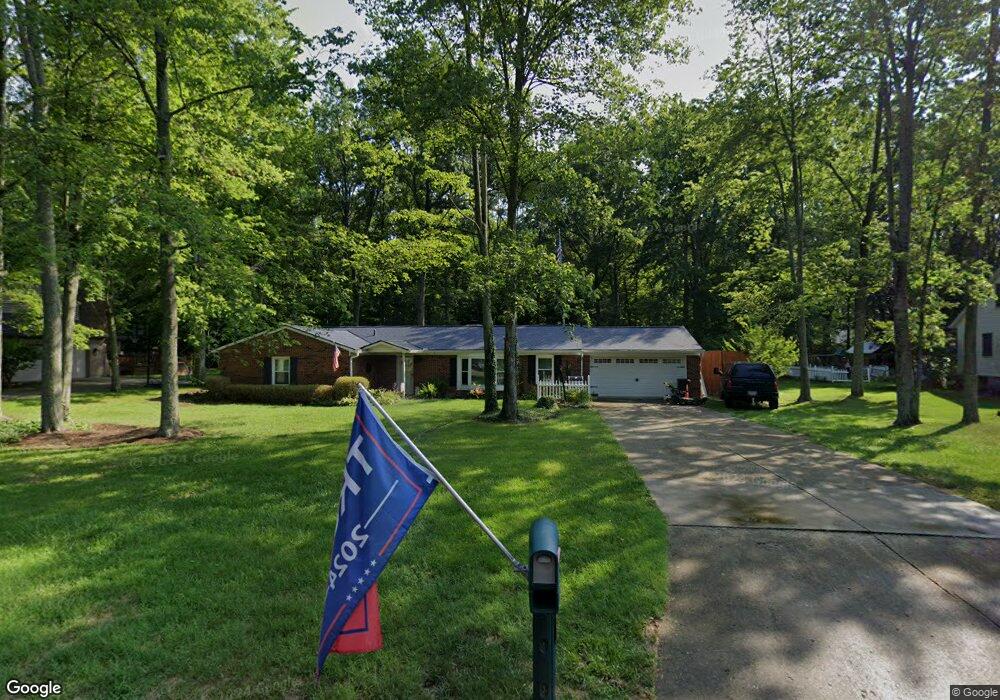

1134 Deerhaven Ct Loveland, OH 45140

Outer Loveland NeighborhoodEstimated Value: $266,000 - $366,000

3

Beds

2

Baths

1,734

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 1134 Deerhaven Ct, Loveland, OH 45140 and is currently estimated at $325,910, approximately $187 per square foot. 1134 Deerhaven Ct is a home located in Clermont County with nearby schools including Milford Senior High School, Milford Christian Academy, and St. Andrew - St. Elizabeth Ann Seton School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2022

Sold by

James Paul S

Bought by

Powell David E

Current Estimated Value

Purchase Details

Closed on

Feb 18, 2008

Sold by

Geiser Helmut and Geiser Rebecca K

Bought by

James Paul S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,600

Interest Rate

5.9%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 19, 2000

Sold by

Dunham Bruce E

Bought by

Geiser Helmut and Geiser Rebecca K

Purchase Details

Closed on

Oct 25, 1995

Sold by

Renner Catherine E

Bought by

Dunham Bruce E and Mcdow Kelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,300

Interest Rate

7.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 12, 1990

Purchase Details

Closed on

Apr 1, 1989

Purchase Details

Closed on

Nov 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Powell David E | $225,000 | Mattingly Ford Title | |

| James Paul S | $164,000 | Attorney | |

| Geiser Helmut | $138,000 | -- | |

| Dunham Bruce E | $123,500 | -- | |

| -- | $95,000 | -- | |

| -- | $91,000 | -- | |

| -- | $77,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | James Paul S | $147,600 | |

| Previous Owner | Dunham Bruce E | $117,300 | |

| Closed | Geiser Helmut | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,653 | $78,760 | $19,430 | $59,330 |

| 2023 | $3,690 | $78,760 | $19,430 | $59,330 |

| 2022 | $4,778 | $78,120 | $14,700 | $63,420 |

| 2021 | $4,781 | $78,120 | $14,700 | $63,420 |

| 2020 | $4,585 | $78,120 | $14,700 | $63,420 |

| 2019 | $4,122 | $66,510 | $12,990 | $53,520 |

| 2018 | $4,123 | $66,510 | $12,990 | $53,520 |

| 2017 | $3,856 | $66,510 | $12,990 | $53,520 |

| 2016 | $3,920 | $57,330 | $11,200 | $46,130 |

| 2015 | $3,598 | $57,330 | $11,200 | $46,130 |

| 2014 | $3,598 | $57,330 | $11,200 | $46,130 |

| 2013 | $3,029 | $46,800 | $12,250 | $34,550 |

Source: Public Records

Map

Nearby Homes

- 6211 Spires Dr

- 1803 Wheatfield Way

- 6149 Century Farm Dr

- 2013 Weber Rd

- 6320 Ashford Dr

- 6141 Brandywine Ct

- 1140 Weber Rd

- 6108 Donna Jay Dr

- 1064 Weber Rd

- 1124 Clover Field Dr

- 6077 Branch Hill Guinea Pike

- 1113 Clover Field Dr

- 5933 Firm Stance Dr

- 6211 Cook Rd

- 1285 State Rte 28

- 1376 Barre Ln

- 1513 Charleston Ln

- 6395 Barre Rd

- 1289 Woodville Pike

- 6379 Derbyshire Ln

- 1132 Deerhaven Ct

- 1136 Deerhaven Ct

- 1130 Deerhaven Ct

- 1125 Deerhaven Ct

- 1123 Deerhaven Ct

- 1127 Deerhaven Ct

- 1121 Deerhaven Ct

- 6234 Deerhaven Ln

- 1128 Deerhaven Ct

- 6113 Doe Ct

- 6236 Deerhaven Ln

- 1126 Deerhaven Ct

- 1137 Deerhaven Ct

- 1124 Deerhaven Ct

- 6122 Doe Ct

- 6115 Doe Ct

- 1122 Deerhaven Ct

- 6238 Deerhaven Ln

- 6233 Deerhaven Ln

- 1120 Deerhaven Ct