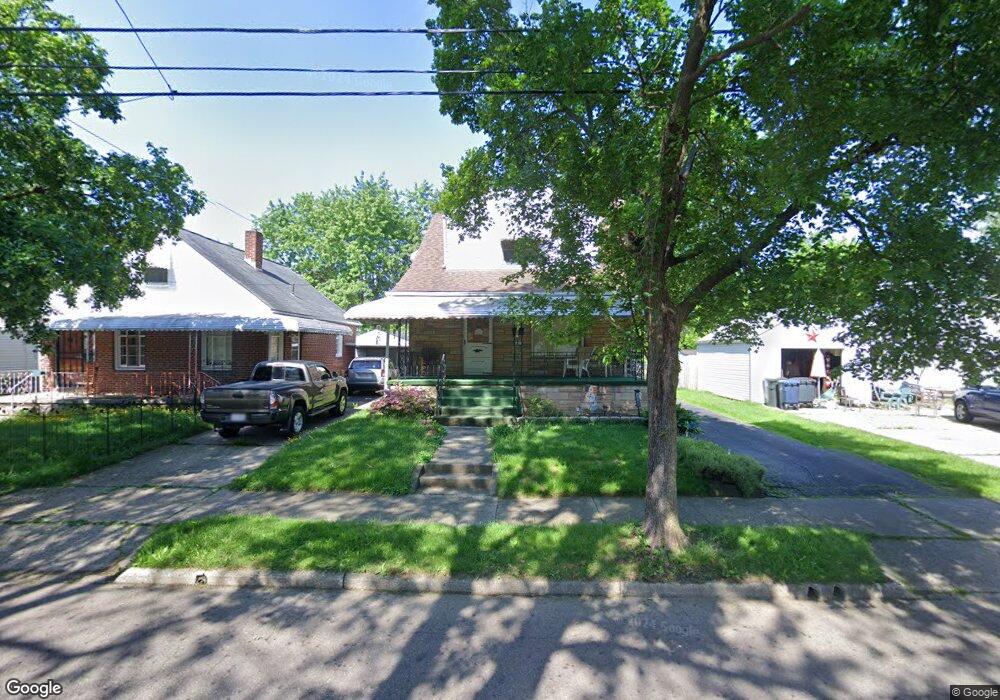

1132 Dietz Ave Akron, OH 44301

South Akron NeighborhoodEstimated Value: $104,515 - $129,000

3

Beds

3

Baths

1,202

Sq Ft

$96/Sq Ft

Est. Value

About This Home

This home is located at 1132 Dietz Ave, Akron, OH 44301 and is currently estimated at $115,629, approximately $96 per square foot. 1132 Dietz Ave is a home located in Summit County with nearby schools including Glover Community Learning Center, Kenmore Garfield Community Learning Center, and Main Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 9, 2009

Sold by

Fleetwood Properties Llc

Bought by

Bowie Gilbert C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,421

Outstanding Balance

$38,362

Interest Rate

5.19%

Mortgage Type

FHA

Estimated Equity

$77,267

Purchase Details

Closed on

Apr 14, 2009

Sold by

Fannie Mae

Bought by

Fleetwood Properties Llc

Purchase Details

Closed on

Nov 24, 2008

Sold by

Burden Daniel J

Bought by

Fanniemae and Federal National Mortgage Association

Purchase Details

Closed on

Aug 14, 2006

Sold by

Piurkowsky Anna M and Piurkowsky Anthony

Bought by

Burden Daniel J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,640

Interest Rate

6.85%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 16, 1998

Sold by

Piurkowsky Anna and Piurkowsky Ann M

Bought by

Piurkowsky Anna M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bowie Gilbert C | $59,500 | Minnesota Title | |

| Fleetwood Properties Llc | $17,000 | Ohio Title Corporation | |

| Fanniemae | $48,000 | Attorney | |

| Burden Daniel J | $78,300 | First American Title Akron | |

| Piurkowsky Anna M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bowie Gilbert C | $58,421 | |

| Previous Owner | Burden Daniel J | $62,640 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,524 | $28,326 | $5,345 | $22,981 |

| 2024 | $1,524 | $28,326 | $5,345 | $22,981 |

| 2023 | $1,524 | $28,326 | $5,345 | $22,981 |

| 2022 | $1,483 | $21,631 | $4,050 | $17,581 |

| 2021 | $1,484 | $21,631 | $4,050 | $17,581 |

| 2020 | $1,518 | $21,630 | $4,050 | $17,580 |

| 2019 | $1,336 | $17,070 | $4,400 | $12,670 |

| 2018 | $1,319 | $17,070 | $4,400 | $12,670 |

| 2017 | $1,352 | $17,070 | $4,400 | $12,670 |

| 2016 | $1,408 | $18,040 | $4,660 | $13,380 |

| 2015 | $1,352 | $18,040 | $4,660 | $13,380 |

| 2014 | $1,341 | $18,040 | $4,660 | $13,380 |

| 2013 | $1,622 | $22,520 | $4,660 | $17,860 |

Source: Public Records

Map

Nearby Homes

- 1102 Dietz Ave

- 1094 Dietz Ave

- 568 Stanton Ave

- 1051 Brown St

- 565 Eva Ave

- 1217 Brown St

- 450 Stanton Ave

- 1218 Dietz Ave

- 979 Neptune Ave

- 1100 Beardsley St

- 1230 Herberich Ave

- 1198 Burkhardt Ave

- 1012 Kling St

- 397 Cole Ave

- 1239 Lily St

- 1043 Coventry St

- 1243 Herberich Ave

- 1025 Coventry St

- 1264 Dietz Ave

- 610 Morgan Ave