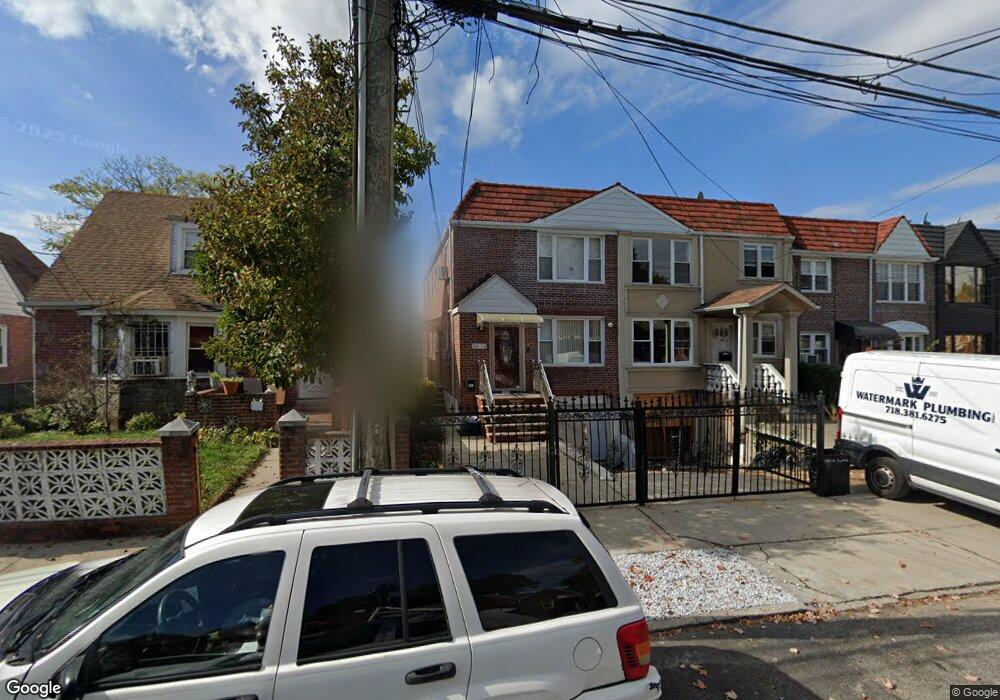

11414 204th St Saint Albans, NY 11412

Saint Albans NeighborhoodEstimated Value: $633,819 - $754,000

--

Bed

--

Bath

1,476

Sq Ft

$472/Sq Ft

Est. Value

About This Home

This home is located at 11414 204th St, Saint Albans, NY 11412 and is currently estimated at $697,205, approximately $472 per square foot. 11414 204th St is a home located in Queens County with nearby schools including P.S. 136 Roy Wilkins and I.S. 192 The Linden.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2015

Sold by

Clement Alice and Lewis Sheila

Bought by

Rowe Marlon O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$378,750

Interest Rate

3.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 18, 2014

Sold by

Clement Alice

Bought by

Clement Alice and Mitchell Josilyn

Purchase Details

Closed on

Aug 6, 2013

Sold by

Clement Alice and Mitchell Joslyn

Bought by

Clement Alice

Purchase Details

Closed on

Mar 1, 2000

Sold by

Wynter Ernest and Wynter Gloria Lee

Bought by

Clement Alice and Mitchell Joslyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,300

Interest Rate

8.4%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 23, 1998

Sold by

Witter Adelaide and Wynter Ernest

Bought by

Wynter Gloria Lee and Wynter Ernest

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rowe Marlon O | $378,750 | -- | |

| Rowe Marlon O | $378,750 | -- | |

| Clement Alice | -- | -- | |

| Clement Alice | -- | -- | |

| Clement Alice | -- | -- | |

| Clement Alice | -- | -- | |

| Clement Alice | $215,000 | Commonwealth Land Title Ins | |

| Clement Alice | $215,000 | Commonwealth Land Title Ins | |

| Wynter Gloria Lee | -- | First American Title Ins Co | |

| Wynter Gloria Lee | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rowe Marlon O | $378,750 | |

| Previous Owner | Clement Alice | $214,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,501 | $29,032 | $8,899 | $20,133 |

| 2024 | $5,501 | $27,389 | $10,059 | $17,330 |

| 2023 | $5,449 | $27,130 | $8,926 | $18,204 |

| 2022 | $5,157 | $30,780 | $12,120 | $18,660 |

| 2021 | $5,397 | $29,700 | $12,120 | $17,580 |

| 2020 | $5,121 | $32,640 | $12,120 | $20,520 |

| 2019 | $4,775 | $29,040 | $12,120 | $16,920 |

| 2018 | $4,609 | $22,608 | $10,355 | $12,253 |

| 2017 | $4,388 | $21,528 | $11,037 | $10,491 |

| 2016 | $4,272 | $21,528 | $11,037 | $10,491 |

| 2014 | $2,230 | $19,020 | $13,440 | $5,580 |

Source: Public Records

Map

Nearby Homes

- 114-42 204th St

- 204-03 Murdock Ave

- 114-62 203rd St

- 114-49 204th St

- 11467 202nd St

- 114-25 201st St

- 114-62 201st St

- 205-29 114th Dr

- 114-11 200th St

- 115-47 205 St

- 114-40 200th St

- 112-32 204th St

- 114-37 199th St

- 114-16 207th St

- 115-69 203rd St

- 20516 115th Dr

- 114-35 198th St

- 11434 208th St

- 114-28 208th St

- 11516 199th St

- 11412 204th St

- 11418 204th St

- 11410 204th St

- 114-10 204th St Unit 2

- 114-10 204th St

- 11406 204th St

- 11422 204th St

- 20310 Murdock Ave

- 11404 204th St

- 114-04 204th St

- 11413 203rd St

- 11411 203rd St

- 20310 Murdock Ave

- 203-10 Murdock Ave

- 11415 203rd St

- 114-13 203rd St

- 20308 Murdock Ave

- 11417 203rd St

- 11426 204th St

- 11402 204th St