1133 Club View Dr Dayton, OH 45458

Estimated Value: $586,669 - $639,000

3

Beds

2

Baths

2,763

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 1133 Club View Dr, Dayton, OH 45458 and is currently estimated at $613,417, approximately $222 per square foot. 1133 Club View Dr is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2004

Sold by

Conrad Martha J and Conrad Richard E

Bought by

Conrad Martha Jane

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2004

Sold by

Conrad Richard E and Conrad Martha J

Bought by

Conrad Martha J

Purchase Details

Closed on

Oct 8, 2003

Sold by

Dunnington Custom Builders Inc

Bought by

Conrad Richard E and Conrad Martha J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,700

Outstanding Balance

$140,608

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$472,809

Purchase Details

Closed on

Sep 29, 2003

Sold by

Yankee Trace Development Inc

Bought by

Dunnington Custom Builders Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,700

Outstanding Balance

$140,608

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$472,809

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Conrad Martha Jane | -- | None Available | |

| Conrad Martha J | -- | -- | |

| Conrad Richard E | -- | Midwest Abstract Company | |

| Dunnington Custom Builders Inc | $392,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Conrad Richard E | $322,700 | |

| Closed | Dunnington Custom Builders Inc | $27,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,903 | $170,100 | $43,310 | $126,790 |

| 2023 | $9,903 | $170,100 | $43,310 | $126,790 |

| 2022 | $11,281 | $154,950 | $39,380 | $115,570 |

| 2021 | $11,310 | $154,950 | $39,380 | $115,570 |

| 2020 | $11,295 | $154,950 | $39,380 | $115,570 |

| 2019 | $11,098 | $136,830 | $39,380 | $97,450 |

| 2018 | $9,902 | $136,830 | $39,380 | $97,450 |

| 2017 | $9,773 | $136,830 | $39,380 | $97,450 |

| 2016 | $9,063 | $120,170 | $39,380 | $80,790 |

| 2015 | $8,976 | $120,170 | $39,380 | $80,790 |

| 2014 | $8,976 | $120,170 | $39,380 | $80,790 |

| 2012 | -- | $115,010 | $35,020 | $79,990 |

Source: Public Records

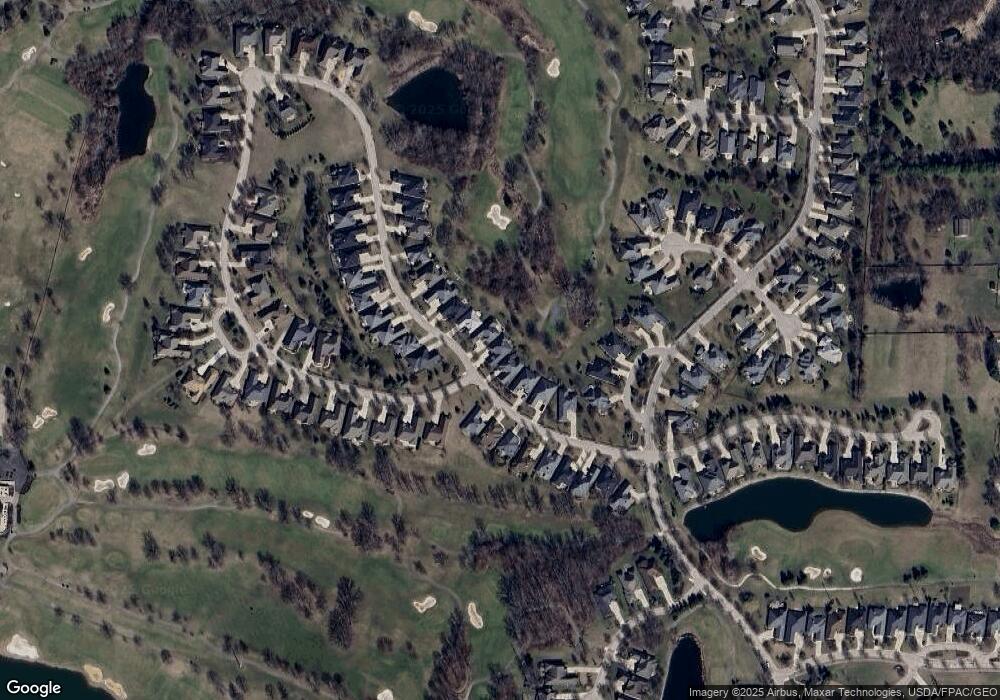

Map

Nearby Homes

- 1248 Club View Dr

- 1267 Club View Dr

- 973 Gardenwood Place

- 985 Gardenwood Place

- 835 Vintage Green Way

- 900 Hidden Branches Dr

- 9725 Southern Belle Ct

- 9508 Magnolia Ct

- 812 Hidden Branches Dr

- 981 Eagle Run Dr

- 1384 Courtyard Place

- 1053 Charter Place

- 376 Yankee Trace Dr

- 1198 W Social Row Rd

- 9460 Banyan Ct

- 9471 Banyan Ct

- 9764 Olde Georgetown Way

- 0 Austin Pike

- 10612 Falls Creek Ln

- 1800 Olde Haley Dr

- 1129 Club View Dr

- 1137 Club View Dr

- 1141 Club View Dr

- 1125 Club View Dr

- 1145 Club View Dr

- 1121 Club View Dr

- 1155 Club View Dr

- 1128 Club View Dr

- 1150 Club View Dr

- 1124 Club View Dr

- 1111 Club View Dr

- 1165 Club View Dr

- 1120 Club View Dr

- 782 Yankee Trace Dr

- 774 Yankee Trace Dr

- 1299 Club View Dr

- 1158 Club View Dr

- 1116 Club View Dr

- 766 Yankee Trace Dr

- 790 Yankee Trace Dr