

- 999 E Dutton Rd

- 1075 E Dutton Rd

- 1020 E Dutton Rd

- 2051 Riley Rd

- 1100 E Dutton Rd

- 1217 Bigham Brown Rd

- 976 E Dutton Rd

- 1229 E Dutton Rd

- 958 E Dutton Rd

- 930 E Dutton Rd

- 1300 E Dutton Rd

- 902 E Dutton Rd

- 1279 E Dutton Rd

- 1382 E Dutton Rd

- 1297 E Dutton Rd

- 944 E Dutton Rd

- 803 E Dutton Rd

- 856 E Dutton Rd

- 1404 E Dutton Rd