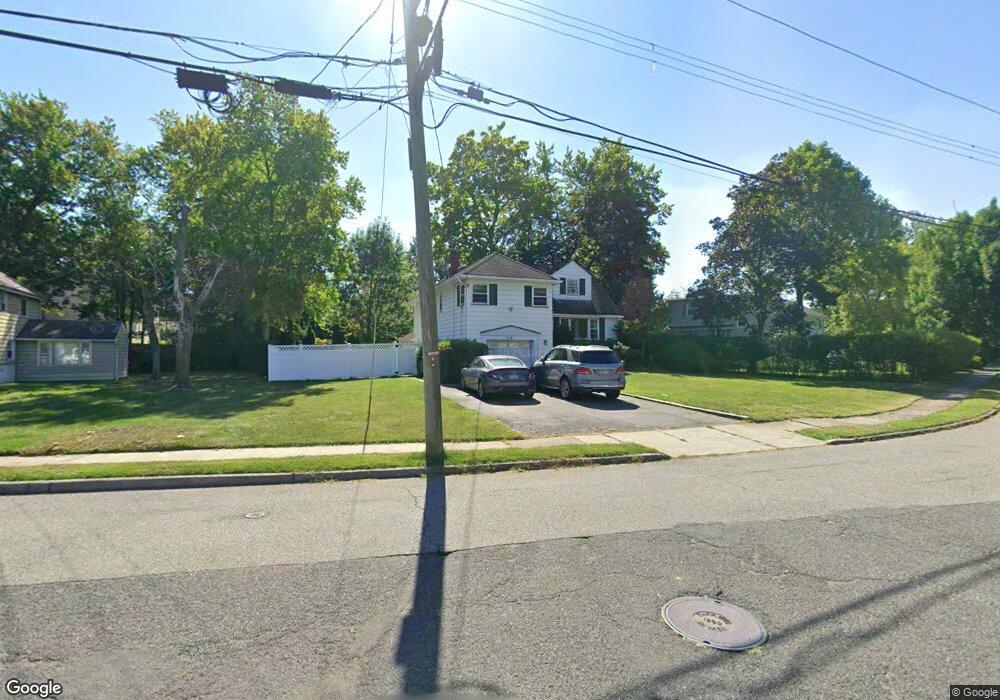

114 Village Cir E Paramus, NJ 07652

Estimated Value: $905,000 - $978,000

3

Beds

2

Baths

1,867

Sq Ft

$506/Sq Ft

Est. Value

About This Home

This home is located at 114 Village Cir E, Paramus, NJ 07652 and is currently estimated at $944,715, approximately $506 per square foot. 114 Village Cir E is a home located in Bergen County with nearby schools including Paramus High School, Ben Porat Yosef, and St. Peter Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2014

Sold by

Iwaoka Miroko and Iwaoka Michael K

Bought by

Nair-Sreelatha Sruti Ramachandran and Nair Anish Chandrasekharan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$293,957

Interest Rate

3.25%

Mortgage Type

New Conventional

Estimated Equity

$650,758

Purchase Details

Closed on

Jul 9, 2004

Sold by

Reynolds Frank G

Bought by

Iwaoka Michael K and Iwaoka Hiroko

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,000

Interest Rate

6.28%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nair-Sreelatha Sruti Ramachandran | $500,000 | -- | |

| Iwaoka Michael K | $500,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nair-Sreelatha Sruti Ramachandran | $400,000 | |

| Previous Owner | Iwaoka Michael K | $333,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,061 | $637,900 | $376,000 | $261,900 |

| 2024 | $8,785 | $598,500 | $348,500 | $250,000 |

| 2023 | $8,350 | $572,700 | $331,000 | $241,700 |

| 2022 | $8,350 | $538,000 | $309,800 | $228,200 |

| 2021 | $8,192 | $495,300 | $284,800 | $210,500 |

| 2020 | $7,544 | $473,000 | $264,800 | $208,200 |

| 2019 | $7,168 | $386,200 | $225,400 | $160,800 |

| 2018 | $7,079 | $386,200 | $225,400 | $160,800 |

| 2017 | $6,955 | $386,200 | $225,400 | $160,800 |

| 2016 | $6,766 | $386,200 | $225,400 | $160,800 |

| 2015 | $6,697 | $386,200 | $225,400 | $160,800 |

| 2014 | $6,639 | $386,200 | $225,400 | $160,800 |

Source: Public Records

Map

Nearby Homes

- 122 Village Cir E

- 150 Village Cir E

- 56 Lilac Ln

- 187 Crest Dr

- 189 Forest Ave Unit 409

- 189 Forest Ave Unit 303

- 1 Sipporta Ln

- 187 Brookfield Ave

- 81 Eastbrook Dr

- 302 Howland Ave

- 104 Trinity Ct

- 29 Millar Ct

- 16 Coles Ct

- 192 Valley Rd

- 4 Schubert Ln

- 6 Schubert Ln

- 215 Kensington Rd

- 212 Lozier Terrace

- 276 Greenway Terrace

- 165 Hebberd Ave

- 118 Village Cir E

- 191 Howland Ave

- 195 Howland Ave

- 199 Howland Ave

- 225 Filippe Ct

- 115 Village Cir W

- 224 Filippe Ct

- 117 Village Cir W

- 122 Village Cir W

- 111 Village Cir W

- 221 Filippe Ct

- 203 Howland Ave

- 220 Filippe Ct

- 92 Andrea Ct

- 124 Village Cir E

- 121 Village Cir W

- 181 Howland Ave

- 123 Village Cir E

- 194 Howland Ave

- 207 Howland Ave