11316 Glen Oaks Ct Unit 21C North Palm Beach, FL 33408

Estimated Value: $518,000 - $770,000

2

Beds

2

Baths

1,841

Sq Ft

$350/Sq Ft

Est. Value

About This Home

This home is located at 11316 Glen Oaks Ct Unit 21C, North Palm Beach, FL 33408 and is currently estimated at $645,241, approximately $350 per square foot. 11316 Glen Oaks Ct Unit 21C is a home located in Palm Beach County with nearby schools including The Conservatory School at North Palm Beach, Palm Beach Gardens Community High School, and The Benjamin Private School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2025

Sold by

Brown Larry G and Brown Jacqueline S

Bought by

Brown Family Trust and Brown

Current Estimated Value

Purchase Details

Closed on

May 30, 2019

Sold by

Frederickson Ivan Charles

Bought by

Brown Larry G and Brown Jacqueline S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Interest Rate

4.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 9, 2013

Sold by

Frederickson Sherry

Bought by

Frederickson Ivan Charles

Purchase Details

Closed on

Mar 3, 2003

Sold by

Manhoff Marshall Jay and Manhoff Merle Manio

Bought by

Frederickson Ivan

Purchase Details

Closed on

Sep 17, 1999

Sold by

Haslam Douglas F

Bought by

Manhoff Marshall J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,125

Interest Rate

7.91%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown Family Trust | -- | None Listed On Document | |

| Brown Larry G | $500,000 | Attorney | |

| Frederickson Ivan Charles | -- | Attorney | |

| Frederickson Ivan | $249,999 | Flagler Title Company | |

| Manhoff Marshall J | $149,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brown Larry G | $400,000 | |

| Previous Owner | Manhoff Marshall J | $112,125 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,258 | $349,389 | -- | -- |

| 2023 | $5,952 | $339,213 | $0 | $0 |

| 2022 | $5,899 | $329,333 | $0 | $0 |

| 2021 | $5,867 | $319,741 | $0 | $0 |

| 2020 | $5,866 | $312,784 | $0 | $0 |

| 2019 | $8,281 | $450,000 | $0 | $450,000 |

| 2018 | $7,289 | $405,000 | $0 | $405,000 |

| 2017 | $6,939 | $405,000 | $0 | $0 |

| 2016 | $5,891 | $261,155 | $0 | $0 |

| 2015 | $5,719 | $237,414 | $0 | $0 |

| 2014 | $5,198 | $215,831 | $0 | $0 |

Source: Public Records

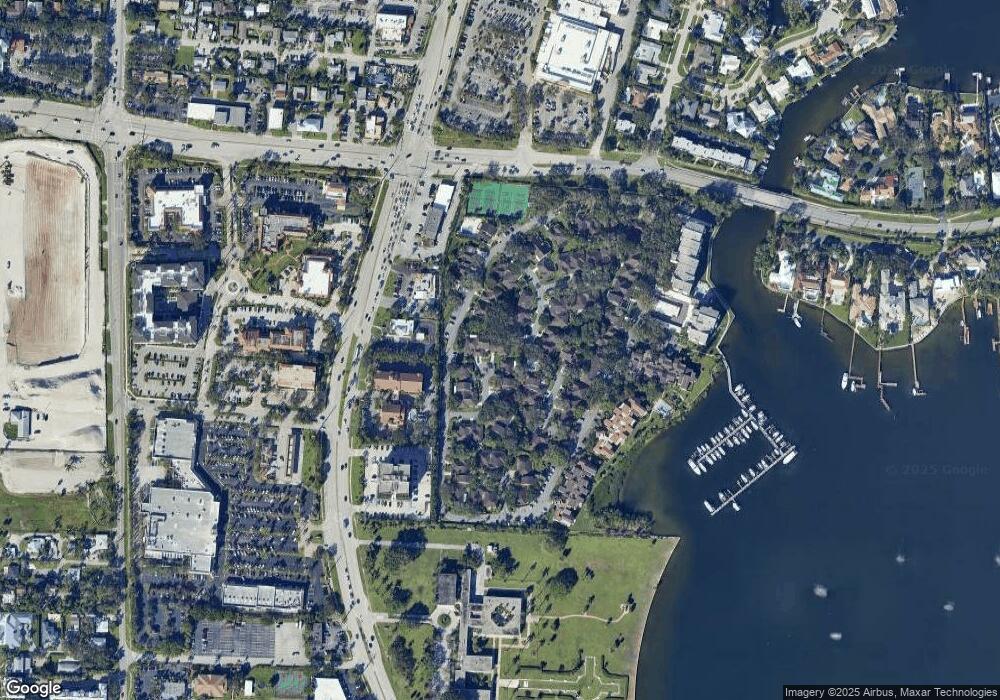

Map

Nearby Homes

- 11337 Briarwood Place Unit 5F

- 11457 Shady Oaks Ln

- 11381 Indian Shore Dr

- 11463 Riverwood Place

- 11258 Twelve Oaks Way

- 11254 Twelve Oaks Way

- 11373 12 Oaks Way

- 1660 Twelve Oaks Way Unit 205

- 11370 Twelve Oaks Way Unit 217

- 11370 Twelve Oaks Way Unit 415

- 11370 Twelve Oaks Way Unit 418

- 11370 Twelve Oaks Way Unit 611

- 11370 Twelve Oaks Way Unit 218

- 11370 Twelve Oaks Way Unit 117

- 11390 Twelve Oaks Way Unit 122

- 11569 Landing Place

- 1950 Portage Landing N

- 1938 Portage Landing N

- 1940 Doffer Ln

- 110 Water Club Way

- 11316 Glen Oaks Ct Unit Plus 40ft Dock

- 11312 Glen Oaks Ct

- 11304 Glen Oaks Ct

- 11332 Briarwood Place Unit 8F

- 11308 Glen Oaks Ct Unit 19C

- 11300 Glen Oaks Ct Unit 23C

- 11320 Twelve Oaks Way

- 11336 Briarwood Place Unit 9F

- 11294 Glen Oaks Ct Unit 25C

- 11296 Glen Oaks Ct Unit 24C

- 11329 Briarwood Place Unit 7F

- 11350 Briarwood Place Unit 10

- 11292 Glen Oaks Ct Unit 26C

- 11433 Shady Oaks Ln

- 11324 Twelve Oaks Way

- 11324 Twelve Oaks Way

- 11324 Twelve Oaks Way Unit 17F

- 11324 Twelve Oaks Way Unit 11324

- 11290 Glen Oaks Ct

- 11340 Briarwood Place