Estimated Value: $509,000 - $704,000

2

Beds

1

Bath

1,536

Sq Ft

$398/Sq Ft

Est. Value

About This Home

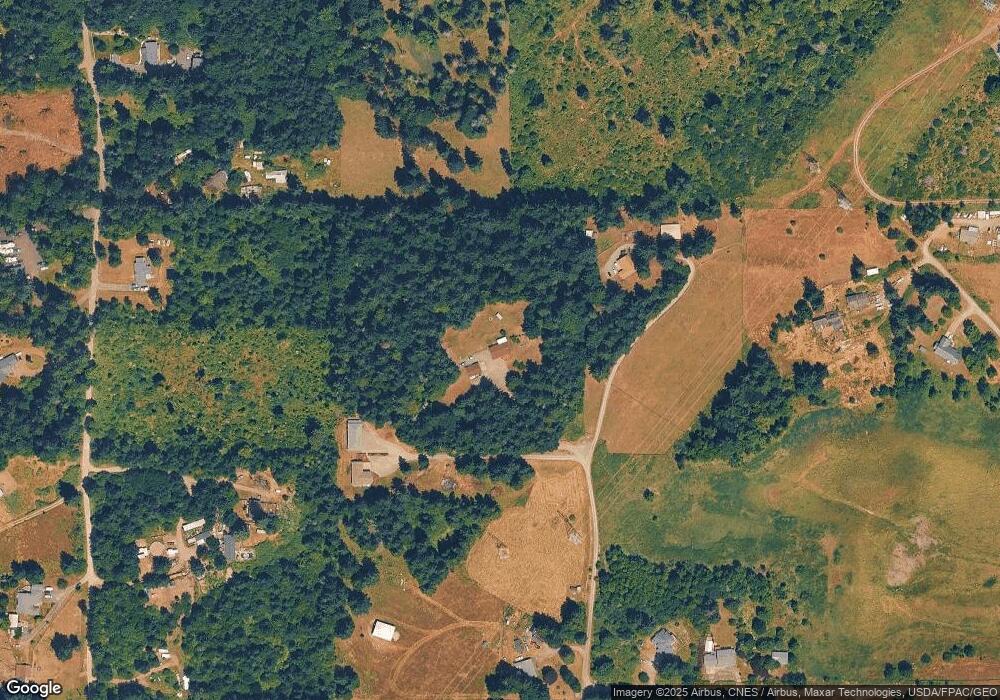

This home is located at 11323 Devin Ln SE, Yelm, WA 98597 and is currently estimated at $610,767, approximately $397 per square foot. 11323 Devin Ln SE is a home located in Thurston County with nearby schools including Yelm Prairie Elementary School, Ridgeline Middle School, and Yelm High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2008

Sold by

Rasey Dennis and Rasey Martha

Bought by

Aananda Shraddhaa and Aananda Christina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,642

Outstanding Balance

$155,186

Interest Rate

5.85%

Mortgage Type

Unknown

Estimated Equity

$455,581

Purchase Details

Closed on

Dec 12, 2001

Sold by

Heuschel Mary Aline and Heuschel Eugene R

Bought by

Rasey Dennis and Rasey Martha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,000

Interest Rate

7.6%

Purchase Details

Closed on

Sep 13, 1996

Sold by

Yancy Gary D and Yancy Brandi J

Bought by

Anderson Mary Alice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,400

Interest Rate

8.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aananda Shraddhaa | $329,950 | First American Title | |

| Rasey Dennis | $195,450 | Transnation Title Insurance | |

| Anderson Mary Alice | $153,568 | Charter Title Corporation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Aananda Shraddhaa | $247,642 | |

| Previous Owner | Rasey Dennis | $162,000 | |

| Previous Owner | Anderson Mary Alice | $125,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,713 | $490,700 | $248,400 | $242,300 |

| 2023 | $4,713 | $486,700 | $209,400 | $277,300 |

| 2022 | $4,280 | $472,900 | $182,400 | $290,500 |

| 2021 | $3,769 | $389,600 | $165,100 | $224,500 |

| 2020 | $3,896 | $299,100 | $122,200 | $176,900 |

| 2019 | $3,119 | $301,500 | $112,400 | $189,100 |

| 2018 | $3,412 | $250,800 | $77,800 | $173,000 |

| 2017 | $3,103 | $235,000 | $76,300 | $158,700 |

| 2016 | $3,055 | $232,000 | $98,200 | $133,800 |

| 2014 | -- | $217,200 | $94,100 | $123,100 |

Source: Public Records

Map

Nearby Homes

- 15845 118th Ln SE

- 15739 Yelm Terra Way SE

- 15418 107th Loop SE

- 15315 Carter Ct SE

- 15316 Carter Ct SE

- 10412 Barry Bridges St SE

- 15130 Carter Loop SE

- 15328 104th Ave SE

- 10236 West Rd SE

- 15120 Carter Loop SE

- 11615 Vail Rd SE

- 201 3rd St NE

- 10024 Cochrane Ave SE

- 10004 Greenbrier Ct SE

- 16127 Prairie Creek Loop SE

- 9745 Hay St SE

- 9738 Hay St SE

- 9756 Hay St SE

- 9744 Hay St SE

- 9703 Hay St SE

- 11417 Devin Ln SE

- 16124 115th Ln SE

- 11525 Devin Ln SE

- 16243 Lauker Ln SE

- 11511 Clark Rd SE

- 11527 Devin Ln SE

- 11125 Clark Rd SE

- 16321 Lauker Ln SE

- 16205 115th Ln SE

- 11417 Clark Rd SE

- 16242 Lauker Ln SE

- 11523 Clark Rd SE

- 11119 Clark Rd SE

- 11529 Devin Ln SE

- 16311 115th Ln SE

- 11227 Clark Rd SE

- 16312 115th Ln SE

- 16307 Tarryton Ln SE

- 16316 Tarryton Ln SE

- 11136 Clark Rd SE