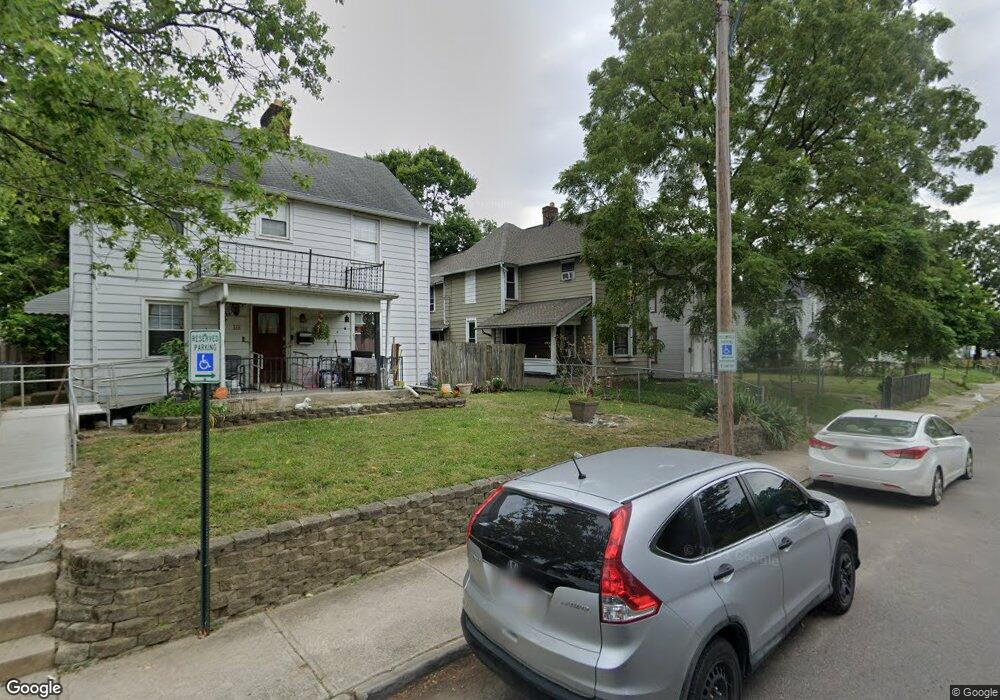

114 Whitethorne Ave Columbus, OH 43223

Central Hilltop NeighborhoodEstimated Value: $151,681 - $184,000

3

Beds

1

Bath

1,540

Sq Ft

$112/Sq Ft

Est. Value

About This Home

This home is located at 114 Whitethorne Ave, Columbus, OH 43223 and is currently estimated at $173,170, approximately $112 per square foot. 114 Whitethorne Ave is a home located in Franklin County with nearby schools including Highland Elementary School, Westmoor Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2010

Sold by

Advantage Bank

Bought by

Warren Susanna K

Current Estimated Value

Purchase Details

Closed on

Feb 4, 2010

Sold by

Investors Home Marketing Llc

Bought by

Advantage Bank

Purchase Details

Closed on

Dec 1, 2003

Sold by

Liquidation Properties Inc

Bought by

Saff Holdings Llc

Purchase Details

Closed on

Jun 19, 2003

Sold by

Salomon Brothers Realty Corp

Bought by

Liquidation Properties Inc

Purchase Details

Closed on

Sep 27, 2002

Sold by

Doerfler Alan

Bought by

Salomon Brothers Realty Corp

Purchase Details

Closed on

Jan 29, 1999

Sold by

Wp Inc

Bought by

Doerfler Alan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Interest Rate

10.7%

Purchase Details

Closed on

Jun 30, 1998

Sold by

Brown Stephen H and Case #97Cve07-6814

Bought by

Bankers Trust Company and Dlj Mtg Acceptance Corp

Purchase Details

Closed on

Dec 22, 1994

Sold by

Smith Alvin D

Bought by

Brown Janice and Brown Stephen H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warren Susanna K | $11,500 | Camco Titl | |

| Advantage Bank | -- | None Available | |

| Saff Holdings Llc | $28,000 | Title First Agency Inc | |

| Liquidation Properties Inc | $28,000 | Title First Agency Inc | |

| Salomon Brothers Realty Corp | $30,600 | -- | |

| Doerfler Alan | $60,000 | Chelsea Title Agency | |

| Bankers Trust Company | $28,600 | -- | |

| Brown Janice | $46,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Doerfler Alan | $48,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,862 | $39,100 | $6,090 | $33,010 |

| 2024 | $1,862 | $39,100 | $6,090 | $33,010 |

| 2023 | $1,770 | $39,095 | $6,090 | $33,005 |

| 2022 | $1,030 | $19,390 | $1,960 | $17,430 |

| 2021 | $1,032 | $19,390 | $1,960 | $17,430 |

| 2020 | $1,034 | $19,390 | $1,960 | $17,430 |

| 2019 | $995 | $16,000 | $1,650 | $14,350 |

| 2018 | $870 | $16,000 | $1,650 | $14,350 |

| 2017 | $995 | $16,000 | $1,650 | $14,350 |

| 2016 | $747 | $10,990 | $3,430 | $7,560 |

| 2015 | $746 | $10,990 | $3,430 | $7,560 |

| 2014 | $681 | $10,990 | $3,430 | $7,560 |

| 2013 | $486 | $12,915 | $4,025 | $8,890 |

Source: Public Records

Map

Nearby Homes

- 172 Whitethorne Ave

- 83 Belvidere Ave

- 178 Belvidere Ave

- 107 Midland Ave Unit 107-109

- 196 Belvidere Ave

- 45 Belvidere Ave

- 34-36 Midland Ave

- 2045 W Broad St

- 181 Clarendon Ave

- 249 Midland Ave

- 265-267 Belvidere Ave

- 244 Clarendon Ave

- 1936 Floral Ave

- 329-331 Whitethorne Ave

- 225 S Highland Ave

- 66 S Wheatland Ave

- 204 S Wheatland Ave

- 264 Nashoba Ave

- 247 Columbian Ave

- 126 S Oakley Ave

- 118 Whitethorne Ave

- 110 Whitethorne Ave Unit 110

- 122 Whitethorne Ave

- 102 Whitethorne Ave Unit 104

- 126 Whitethorne Ave

- 124 Whitethorne Ave

- 98 Whitethorne Ave

- 132 Whitethorne Ave Unit 134

- 132-134 Whitethorne Ave

- 94 Whitethorne Ave

- 136 Whitethorne Ave Unit 138

- 136-138 Whitethorne Ave

- 136 Whitethorne Ave Unit 38

- 107 Belvidere Ave

- 121 Whitethorne Ave

- 88 Whitethorne Ave

- 140 Whitethorne Ave

- 103 Belvidere Ave

- 113 Whitethorne Ave

- 109 Whitethorne Ave