11358 Lost Tree Way North Palm Beach, FL 33408

Estimated Value: $4,982,000 - $7,096,000

3

Beds

3

Baths

2,790

Sq Ft

$2,168/Sq Ft

Est. Value

About This Home

This home is located at 11358 Lost Tree Way, North Palm Beach, FL 33408 and is currently estimated at $6,048,689, approximately $2,167 per square foot. 11358 Lost Tree Way is a home located in Palm Beach County with nearby schools including The Conservatory School at North Palm Beach, William T. Dwyer High School, and Howell L. Watkins Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2025

Sold by

Minshall Peter C and Minshall Suzanne S

Bought by

Stephen C Conley 2018 Trust and Ellen Josephine Conley 2018 Trust

Current Estimated Value

Purchase Details

Closed on

Jul 21, 2011

Sold by

Daberko David A and Daberko Deborah L

Bought by

Minshall Peter C and Minshall Suzanne S

Purchase Details

Closed on

Aug 6, 1998

Sold by

Blount Robert G and Blount Joellen F

Bought by

Daberko David A and Daberko Deborah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

6.96%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 27, 1995

Sold by

Ryan James H and Ryan Patricia G

Bought by

Blount Robert G and Blount Joellen Fisher

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$648,000

Interest Rate

9.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stephen C Conley 2018 Trust | $6,300,000 | None Listed On Document | |

| Minshall Peter C | $2,100,000 | Attorney | |

| Daberko David A | $855,000 | -- | |

| Blount Robert G | $775,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Daberko David A | $500,000 | |

| Previous Owner | Blount Robert G | $648,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $78,820 | $3,639,627 | -- | -- |

| 2023 | $75,204 | $3,308,752 | $6,200,930 | $268,197 |

| 2022 | $56,679 | $3,007,956 | $0 | $0 |

| 2021 | $48,546 | $2,824,707 | $2,645,000 | $179,707 |

| 2020 | $43,404 | $2,450,936 | $2,415,000 | $35,936 |

| 2019 | $43,934 | $2,450,936 | $2,415,000 | $35,936 |

| 2018 | $40,354 | $2,322,382 | $2,289,491 | $32,891 |

| 2017 | $38,990 | $2,323,070 | $2,289,491 | $33,579 |

| 2016 | $35,257 | $1,941,880 | $0 | $0 |

| 2015 | $33,241 | $1,769,593 | $0 | $0 |

| 2014 | $30,855 | $1,623,039 | $0 | $0 |

Source: Public Records

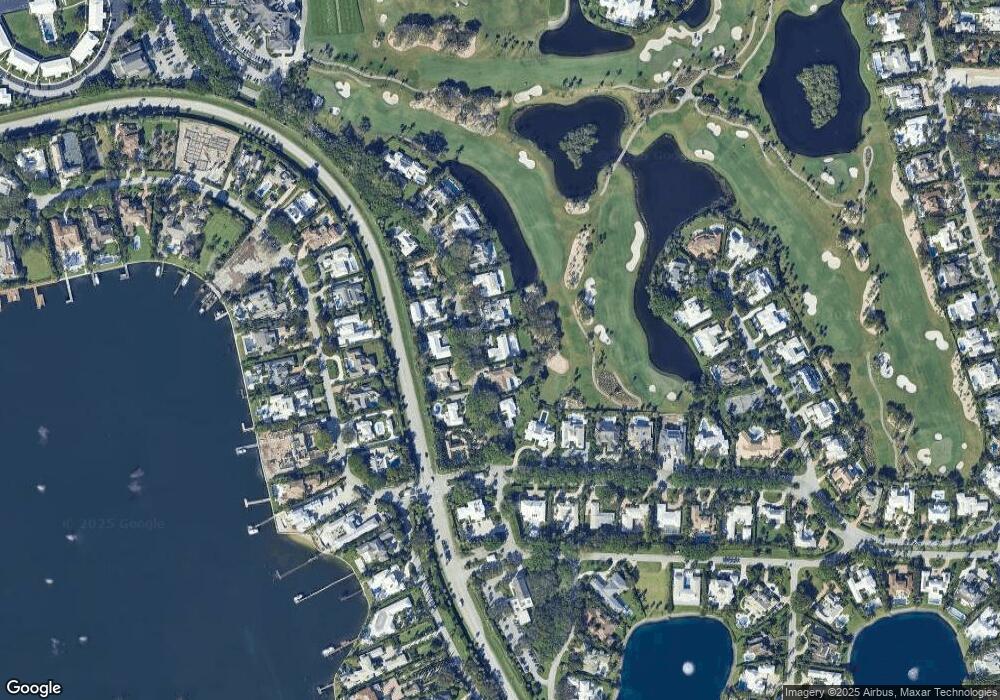

Map

Nearby Homes

- 11354 Old Harbour Rd

- 2 Church Ln Unit 115-116

- 1 Church Ln Unit 111-112

- 1938 Portage Landing N

- 1950 Portage Landing N

- 1454 Point Way

- 11390 Twelve Oaks Way Unit 122

- 11370 Twelve Oaks Way Unit 412

- 11370 Twelve Oaks Way Unit 217

- 11370 Twelve Oaks Way Unit 415

- 11370 Twelve Oaks Way Unit 418

- 11370 Twelve Oaks Way Unit 611

- 11370 Twelve Oaks Way Unit 218

- 11370 Twelve Oaks Way Unit 117

- 11373 12 Oaks Way

- 1660 Twelve Oaks Way Unit 205

- 110 Water Club Way

- 11569 Landing Place

- 11337 Briarwood Place Unit 5F

- 11457 Shady Oaks Ln

- 11332 Lost Tree Way

- 11382 Lost Tree Way

- 11359 Lost Tree Way

- 11337 Lost Tree Way

- 11406 Lost Tree Way

- 11300 Lost Tree Way

- 11385 Lost Tree Way

- 11313 Lost Tree Way

- 925 Village Rd

- 11411 Lost Tree Way

- 11287 Lost Tree Way

- 895 Village Rd

- 11444 Lost Tree Way

- 11290 Old Harbour Rd

- 11276 Old Harbour Rd

- 875 Village Rd

- 11439 Lost Tree Way

- 11304 Old Harbour Rd

- 11260 Old Harbour Rd

- 11460 Lost Tree Way