11215 Tyrone Trail Unit 91 Fenton, MI 48430

Estimated Value: $584,984 - $654,000

--

Bed

1

Bath

2,378

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 11215 Tyrone Trail Unit 91, Fenton, MI 48430 and is currently estimated at $617,996, approximately $259 per square foot. 11215 Tyrone Trail Unit 91 is a home located in Livingston County with nearby schools including Fenton Senior High School and St. John the Evangelist Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2017

Sold by

Weir Christopher M and Weir Jessica L

Bought by

Bright Bruce C and Bright Liliana D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$107,560

Interest Rate

4.02%

Mortgage Type

New Conventional

Estimated Equity

$510,436

Purchase Details

Closed on

Apr 8, 2002

Sold by

Weir Building Co Llc

Bought by

Weir Christopher M and Weir Jessica L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,800

Interest Rate

6.82%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bright Bruce C | $406,530 | Cislo Title | |

| Weir Christopher M | -- | Lawyers Title Insurance Corp | |

| Weir Building Co Llc | $69,000 | Lawyers Title Insurance Corp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bright Bruce C | $205,000 | |

| Previous Owner | Weir Building Co Llc | $249,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,277 | $290,400 | $0 | $0 |

| 2024 | $2,066 | $265,300 | $0 | $0 |

| 2023 | $1,971 | $244,000 | $0 | $0 |

| 2022 | $4,826 | $193,000 | $0 | $0 |

| 2021 | $4,772 | $199,100 | $0 | $0 |

| 2020 | $4,754 | $193,000 | $0 | $0 |

| 2019 | $4,699 | $189,100 | $0 | $0 |

| 2018 | $4,625 | $156,800 | $0 | $0 |

| 2017 | $3,316 | $156,800 | $0 | $0 |

| 2016 | $3,293 | $148,100 | $0 | $0 |

| 2014 | $3,215 | $137,600 | $0 | $0 |

| 2012 | $3,215 | $122,800 | $0 | $0 |

Source: Public Records

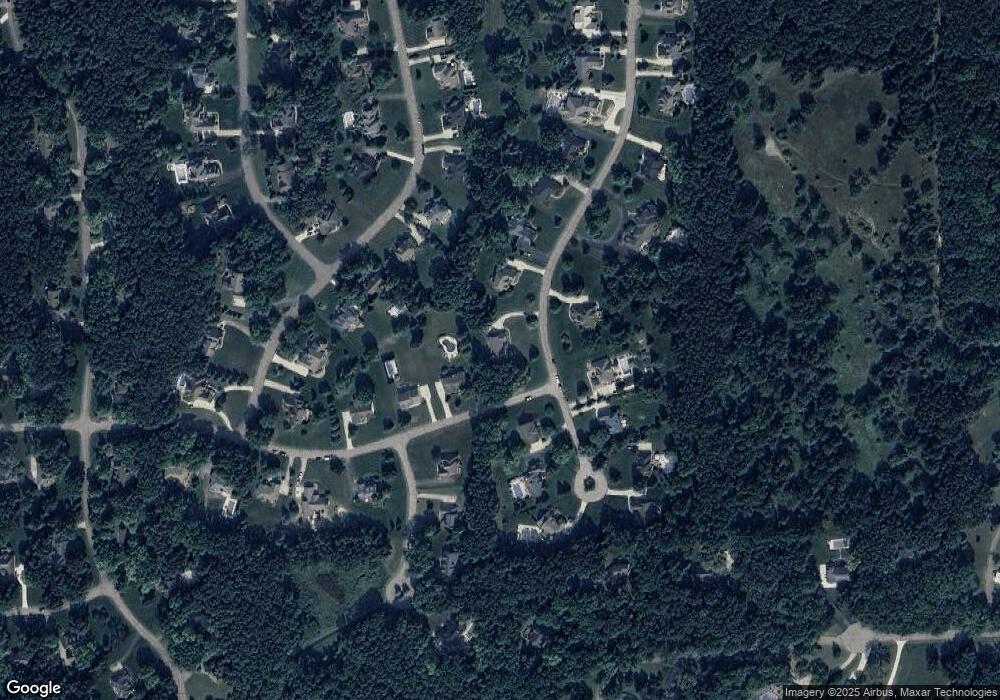

Map

Nearby Homes

- 0 Tyrone Trail Unit 20251012607

- 3424 W Shiawassee Ave

- 103 Chinkapin Rill

- 17 Sunset Ln

- 44 Retreat Way

- 24 Sunset Ln

- 189 Chinkapin Rill

- 11461 White Lake Rd

- 00 White Lake Rd

- 12189 Dentonview Dr

- 843 Whisperwood Trail Unit 31

- 11030 White Lake Rd

- 919 Whisperwood Dr

- 11577 Farmhill Dr

- 11548 Farmhill Dr

- 12160 White Lake Rd

- 16166 Aspen Hollow Dr

- 16445 Sleepy Hollow Dr

- 4116 Split Rail Ln

- 4341 Stepping Stone

- 3138 Apple Wood Unit 90

- 11229 Tyrone Trail

- 11197 Tyrone Trail Unit 76

- 3150 Apple Wood

- 11204 Tyrone Trail

- 11228 Tyrone Trail Unit 69

- 11344 Fawn Valley Trail

- 11241 Tyrone Trail Unit 93

- 11332 Fawn Valley Trail Unit Bldg-Unit

- 11332 Fawn Valley Trail Unit 112

- 11270 Honeysuckle Ct Unit 77

- 11192 Tyrone Trail

- 11368 Fawn Valley Trail

- 11181 Tyrone Trail Unit Bldg-Unit

- 11181 Tyrone Trail Unit 75

- 11320 Fawn Valley Trail Unit 113

- 3162 Apple Wood

- 3162 Applewood

- LOT 7 Marsh View Ct

- LOT 11 Marsh View Ct