11429 Dorian Ct New Port Richey, FL 34654

River Ridge NeighborhoodEstimated Value: $313,974 - $352,000

3

Beds

2

Baths

2,078

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 11429 Dorian Ct, New Port Richey, FL 34654 and is currently estimated at $328,744, approximately $158 per square foot. 11429 Dorian Ct is a home located in Pasco County with nearby schools including River Ridge High School, Cypress Elementary School, and River Ridge Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 1, 2016

Bought by

Csh 2016-1 Borrower Llc

Current Estimated Value

Purchase Details

Closed on

Oct 22, 2014

Sold by

Lape Edward L

Bought by

Colfin Ah Florida 6 Llc

Purchase Details

Closed on

Jan 6, 2012

Sold by

Lape Edward L and Lape Kelly D

Bought by

Weber George and Lape Family Land Trust

Purchase Details

Closed on

Aug 6, 2008

Sold by

Eriksen Carolyn

Bought by

Lape Edward L and Lape Kelly D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,036

Interest Rate

6.43%

Mortgage Type

VA

Purchase Details

Closed on

Apr 19, 2005

Sold by

N G Development Corp

Bought by

Eriksen Carolyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,900

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Csh 2016-1 Borrower Llc | $100 | -- | |

| Colfin Ah Florida 6 Llc | $117,400 | Attorney | |

| Weber George | $8,500 | None Available | |

| Lape Edward L | $164,500 | Sunbelt Title Agency | |

| Eriksen Carolyn | $184,192 | Heartland Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lape Edward L | $168,036 | |

| Previous Owner | Eriksen Carolyn | $97,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,599 | $285,432 | $46,666 | $238,766 |

| 2024 | $4,599 | $289,412 | $46,666 | $242,746 |

| 2023 | $4,399 | $296,834 | $40,561 | $256,273 |

| 2022 | $3,527 | $237,034 | $33,818 | $203,216 |

| 2021 | $3,172 | $198,200 | $24,740 | $173,460 |

| 2020 | $2,807 | $165,059 | $18,316 | $146,743 |

| 2019 | $2,823 | $164,696 | $18,316 | $146,380 |

| 2018 | $2,720 | $158,144 | $18,316 | $139,828 |

| 2017 | $2,431 | $140,159 | $18,316 | $121,843 |

| 2016 | $2,248 | $132,345 | $18,316 | $114,029 |

| 2015 | $2,041 | $112,351 | $18,316 | $94,035 |

| 2014 | $1,805 | $100,876 | $17,679 | $83,197 |

Source: Public Records

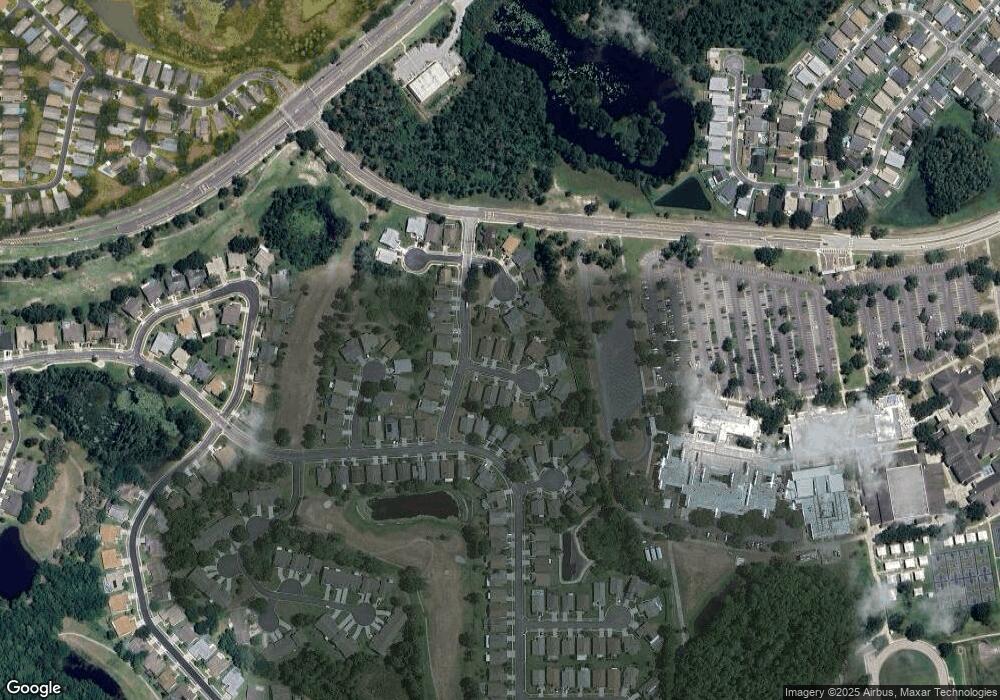

Map

Nearby Homes

- 11418 Tee Time Cir

- 11343 Tee Time Cir

- 11520 Lounds Ct

- 7739 Harbor Bridge Blvd

- 11506 Dampier Ct

- 7814 Brisbane Ct

- 11915 Tee Time Cir

- 0 Moon Lake Rd Unit MFRW7863538

- 7821 Floradora Dr

- 7825 Prospect Hill Cir

- 11142 Port Douglas Dr

- 7940 Fashion Loop

- 11149 Port Douglas Dr

- 7633 Piping Rock Ct

- 7825 Burnet Ln

- 10908 Claymont Dr

- 11324 Striped Bass Ct

- 11311 Striped Bass Ct

- 11303 Striped Bass Ct

- 10900 Livingston Dr

- 11433 Dorian Ct

- 11423 Dorian Ct

- 11448 Marsh Creek Ct

- 11428 Dorian Ct

- 11424 Dorian Ct

- 11432 Dorian Ct

- 11432 Marsh Creek Ct

- 11443 Dorian Ct

- 11449 Marsh Creek Ct

- 7633 Emery Dr

- 7627 Emery Dr

- 7637 Emery Dr

- 11436 Dorian Ct

- 7621 Emery Dr

- 7643 Emery Dr

- 11444 Dorian Ct

- 11440 Dorian Ct

- 7615 Emery Dr

- 7649 Emery Dr

- 11419 Tee Time Cir