11425 NE 189th St Battle Ground, WA 98604

Estimated Value: $572,000 - $684,973

3

Beds

2

Baths

1,720

Sq Ft

$376/Sq Ft

Est. Value

About This Home

This home is located at 11425 NE 189th St, Battle Ground, WA 98604 and is currently estimated at $646,993, approximately $376 per square foot. 11425 NE 189th St is a home located in Clark County with nearby schools including Maple Grove Primary School, Prairie High School, and Firm Foundation Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2009

Sold by

Nylund Homes Inc

Bought by

Clark Walter Paul and Clark Carrie C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,000

Outstanding Balance

$154,119

Interest Rate

5.25%

Mortgage Type

New Conventional

Estimated Equity

$492,874

Purchase Details

Closed on

Sep 15, 2009

Sold by

Clemmer Casey J and Clemmer Traci L

Bought by

Nylund Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,000

Outstanding Balance

$154,119

Interest Rate

5.25%

Mortgage Type

New Conventional

Estimated Equity

$492,874

Purchase Details

Closed on

Sep 26, 2001

Sold by

Rhino Construction Llc

Bought by

Clemmer Casey J and Clemmer Traci L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,500

Interest Rate

6.9%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clark Walter Paul | $260,000 | Columbia Title Agency | |

| Nylund Homes Inc | $225,001 | Accommodation | |

| Clemmer Casey J | $164,245 | Clark County Title Company | |

| Dickinson Greg D | -- | Clark County Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clark Walter Paul | $234,000 | |

| Previous Owner | Clemmer Casey J | $167,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,336 | $627,966 | $225,982 | $401,984 |

| 2024 | $5,040 | $608,283 | $225,982 | $382,301 |

| 2023 | $5,589 | $636,437 | $215,982 | $420,455 |

| 2022 | $4,780 | $656,213 | $218,451 | $437,762 |

| 2021 | $4,765 | $520,798 | $168,327 | $352,471 |

| 2020 | $4,958 | $473,583 | $158,688 | $314,895 |

| 2019 | $4,148 | $483,616 | $168,327 | $315,289 |

| 2018 | $4,886 | $463,285 | $0 | $0 |

| 2017 | $3,661 | $417,085 | $0 | $0 |

| 2016 | $3,556 | $338,863 | $0 | $0 |

| 2015 | $3,568 | $303,382 | $0 | $0 |

| 2014 | -- | $290,085 | $0 | $0 |

| 2013 | -- | $260,472 | $0 | $0 |

Source: Public Records

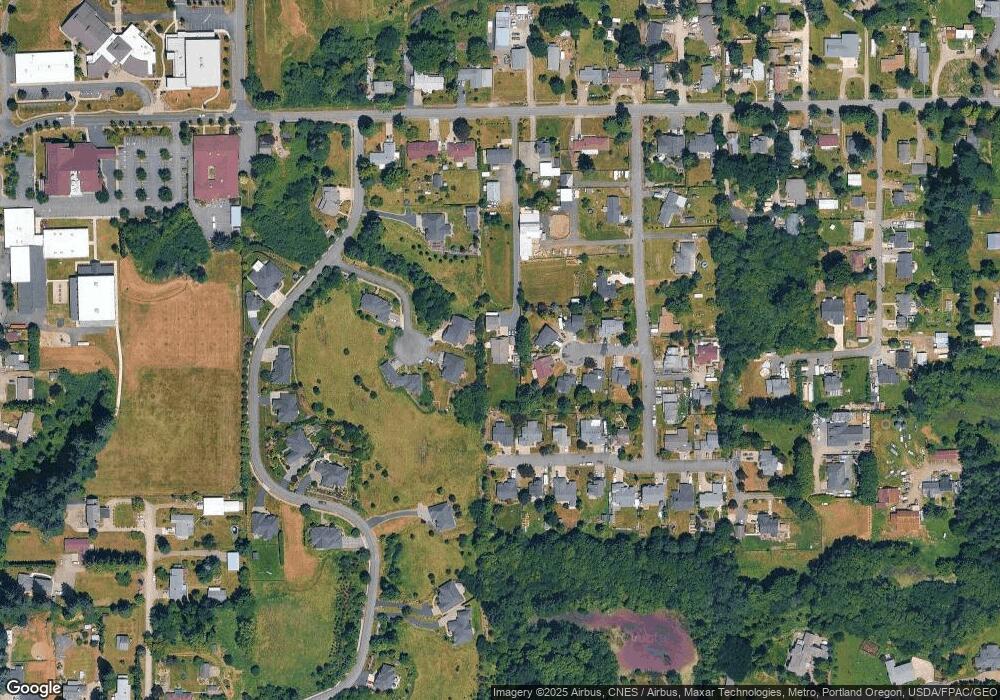

Map

Nearby Homes

- 11700 NE 185th St

- 18004 NE 113th Ave

- 1613 SW 25th Cir

- 1707 SW 25th Cir

- 10704 NE 189th St

- 18001 NE 110th Ave

- Glenwood Plan at Woodin Creek Station

- Turquoise Plan at Woodin Creek Station

- Laurel Plan at Woodin Creek Station

- Dahlia Plan at Woodin Creek Station - Townhomes

- Nettle Plan at Woodin Creek Station - Townhomes

- Bramble Plan at Woodin Creek Station - Townhomes

- Oakridge Plan at Woodin Creek Station

- Riverbend Plan at Woodin Creek Station

- 409 SW 31st St

- 4102 NE 187th St Unit LOT 289

- 12605 NE 184th St

- 411 SW 32nd St

- 3201 SW 4th Ave

- 3115 SW 4th Ave

- 11502 NE 186th Cir

- 11503 NE 186th Cir

- 11327 NE 187th Cir

- 11323 NE 187th Cir

- 11505 NE 186th Cir

- 11506 NE 186th Cir

- 11414 NE 185th St

- 11500 NE 185th St

- 11509 NE 186th Cir

- 11506 NE 185th St

- 11326 NE 187th Cir

- 11512 NE 186th Cir

- 18616 NE 116th Ave

- 18616 NE 116th Ave

- 18808 NE 116th Ave

- 18706 NE 116th Ave

- 11512 NE 185th St

- 11515 NE 185th St

- 0 NE 187th Ct Unit 11641828

- 0 NE 187th Ct Unit 11566864